- DXY quickly faded the initial optimism and dropped below 94.00.

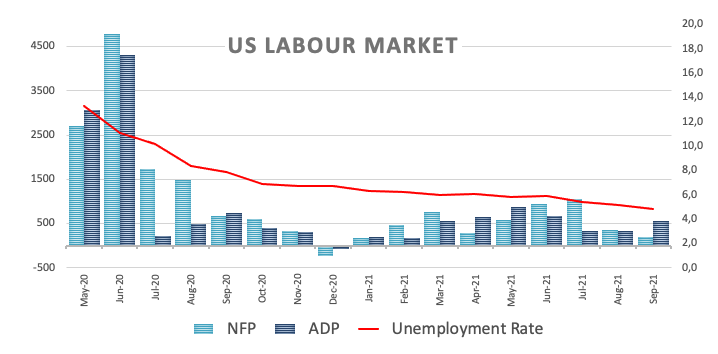

- The US economy added 194K jobs in September vs. 500K expected.

- The US jobless rate edged lower to 4.8% (from 5.2%).

The US Dollar Index (DXY), which gauges the greenback vs. a bundle of its main rival currencies, retakes the 94.00 barrier following an ephemeral test of the 93.90 zone.

US Dollar Index trimmed gains on Payrolls

The index now loses ground for the second session in a row after disheartening Payrolls figures forced the buck to fade the earlier advance and prompted US yields to recede some ground as well.

Indeed, the dollar sank into the negative territory after Nonfarm Payrolls figures showed the economy added 194K jobs during last month, coming in (very) short of the 500K expected. On a rosier side, the Unemployment Rate improved to 4.8% (from 5.2%).

Additional data saw the Participation Rate at 61.6% (from 61.7%) and Average Hourly Earnings expanding at a monthly 0.6% and 4.6% from a year earlier.

Despite coming in short of consensus, September’s Payrolls are unlikely to deter speculations of a sooner-rather-than-later QE tapering. The pace of job creation may have lost some traction but remains on track, while inflation have passed by far the “tapering threshold”. In addition, Fedspeak remains largely supportive of the Fed start trimming the stimulus programme in the relatively short term… November?

US Dollar Index relevant levels

Now, the index is losing 0.08% at 94.12 and a break above 94.50 (2021 high Sep.30) would open the door to 94.74 (monthly high Sep.25 2020) and then 94.76 (200-week SMA). On the flip side, the next down barrier emerges at 93.67 (weekly low Oct.4) followed by 93.51 (20-day SMA) and finally 92.98 (weekly low Sep.23).