- SPY boosted by friendly Fed as taper talk thankfully limited.

- Fed is to start tapering but no timeline set.

- SPY reacts positively to potentially bad news, is that a positive?

We have a potential tongue twister from our last bullet point above. The SPY reacted positively to potentially negative news, so is that really a positive? Well, the question is valid and we think the answer is a positive yes. The so-called “wall of worry” we have been hearing about is starting to crumble and the Fed took a gentle approach rather than a sledgehammer to further chip away at that bearish wall. Just to recap what has been keeping you up at night, we had Evergrande, tapering and delta among others. Evergrande paid some interest so easing those fears, the Fed talked taper but did not put a timeline on it and delta does look to be under control with vaccines proving effective. So what else do we have to worry about? Inflation was the theme earlier in the year when ten-year yields spiked but the Fed made a slightly surprising mention of an interest rate hike happening sooner rather than later to control inflation. This could certainly have provided fuel for bears as rising rates is generally not helpful to Nasdaq stocks in particular. But as we keep on saying, uncertainty is the markets biggest fear and now the Fed has provided some level of certainty. The reaction of markets into the close certainly sends the message that the market was happy with the Fed performance and happy that rate rises are coming! Certainly an unusual statement.

SPY 15 minute

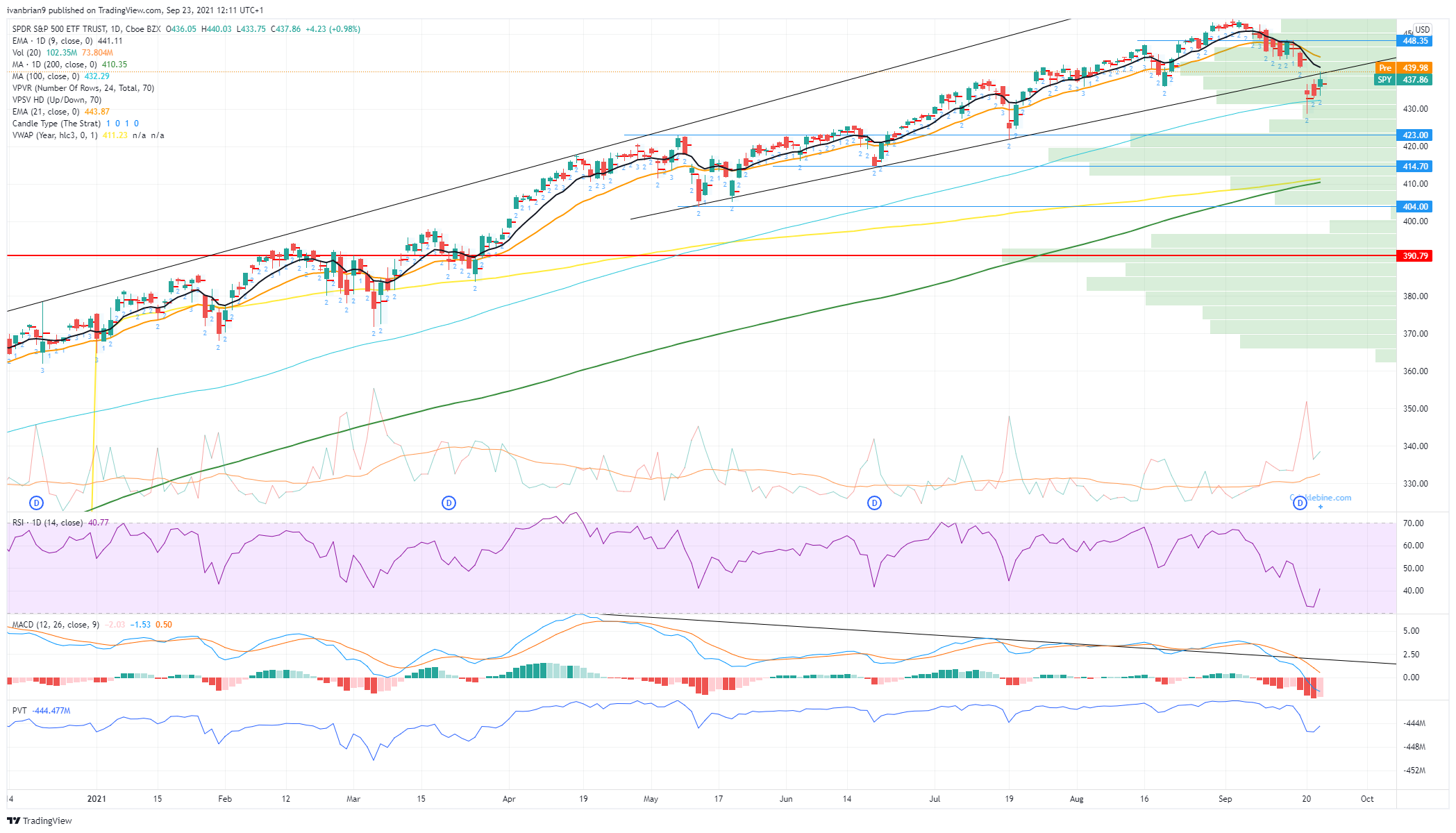

SPY stock forecast

The gap from Monday is not quite filled but is likely to go on the open today as European markets are well ahead. This will bring us into a neutral zone technically although we are now bullish after yesterdays price action. Above $448 the chart turns bullish. Look for volume to increase today as inflows return and investors return to some of their favourite names. The volume will confirm the bulls are back.

FXStreet View: Neutral technically but bullish based on price action, bullish above $448, neutral $443 to $448. Bearish below $433.

-637679921226133151.png)