This is a breaking news story. Check back for updates.

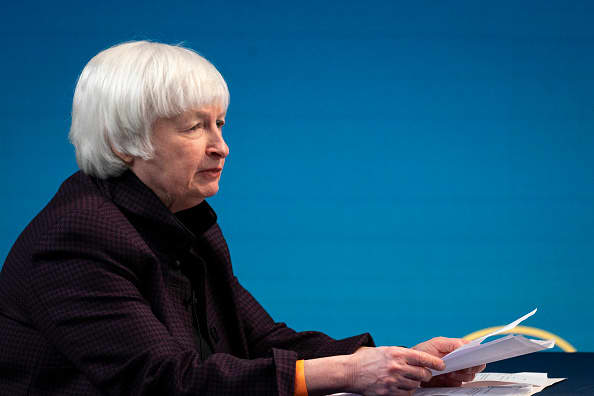

Treasury Secretary Janet Yellen conceded Tuesday that interest rates may have to rise to keep a lid on the burgeoning growth of the U.S. economy brought on in part by trillions in government stimulus spending.

“It may be that interest rates will have to rise somewhat to make sure that our economy doesn’t overheat,” Yellen said during a economic seminar presented by The Atlantic. “Even though additional spending is relatively small to the size of the economy, it could cause some very modest increases in interest rates.”

“But these are investments our economy needs to be competitive and productive,” she added.

Since the Covid-19 pandemic broke in March 2020, Congress has allocated some $5.3 trillion in stimulus spending, resulting in a more than $3 trillion budget deficit in fiscal 2020 and a $1.7 trillion shortfall in the first half of fiscal 2021.

The Biden administration is pushing an infrastructure plan that could see another $4 trillion spent on a variety of longer-term projects.

Though she said the U.S. needs to focus on fiscal responsibility longer term, she said spending on matters central to the government’s mission has been ignored for too long.

President Joe Biden is “taking a very ambitious approach, making up for really over a decade of inadequate investment in infrastructure, in R&D, in people, in communities and small businesses, and it is an active approach,” Yellen said. “But we’ve gone for way too long on letting long-term problems fester in our economy.”

The Federal Reserve, which Yellen led from 2014-18, has kept short-term interest rates anchored near zero for more than a year, despite an economy growing at its fastest pace in nearly 40 years. Central bank officials have vowed to keep accommodative policy in place until the economy makes “substantial further progress” towards full and inclusive employment and inflation that averages around 2% over a longer term.

Inflation concerns have arisen due to all the spending and the rapid growth, but Fed officials have said that after a brief rise this year, price pressures are likely to ebb.

Yellen repeated Tuesday that she is largely not concerned about inflation becoming a problem, though she added that there are tools to address it should that happen. Fed Chairman Jerome Powell recently said that the primary tool to control inflation is through higher interest rates.

Become a smarter investor with CNBC Pro.

Get stock picks, analyst calls, exclusive interviews and access to CNBC TV.

Sign up to start a free trial today.