As Treasury yields pull higher, the dollar is staying underpinned to start the new week with the jump above 125.00 in USD/JPY also providing an added technical impetus for the greenback at the moment.

That is seeing cable drop below 1.3000 again with UK monthly GDP data also rather disappointing but that’s not exactly a major surprise.

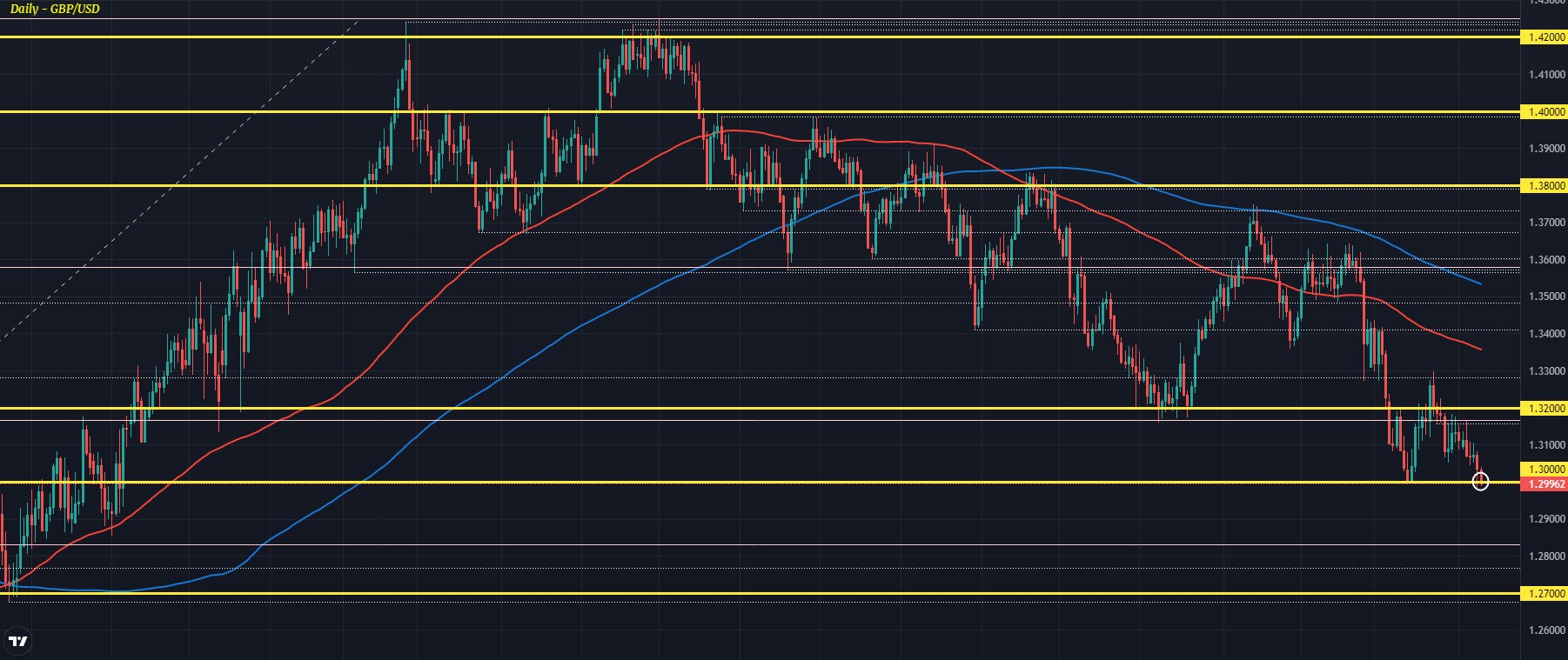

The 1.3000 level has been a key support region for the pair since March trading and a firm break below that could set off the next leg lower in GBP/USD.

The 50.0 retracement level of the swing higher from March 2020 to February 2021 stands at 1.2830 and will be the next key level to watch on any drop below 1.3000.

From a fundamental standpoint, there’s also a divergence in central bank conviction as of late with the BOE scaling back on their hawkish rhetoric while the Fed is maintaining that they can keep up a more aggressive tightening cycle.