- GBP/USD is on the warpath as the US dollar loses traction and support of yields.

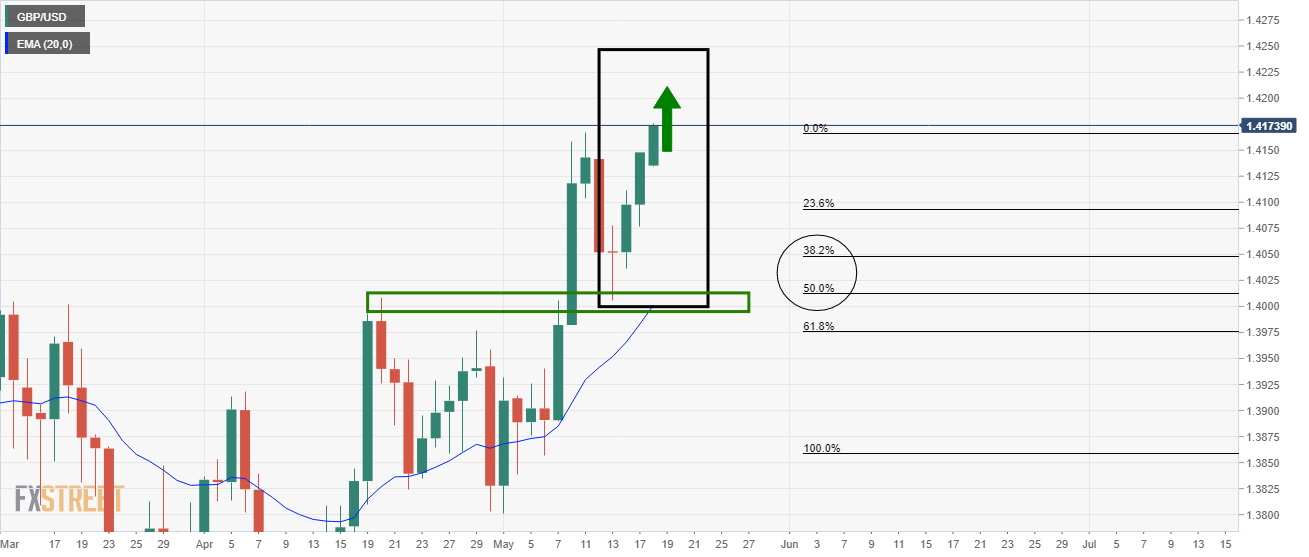

- Bulls target the 1.42 area in a break on the daily resistance.

GBP/USD is currently trading at 1.4166 adding 40 pips on the day so far to trade 0.3% higher.

Cable has travelled between a low of 1.4125 to a high of 1.4174 while the greenback teeters near multi-month lows with Treasury yields stalling due.

There are renewed expectations that US interest rates will remain low for an extended period after more Fed talk advocated for a lower-for-longer regime.

Dallas Federal Reserve President Robert Kaplan on Monday reiterated his view that he does not expect interest rates to rise until next year.

Additionally, Federal Reserve’s vice chairman Richard Clarida has said the Fed will respond to higher inflation should that be required. He, amongst others, have constantly insisted that now is not the time to start taper talk while employment remains deep in a hole.

The US central bank will also release minutes from its most recent meeting, which will give traders a lot of hints about where monetary policy is headed this year.

The market’s thinking is that the central bank will tolerate what it sees as a temporary acceleration in inflation, which will keep the dollar lower against most major currencies.

Domestically, sterling has been buoyed recently as investors continue to cheer the easing of strict coronavirus restrictions on economic activity.

With that being said, a note from earlier in the UK’s The Times warns that the UK’s PM Boris Johnson may have to rethink social distancing relaxations if the Indian variant takes a hold.

GBP/USD technical analysis

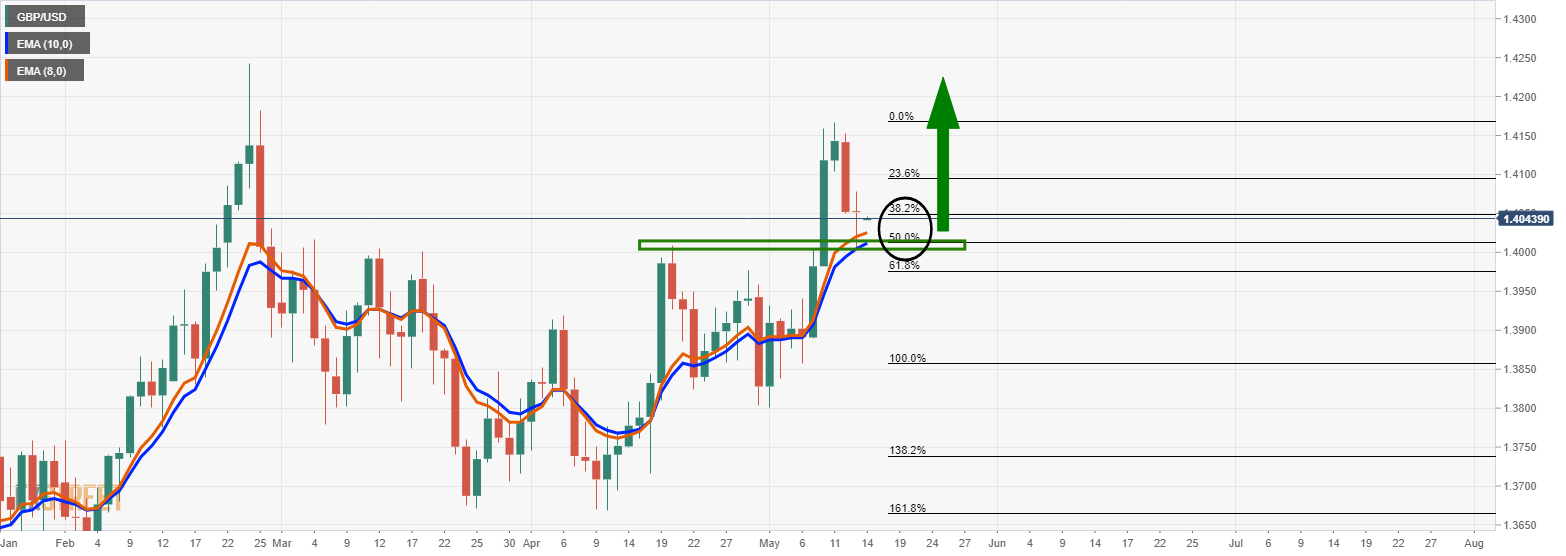

Meanwhile, as per the prior analysis, GBP/USD Price Analysis: Bulls looking for breakout to the topside, the bulls are indeed moving on with their plans to take down the daily highs in pursuit of the psychological 1.42 area.

Prior GBP/USD analysis, daily and 4-hour time frames

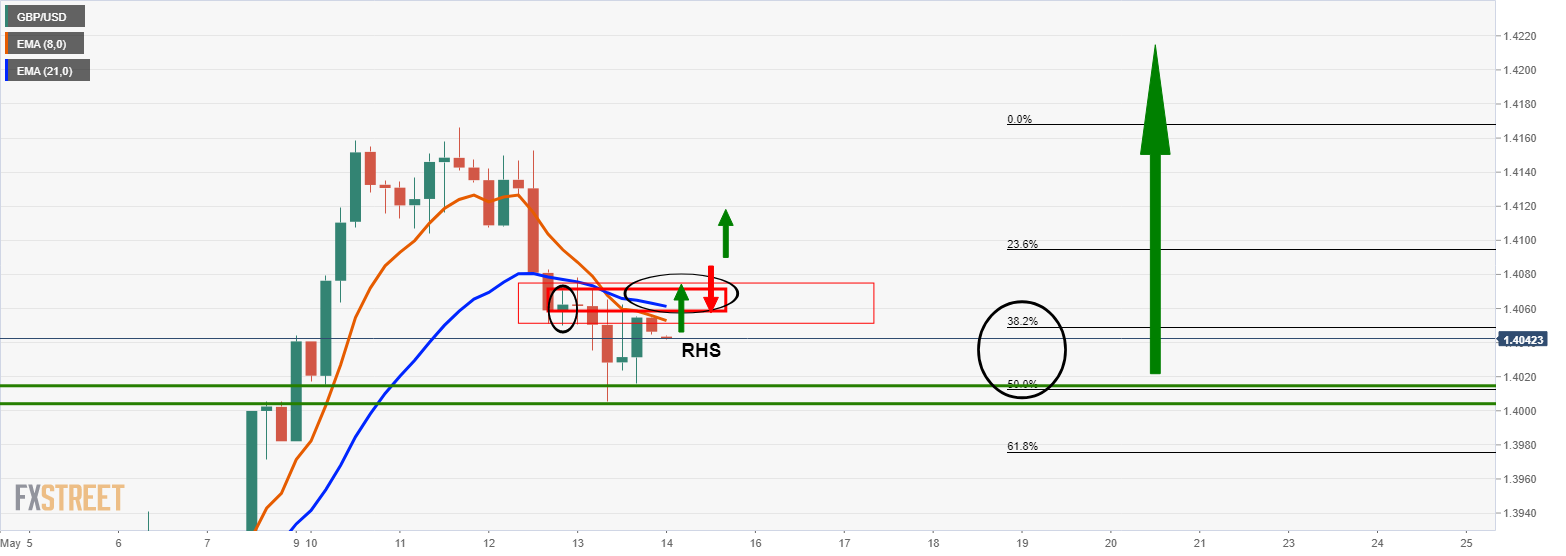

‘Nevertheless, the 4-hour chart is forming a bullish reverse head and shoulders formation and on completion, the bullish price action could well burst into life.‘

‘The right-hand shoulder of the bullish reverse head and shoulders is in the process of being formed.

Bulls will want to see the price break the prior highs within this formation and hope for a discount on a retest of the structure before committing to the bullish thesis.’