- USD/JPY bulls are back in play as the US dollar breaks critical 92.20 resistance, DXY.

- 110.00 is eyed as a target for the bulls on a break of daily resistance.

The following is a top-down analysis of USD/JPY that arrives at a bullish bias into the 110 area so long as the greenback continues to climb out of the doldrums.

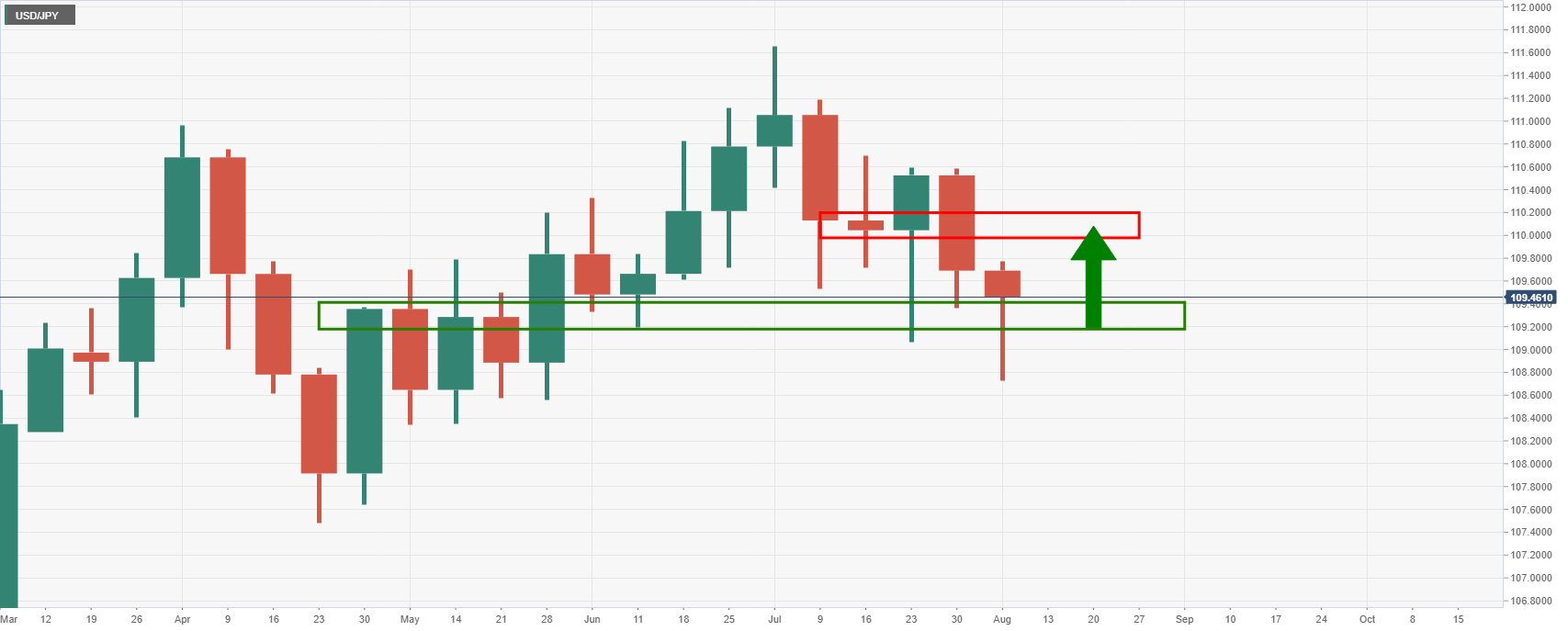

Daily chart

The price has corrected to test the bear’s commitments at daily resistance in the 109.60s which is so far holding up.

A failure here could lead to a downside extension to test the weekly support structure in the 108.50s

DXY correction getting underway?

The US dollar, however, is testing the old 92.30 resistance today with a high made of 92.308 so far.

A positive continuation on a bullish close could be in play for the foreseeable future as the price moves in on the 38.2% Fibonacci retracement and eyes the neckline of the M-formation.

This is located near the 61.8% Fibo and 92.50.

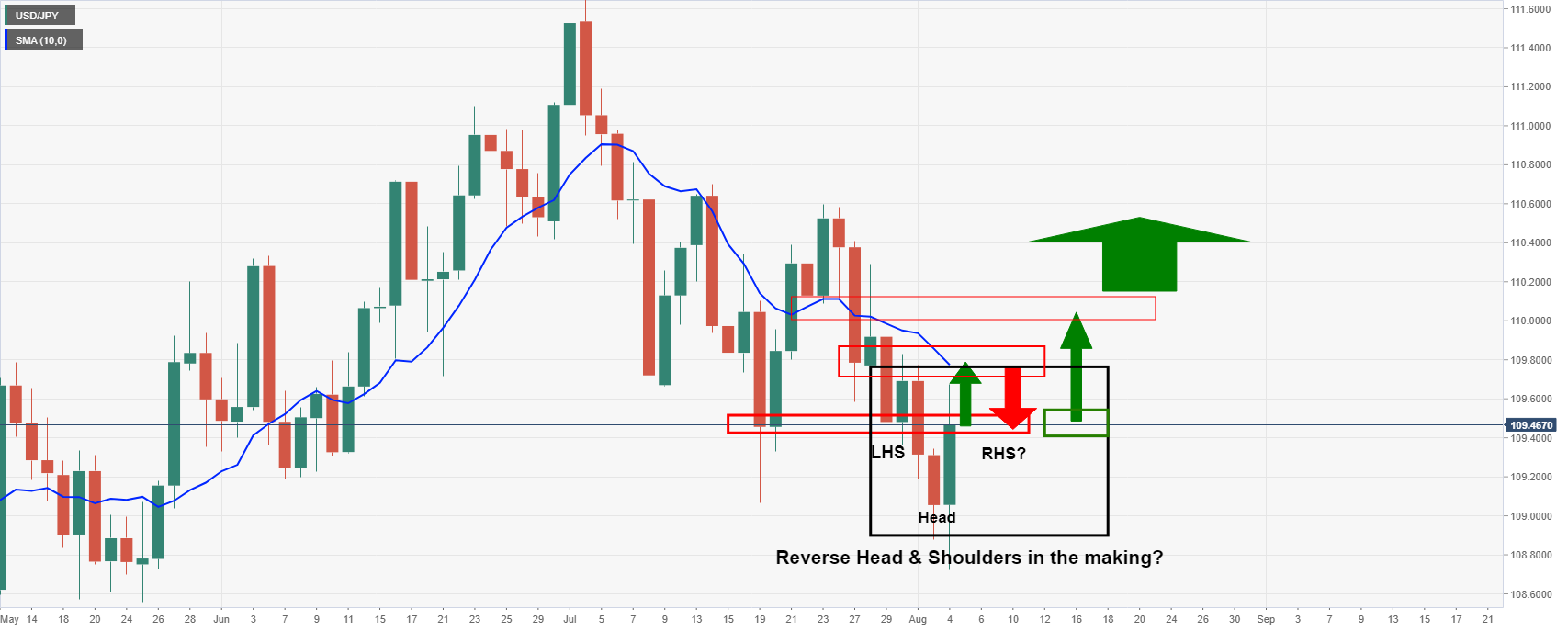

Bullish outlook for USD/JPY

From a weekly perspective, the price is testing support.

If this were to hold, there will be a focus on the neckline of the M-formation near 110.00 the figure as illustrated above.

In choppy forex conditions, what could play out, in the interim, is a bullish reverse Head & Shoulders pattern on the daily chart as the dollar corrects higher.