S&P 500 Technical Analysis After the Gap Down at This Week’s Open – Why Traders Needed Patience Near Friday’s Close

The S&P 500 opened the new trading week on Monday, January 26, 2026, with what looked like a scary gap down. From Friday’s close near 6,933.75, futures briefly dropped to around 6,879, a move of more than 50 points.

For many traders, that kind of opening move immediately triggers fear, urgency, and short-selling instincts.

But this is exactly where a solid technical map matters.

Instead of reacting emotionally to the size of the gap, experienced traders focus on key technical junctions, how price behaves around them, and what that behavior tells us about probability. In this case, the early price action delivered an important lesson about gap dynamics, liquidity, and why shorting too early is often a mistake.

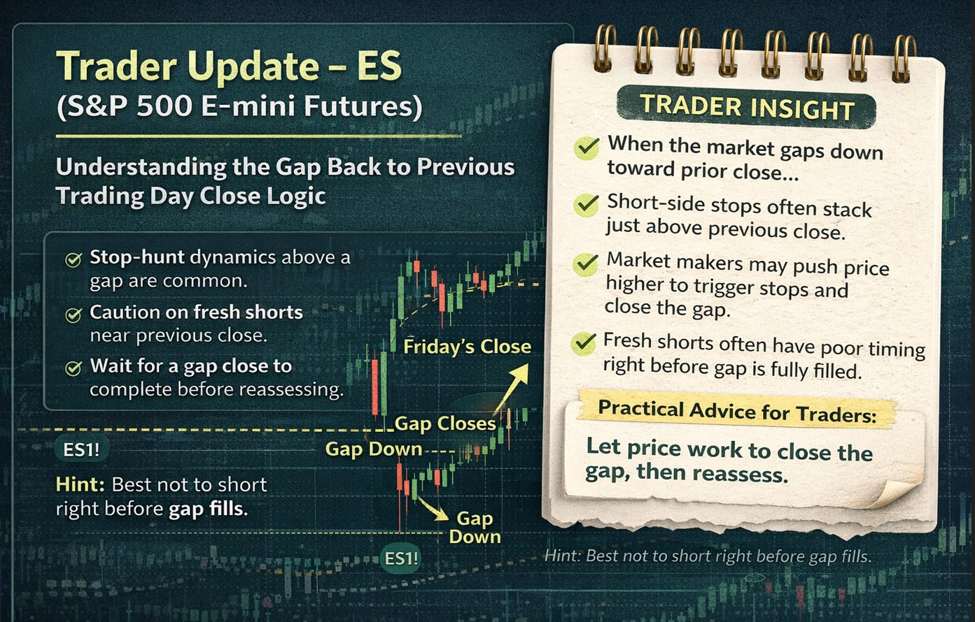

Why the Previous Trading Day Close Matters After a Gap Down

When markets gap down at the open, especially after a weekend, many traders talk about “yesterday’s close.”

In reality, the reference point is the previous trading day close, which in this case was Friday, since Sunday trading was closed.

As price moved higher during Monday’s session, futures were still slightly below Friday’s close, shown by the small negative percentage on the chart. That detail matters more than it may seem.

Here is why.

After a gap down, a common pattern unfolds:

-

Some traders short the market early, assuming momentum will continue lower

-

Others wait for a partial retracement and then enter shorts

-

Many of those shorts place their stop-loss orders just above Friday’s close

This creates a clear liquidity pocket above the previous close. Market participants with size, including algorithms and market makers, are well aware of this behavior.

Liquidity attracts price.

Stop-Hunt Dynamics Near the Gap Fill

As price grinds higher toward the previous close, two forces often combine.

First, stop-hunt dynamics come into play. When stops are clustered just above a well-known reference level like Friday’s close, it becomes easier for price to push slightly higher, close the gap, and even overshoot briefly. That move clears out short positions and releases liquidity into the market.

Second, natural dip buying often joins the move. Some buyers are not thinking about stops at all. They are responding to technical structure, support, or broader trend context and simply see value.

When these forces align, the probability of a full gap close increases sharply.

This is why shorting the market right before a gap is filled is often poor timing. Even if the broader outlook later turns bearish, the risk-reward at that moment is usually unfavorable.

Technical Structure That Supported Buyers

Beyond gap mechanics, the chart itself provided several constructive signals.

The gap down landed directly on a retest of a bullish structure, including a channel and a bull flag. That retest held cleanly, and buyers stepped in decisively.

There was also an anchored VWAP reference from a prior contract rollover period. Notably, buyers did not even allow price to reach that VWAP level before stepping in. That behavior often signals urgency from buyers, not weakness.

Another subtle but important detail was the formation of a higher low. The most recent low was slightly higher than the previous one, and neither touched VWAP. This tells us buyers were willing to defend price earlier and earlier, a classic sign of underlying strength.

These are the kinds of details that separate reactive trading from informed decision-making.

Why Many Traders Misread the Gap Down

From a purely visual perspective, a 50-plus point drop from Friday’s close looks bearish. On higher timeframes, it can feel dramatic and intimidating.

That is why many traders rushed to short the market early.

However, without understanding where price is relative to key references, those trades lack context. A gap down does not automatically mean continuation lower. What matters is how price reacts at known junctions.

In this case, the market showed clear signs of buyer defense well before the gap was filled. That alone should have made traders cautious about pressing shorts.

Waiting for confirmation does not mean missing opportunity. Often, it means avoiding bad trades.

Practical Takeaway for Traders

When the market gaps down and then begins grinding higher:

-

Watch how price behaves near the previous trading day close

-

Be cautious with shorts as the gap approaches completion

-

Understand that liquidity often sits just above obvious reference levels

-

Let the market finish its business before looking for the next setup

This does not mean the market cannot turn lower afterward. It simply means that timing matters, and probability shifts as price approaches key levels.

Good trading is not about prediction. It is about recognizing when risk-reward is no longer in your favor.

Please note, S&P 500 Traders

What looked like a frightening start to the week turned into a valuable technical lesson. Buyers defended key structure, the gap began to close, and traders who stayed patient avoided unnecessary losses.

This type of behavior repeats across markets and instruments. Understanding it can save capital and improve decision-making over time.

For more market perspectives, educational insights, and trade discussions, visit investingLive.com, check out our YouTube channel, and join the investingLive Stocks Telegram channel, which is free.

Stay disciplined, stay patient, and have a strong trading week ahead.

This article was written by Itai Levitan at investinglive.com.