NASDAQ 100 futures (NQ) are currently rotating near the 25,330–25,350 area, a zone that has acted as the market’s balance point so far today. While price has moved both higher and lower intraday, neither buyers nor sellers have been able to force lasting acceptance outside this range.

This makes 25,365 on the upside and 25,310 on the downside the two most important price areas to watch for the rest of today’s session.

These levels are not arbitrary. They reflect where the market has repeatedly tested, rejected, and re-tested value. That is why professional traders, algorithms, and institutions are focused on them. But before we do that, let’s jump into the broader technical analysis view for today’s Nasdaq:

Today’s Nasdaq Market Context: Balance Before Direction

Market dynamics for February 10, 2026, are being shaped by a landmark US-India trade deal targeting $500 billion in purchases, which promises to slash tariffs on American energy, technology, and agricultural exports. This geopolitical shift coincides with a significant move in Asian markets, where China’s onshore yuan (CNY) has surged to its highest level since May 2023 as Beijing reportedly encourages banks to reduce U.S. Treasury exposure. While the day’s economic calendar features December U.S. Retail Sales and the Employment Cost Index, these are largely viewed as lagging indicators as traders brace for tomorrow’s Non-Farm Payrolls report.

In the commodities and digital asset space, precious metals like gold and silver have managed a tentative bounce since Friday, though they currently lack the “spark” to overcome key resistance levels near $5,100 and $89.25, respectively. Meanwhile, Bitcoin technical analysis shows the cryptocurrency holding above critical VWAP support zones following a 21% surge. Traders are closely monitoring the $67,750 level to determine if this rebound marks the start of a genuine base-building phase or a temporary counter-trend move before further volatility.

So let’s see how all of the above contributed to today’s Nasdaq futures so far. At the time of analysis, NASDAQ futures remain in a balanced market environment:

-

Price is rotating around VWAP

-

Value areas from recent sessions overlap heavily

-

Moves beyond the range have struggled to hold

In practical terms, this tells us the market is still negotiating value, not trending. In this type of environment, price movement alone is not enough. What matters is whether the market accepts higher or lower prices after testing them.

The tradeCompass Levels That Matter Today

Bullish Acceptance Zone for Nasdaq Futures Today

Above 25,365

A more constructive bullish outlook only develops if:

-

Price moves above 25,365

-

It holds above that area instead of quickly falling back

-

Buying pressure shows consistency rather than brief spikes

If the market accepts above this zone, it signals that participants are comfortable doing business at higher prices. That is when upside targets later in the session become more realistic.

Without acceptance, upside moves are more likely to be fades back toward VWAP.

Bearish Acceptance Zone for Nasdaq Futures Today

Below 25,310

A bearish scenario gains traction only if:

-

Price moves below 25,310

-

It remains accepted below that level

-

Selling pressure begins to dominate rather than fade

If price dips below this area but quickly returns, it suggests sellers are not in control and downside risk is limited.

Neutral and Rotational Zone for Nasdaq Futures Today

Between 25,310 and 25,365

As long as price remains inside this range:

-

Expect two-sided trade

-

Breakouts have a higher failure risk

-

Patience often offers better risk management than activity

This is the zone where many traders get chopped up by reacting to every small move. Professionals typically wait for confirmation outside of it.

Delta Insight Without the Noise

Delta, which reflects the balance between aggressive buying and selling, adds important context to today’s price action.

So far:

-

Buying pressure has appeared, but has not steadily expanded

-

Selling pressure has also appeared, but without follow-through

-

Neither side has been able to impose control

This mixed delta behavior supports the broader message from price action. The market is active, but not yet decisive.

When delta begins to progress consistently in one direction after price leaves the value area, that is when conviction usually follows.

Why These Nasdaq Futures Levels Are Different From Random Numbers

Anyone can say:

“If NASDAQ goes above 25,500 it is bullish. If it goes below, it is bearish.”

That statement sounds confident, but it lacks context.

The levels discussed here are different because they are based on:

-

Where value was established

-

Where acceptance previously failed

-

Where professional participants are most likely to react

This is why the tradeCompass framework focuses on behavior around key zones, not single price prints.

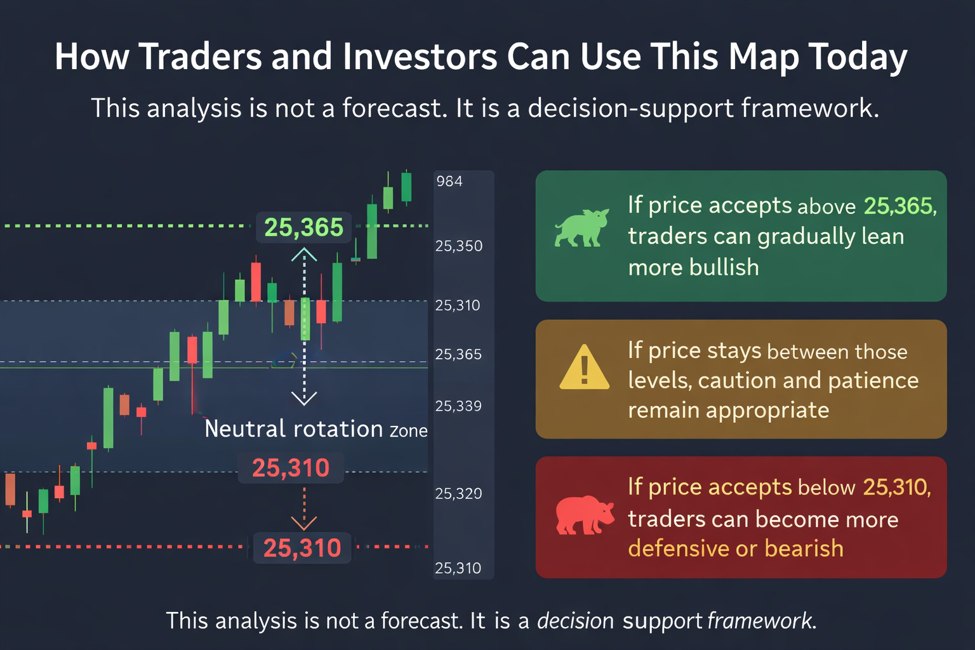

How Nasdaq Traders and Investors Can Use This Map Today

This analysis is not a forecast. It is a decision-support framework.

-

If price accepts above 25,365, traders can gradually lean more bullish

-

If price accepts below 25,310, traders can become more defensive or bearish

-

If price stays between those levels, caution and patience remain appropriate

Used alongside your own tools, timeframes, and risk management, this approach helps reduce emotional decisions and improves alignment with how professional markets actually function.

NASDAQ futures are at an inflection point today.

The next meaningful move is likely to come after value acceptance, not during the current back-and-forth. Watching how price behaves around 25,365 and 25,310 will provide far more insight than reacting to every tick in between.

This tradeCompass-style analysis offers a professional map of the market, not a promise of direction.

Trade at your own risk.

===============

Live Trader Update – 05:12

Tuesday, 10 February 2026

Eastern Time (ET)

NASDAQ 100 futures attempted to extend higher earlier but failed to secure acceptance above the 25,380-25,390 area. After that upside test stalled, price rotated back into the prior value zone and is now trading again around 25,350-25,360, where recent balance has formed.

From a market structure perspective, this shifts the tone back to neutral. The earlier bullish repricing attempt lost momentum, not due to aggressive selling, but due to a lack of follow-through and commitment at higher prices.

What matters now:

-

Bullish continuation: Only reactivates if price regains and holds above 25,380+, with value building higher.

-

Neutral / chop: Likely as long as price remains between ~25,310 and ~25,380.

-

Bearish risk: Increases only if price accepts below ~25,310, which has not occurred.

Until acceptance appears on either side, this remains a decision zone, not a trending environment. Patience and selective positioning remain key.

This is decision support, not a prediction. Trade at your own risk.

————————————————–

Live NASDAQ Market Update – 08:33

Tuesday, 10 February 2026

Eastern Time (ET)

NASDAQ 100 futures are showing early signs of a downside value shift after failing to sustain higher prices earlier in the session. The prior upside attempt above the 25,360–25,370 area did not gain acceptance, and price has since rotated back through VWAP, with activity now concentrating closer to 25,335–25,340.

From a structural perspective, this marks a change in tone. What began as a neutral balance has started to tilt lower, as selling pressure has expanded and upside follow-through has weakened on bounce attempts.

What matters now:

-

Primary risk zone: Below ~25,340, downside acceptance risk increases.

-

Downside focus: 25,310–25,315 is the next key area where the market will decide whether lower prices are accepted.

-

Bullish recovery: Requires a reclaim and hold above 25,360–25,370 to neutralize the current pressure.

Until acceptance becomes clear, this remains a transition phase, not a confirmed trend. Moves should be evaluated by how price behaves around these levels rather than by speed alone.

This is decision support, not a prediction. Trade at your own risk.

——————————————

Live NASDAQ Futures Market Update – 13:52

Tuesday, 10 February 2026

Eastern Time (ET)

NASDAQ 100 futures are currently trading near 25,286, extending the downside move after failing to regain key resistance areas earlier in the session. The market remains under pressure, with price continuing to trade well below today’s developing VWAP, reinforcing the bearish intraday structure.

From a technical and order flow perspective, the focus now shifts to a series of untested, high-importance reference levels below, while a dense resistance cluster has formed overhead.

Key resistance cluster above (bullish barrier)

The most important resistance zone sits between 25,355 and 25,370, where multiple professional reference points align:

-

Today’s developing VWAP: ~25,355

-

Yesterday’s Value Area High: ~25,361

-

Today’s developing Point of Control: ~25,370

This triple-level cluster represents a major acceptance hurdle for any bullish recovery attempt. As long as price remains below this zone, upside moves should be treated as corrective bounces, not trend reversals. Bulls would need to reclaim and hold above this area to meaningfully neutralize the current pressure.

Key downside levels in focus (all untested since yesterday)

With price now below today’s value and VWAP, attention turns to naked levels from the prior session, which often act as natural magnets during continuation moves:

-

Yesterday’s VWAP: ~25,247

This level sits below today’s low and is the nearest downside reference. A test here would be technically normal in the current context. -

Yesterday’s Point of Control: ~25,120

A deeper level where heavy prior participation occurred. Acceptance near this area would suggest the market is comfortable trading lower. -

Yesterday’s Value Area Low: ~25,018

The lower boundary of prior value and a more extreme downside reference if selling pressure accelerates.

The fact that all three levels are naked increases their relevance as potential downside targets if current acceptance continues.

Nasdaq Futures market structure and acceptance read

Recent price behavior shows that downside moves are holding, while bounce attempts lack the ability to reclaim prior value areas. This suggests the market is accepting lower prices rather than simply rotating, which keeps downside risk elevated into the remainder of the session.

That said, acceptance remains the key concept. The market will continue to provide information based on how it behaves at each of these levels, not just whether it touches them.

Summary for Nasdaq traders and investors now

-

Current price: ~25,286

-

Primary resistance: 25,355–25,370

-

Nearest downside focus: 25,247 (yesterday’s VWAP)

-

Deeper downside levels: 25,120 (POC), 25,018 (VAL)

-

Bias: Bearish while below reclaimed value

-

Key concept: Watch for acceptance or rejection at each level, not just price speed

This framework provides a professional map of where decisions are most likely to occur. It is decision support, not a prediction.

Trade at your own risk.

This article was written by Itai Levitan at investinglive.com.