AUD/USD climbs 1.63% on the week

The US dollar is down after today’s non-farm payrolls report but that only continued the selling trend this week.

The Australian dollar, kiwi and surprising Swiss franc were at the top of the FX chart, followed by GBP, EUR, CAD and JPY.

The moves are decent-sized with everything except the yen gaining +1% against the dollar.

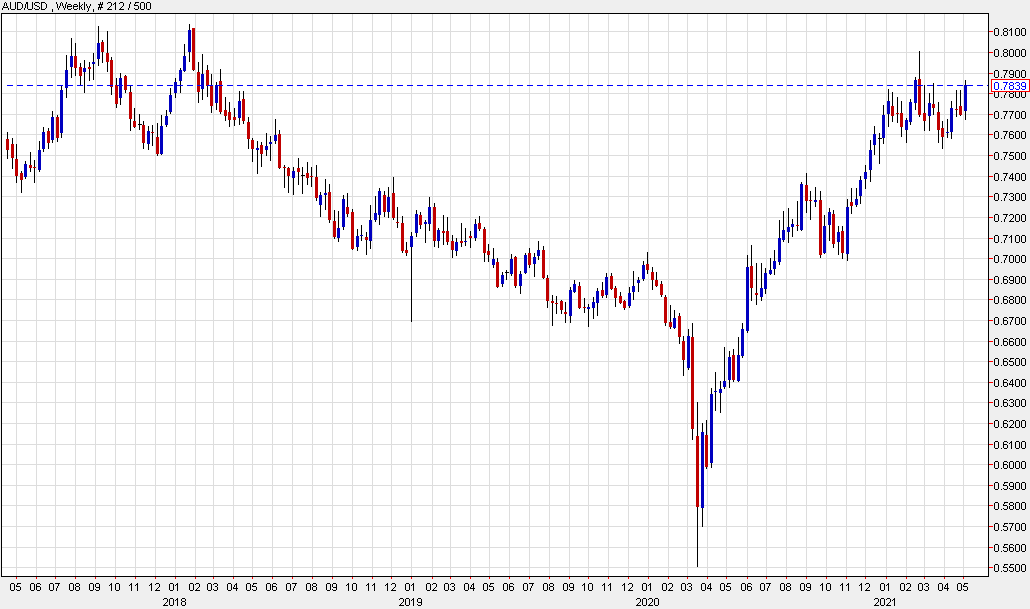

The weekly AUD/USD chart shows that it hasn’t been a decisive move in this pair, but it’s creeping back towards the highs of the year as part of a 5-month period of consolidation.

You have to imagine that if China and Australia were on better terms, this chart would be breaking the 2018 high.

This article was originally published by Forexlive.com. Read the original article here.