NASDAQ Technical Analysis Today (16 January 2026): Why Yesterday’s Late Selloff Did Not Break the Bullish Structure

I’ll start out with a medium term view of the market, the way I see it, via this Nasdaq technical analysis video from today. During our analysis, we always look at Nasdaq futures (NQ, not NDX).

Traders looking at the NASDAQ late on Thursday, 15 January, may have walked away with a cautious impression. After a strong intraday rebound, price gave back a meaningful portion of gains into the close, finishing below the daily high-volume node and below the midpoint of the session’s range.

For some, that raised a familiar concern: Was this the start of a bull trap?

For others, especially those hearing increasingly bullish narratives about a push toward new all-time highs, the late selloff felt like a warning sign that momentum had already failed.

That surface-level reading, however, misses what was happening inside the auction.

From the above video, and the above context and question in mind, we shall proceed to the deeper order flow analysis for Nasdaq so far today…

What Order Flow Shows Beneath Yesterday’s Close

OrderFlow Intel analysis revealed that yesterday’s selling was not accepted as a new bearish regime. Instead, it appeared as late-session profit taking and inventory adjustment, occurring after a successful recovery from the earlier washout near 25,560.

Key observations from order flow:

-

Buyers successfully defended the 25,600–25,640 repaired value zone.

-

Selling pressure into the close did not lead to acceptance below that area.

-

The medium-term recovery structure remained intact, even as momentum cooled.

This distinction matters. A market that rejects higher prices behaves very differently from one that simply pauses after a strong move.

Live Context for Friday, 16 January 2026: What Matters Right Now

As of today’s session, the NASDAQ futures are behaving in a way that supports that interpretation.

-

Today’s developing daily low is holding above ~25,700, which aligns with prior resistance from early January and sits above yesterday’s repaired value.

-

The developing daily high-volume node is near ~25,742, suggesting value is rebuilding higher, not collapsing.

-

On the intraday charts, price has re-entered yesterday’s value area, reclaimed yesterday’s value area low near 25,785, and is rotating toward yesterday’s point of control around 25,880, which remains a key decision level.

This is not breakout behavior yet, but it is constructive stabilization, not bearish rejection.

Why This Is a Decision Zone, Not a Breakdown for Nasdaq

Markets rarely move in straight lines, especially after sharp recoveries. What we are seeing today is a negotiation phase:

-

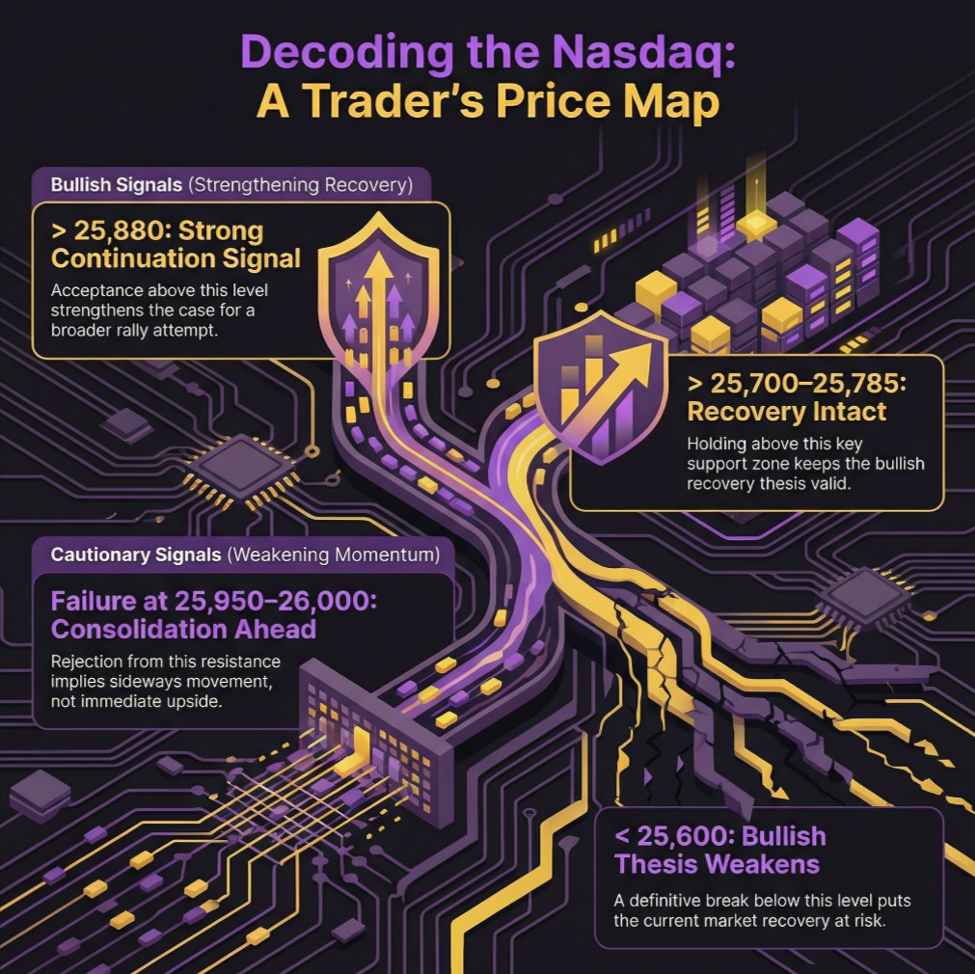

Below 25,600, the bullish recovery thesis would weaken.

-

Holding above 25,700–25,785 keeps the recovery intact.

-

Repeated acceptance above 25,880 would strengthen the case for a broader continuation attempt.

-

Failure near 25,950–26,000 without acceptance would imply more consolidation rather than immediate upside.

OrderFlow Intel helps frame these scenarios by focusing on acceptance versus rejection, rather than reacting emotionally to a single candle close.

Why This Page Is a Live NASDAQ Analysis for Today

This NASDAQ technical analysis for 16 January 2026 is intentionally live and evolving.

Rather than publishing a static opinion, this page will be updated as:

-

New order flow information develops

-

Key levels are tested or defended

-

Acceptance or rejection becomes clearer

For traders and investors who follow the NASDAQ directly, or use it as a proxy for broader equity market risk, returning to this page later today may provide additional orderFlow Intel updates at the bottom of the article. Look at the bottom of this page as today evolves.

The Takeaway for Traders and Investors Today

Yesterday’s late selloff did not end the bullish premise.

It transitioned the market from impulse to evaluation.

Order flow continues to suggest that:

-

The downside washout has been repaired.

-

Buyers are still active at higher levels.

-

The market is deciding whether it can accept higher value, not abandoning it.

That is a very different message than what the closing candle alone might imply.

This is exactly the kind of environment where context and structure matter more than headlines, and where orderFlow Intel provides meaningful decision support beyond traditional technical analysis.

Trader Update – European Session Follow-Up

11:03 – Friday, 16 January 2026 (CET)

Time in Brussels, Belgium

Following the European market open, the NASDAQ continues to behave constructively, and the broader bullish recovery thesis remains intact.

Despite some hesitation and rotation, buyers are still holding key ground, and there are no signs so far that sellers are regaining structural control. Importantly, the market is not responding to yesterday’s late selloff with renewed downside pressure.

Are bulls still in control?

On the higher timeframes, the answer is yes, cautiously.

-

On the daily view, value remains in the upper portion of the developing range, with the high-volume node still positioned near the top of the day. This suggests the market is accepting higher prices gradually, rather than rejecting them.

-

On the medium-term structure, price is holding above the repaired value zone around 25,700–25,640, which remains the key area bulls need to defend. As long as this zone holds, the recovery structure stays valid.

-

On the intraday charts, price has retraced toward fair value (VWAP) and found buyers before meaningful acceptance below it, which is a constructive sign during a grinding, low-volatility phase.

In short, bulls are not accelerating, but they are not losing ground either.

Are bears getting stronger?

So far, there is no evidence of increasing bearish control.

-

Selling attempts remain rotational, not initiative.

-

Downside probes have failed to gain acceptance below key value areas.

-

Order flow shows absorption rather than liquidation, meaning sellers are testing, but not pressing with conviction.

This keeps the downside risk contained, even if upside progress remains slow.

Updated orderFlow Intel scores (–10 to +10 scale)

-

Higher timeframe (daily): +4

The washout has been repaired, and structure remains constructive, though not yet in breakout mode. -

Medium timeframe: +5

The recovery is intact, but the market is in a negotiation and digestion phase, not a momentum phase. -

Short-term timeframe: +1

Slightly constructive, but highly tactical. This score can change quickly and is less relevant for positioning decisions.

What this means for traders and investors

This is a market that is working through higher value, not rejecting it. That process often looks frustrating on lower timeframes, but it is typical after sharp recoveries.

The key takeaway is simple:

-

The bullish premise is not done.

-

The market is stabilizing, not failing.

-

Directional clarity will come from acceptance or rejection at higher value levels, not from short-term noise.

We will continue updating this page as the session develops and as orderFlow Intel provides additional insight into whether the market is ready to accept higher prices or needs more time to consolidate.

This article was written by Itai Levitan at investinglive.com.