>> Free Account

Best Forex Broker in <<

[Free Demo in 30 seconds]

Forex trading is complex. Choosing the right broker is key to success. It requires careful analysis and strategic thinking.

When trading in the forex market, picking a broker is more than just looking at prices. A good broker offers important tools for smooth transactions and reliable access to markets. They also provide essential tools for your trading strategies.

Choosing a forex broker involves looking at several factors. These include regulatory compliance, trading platforms, transaction costs, market reputation, and customer support. Experienced traders know these elements are important for a good trading experience.

Understanding Forex Brokers and Their Role in Trading

>> Free Account

Best Forex Broker in <<

[Free Demo in 30 seconds]

Forex trading needs special helpers to connect traders to global markets. These experts help with international money deals. They also give traders the tools they need to trade.

A forex broker is like a bridge for traders to the world of currency exchange. They help traders buy and sell money using advanced platforms and accounts.

What Defines a Forex Broker?

Forex brokers are licensed to:

- Execute currency trading orders

- Provide market access

- Offer trading platforms

- Supply real-time price information

Types of Forex Broker Categories

There are different types of forex brokers for different needs. The main types are:

| Broker Type | Key Characteristics |

|---|---|

| Dealing Desk (DD) | Intermediate trading through internal price setting |

| No Dealing Desk (NDD) | Direct market access with transparent pricing |

| ECN Brokers | Electronic communication network with direct market connections |

Understanding Forex Brokerage Accounts

Forex brokerage accounts are special platforms for traders. They allow traders to:

- Open trading positions

- Manage currency investments

- Track market performance

- Execute trades with minimal friction

Choosing the right forex broker is key to success in trading. It affects how well you do with your investments.

How to Choose a Forex Broker: Key Selection Criteria

>> Free Account

Best Forex Broker in <<

[Free Demo in 30 seconds]

Choosing the right forex broker is very important for traders. It affects their success in the financial markets. Traders need to look at several key criteria when picking a broker.

When picking a broker, traders should focus on a few important things:

- Regulatory Compliance: Make sure the broker is licensed by trusted financial bodies like FCA or ASIC

- Competitive Trading Costs: Look at spreads, commissions, and any hidden fees

- Trading Platform Quality: Check if the platform is easy to use and has good technical features

- Market Access: See what trading instruments are available

Financial safety is the most important thing when choosing a forex broker. Regulated brokers protect traders with strict rules and separate client funds. Brokers offer leverage, which can increase gains but also risks. It’s key to know the margin requirements.

Here are some key things to look at:

- Account funding options

- How fast withdrawals are processed

- How good the customer support is

- The educational resources available

Traders should do a lot of research and compare different brokers. This helps find the best one for their trading style and financial goals. Using demo accounts can give a good idea of a broker’s platform and conditions before investing real money.

Trading Platforms and Technical Features

Forex trading platforms have changed how we deal with financial markets. Today’s platforms have advanced tools. These tools help traders make quick, smart choices.

Understanding mobile forex trading is key. Traders need platforms that work well on all devices. This ensures smooth trading, no matter where you are.

Popular Trading Platforms

There are three top forex trading platforms:

- MetaTrader 4 (MT4): A classic favorite

- MetaTrader 5 (MT5): Offers more features

- cTrader: Known for its easy-to-use design

Mobile Trading Capabilities

Mobile trading is a must for those who want to stay connected. Brokers have made apps that let you:

- See live prices

- Make trades instantly

- Manage your account fully

Technical Analysis Tools

Top forex platforms have great tools for analysis:

| Tool Category | Key Features |

|---|---|

| Charting | Many timeframes, custom indicators |

| Automated Trading | Expert Advisors, algorithms |

| Risk Management | Stop-loss, take-profit |

Traders use these tools to improve their strategies. This helps them earn more.

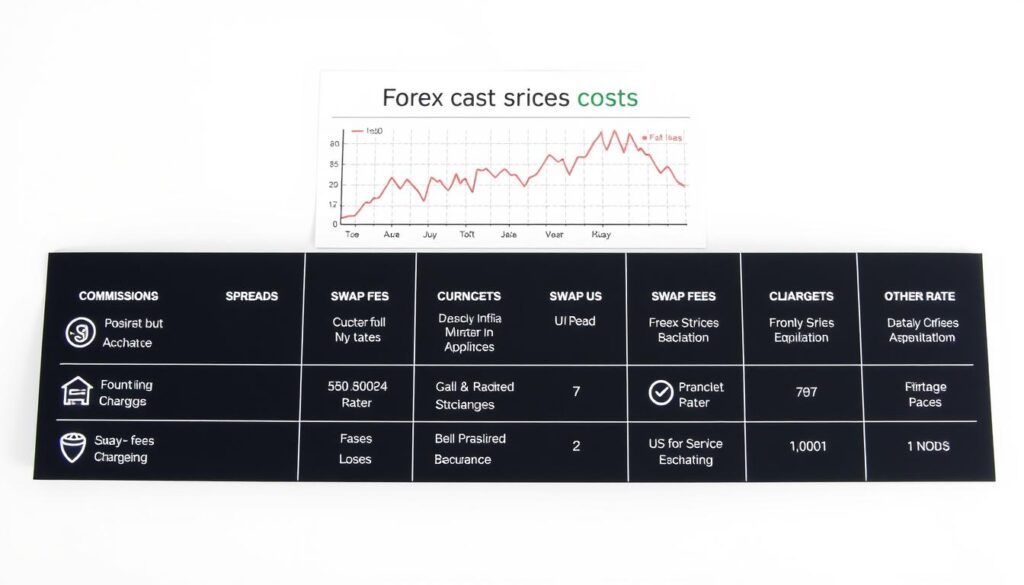

Understanding Costs and Trading Conditions

Forex trading costs are complex. They affect how well you do in trading. The conditions set by your broker are key to making money.

The spread is the main cost in forex. It’s the price difference between buying and selling. Spreads change with different currency pairs and brokers. It’s important to look at these costs closely, as they affect your profits.

- Fixed spreads offer steady prices

- Variable spreads change with market conditions

- Tight spreads mean lower trading costs

There are more costs in forex trading than just spreads. You also need to think about:

- Commission fees

- Overnight swap rates

- Inactivity charges

- Withdrawal and deposit fees

Broker conditions are not just about money. Speed, slippage, and how often you get quotes matter a lot. It’s smart to check a broker’s fees before you start trading.

Looking at different brokers helps you save money. You should choose a broker with clear prices and fees. This makes your trading better.

Market Access and Trading Opportunities

The forex market is a global financial system full of trading chances. It lets traders access one of the most liquid markets in the world. Sophisticated brokers offer platforms for trading many currency pairs across global exchanges.

Traders can find many trading chances, from big pairs like EUR/USD to rare ones with emerging market currencies. Professional brokers give full market access, including major, minor, and exotic pairs. This helps in managing risks and making profits.

Today’s trading platforms have more than just currency trading. Some brokers also offer things like cryptocurrencies, stocks, and commodities. This lets investors build complex and balanced portfolios that fit their risk levels and goals.

Choosing the right forex broker is key. Investors should look at the variety of markets, global coverage, costs, and tech features. Picking a broker that matches your trading goals can lead to better results.