- USD/CHF edges higher during the two-day uptrend towards weekly high.

- Downbeat momentum, key SMA hurdle challenges the further upside.

- 61.8% Fibonacci retracement offers strong support, bulls may aim for 0.9200 during further advances.

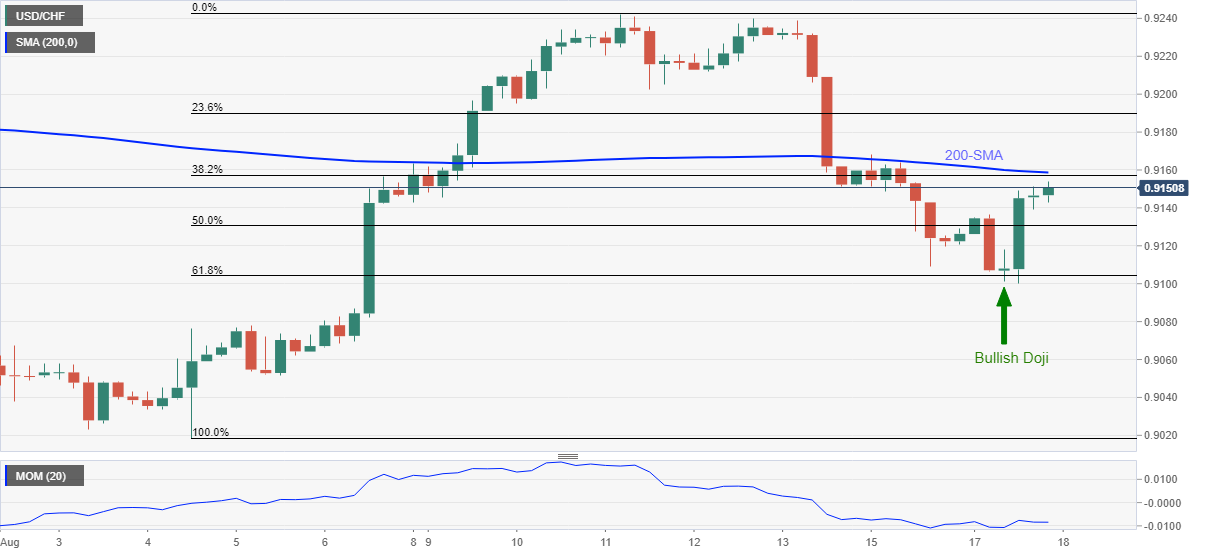

USD/CHF remains on the front foot, recently easy around 0.9150 during Wednesday’s Asian session. The Swiss currency pair bounced off the 61.8% Fibonacci retracement (Fibo.) of August 04–11 upside the previous day to snap the earlier two-day downtrend.

The recovery moves, however, struggle to gain pace as the Momentum line portrays sluggish moves near the 200-SMA.

Hence, the rebound needs to overcome the key SMA hurdle of around 0.9160, also including 38.2% Fibonacci retracement, to convince the USD/CHF buyers. It should be noted that the weekly top surrounding 0.9170 adds to the upside filters.

Should the quote rises past 0.9170, August 11 lows near the 0.9200threshold and the monthly peak close to 0.9242 will be on the bull’s radar.

Meanwhile, pullback moves may recall the 0.9130 support levels on the chart before highlighting the 61.8% Fibo. for the USD/CHF bears, bear 0.9105. It’s worth noting that the 0.9100 threshold offers extra support to challenge the pair’s downside towards the monthly low near 0.9060.

USD/CHF: Four-hour chart

Trend: Pullback expected