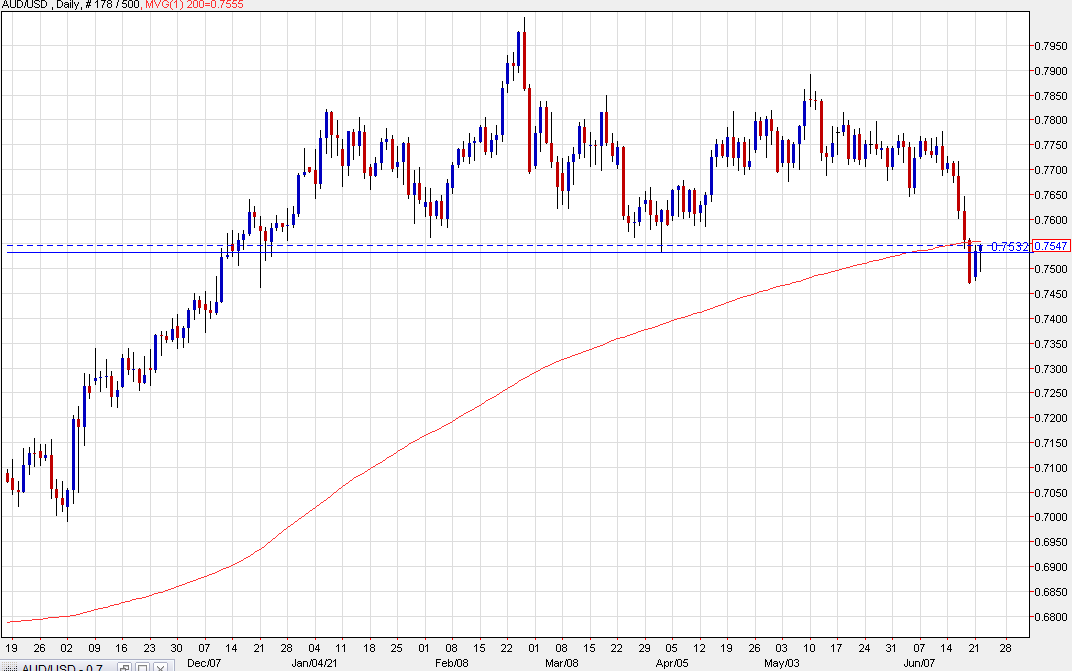

A look at the AUD/USD daily chart

Perhaps the scariest chart coming into this week was AUD/USD. On Friday it broke through the lows of the year and the 200-day moving average in what looked like it could be a major breakdown.

Yet a few days later and the breakdown is still up for debate. There has been no follow-through to the downside and other risk assets have rejected the ‘big turn’ idea from the Fed. At the same time, the bounce hasn’t exactly been inspiring. AUD/USD hasn’t cleared Friday’s opening level and the 200-day moving average hasn’t been broken.

I like the upside on a break of the 200-dma, but not until then.

This article was originally published by Forexlive.com. Read the original article here.