Weekly US futures positioning data for the week ending June 11, 2021:

- EUR long 107K vs 109K long last week. Longs trimmed by 2K

- GBP long 27K vs 24K long last week. Longs increased by 3K

- JPY short 37K vs 47K short last week. Shorts trimmed by 10K

- CHF long 1K vs flat last week. Shorts increased by 1K

- AUD short 9K vs 2K short last week. Shorts increased by 7K

- NZD long 5K vs 6K long last week. Longs trimmed by 1K

- CAD long 45K vs 49K long last week. Longs trimmed by 4K

The main move was in buying the yen and selling the Australian dollar. That’s a classic risk off trade and reflects the apprehension in broader markets.

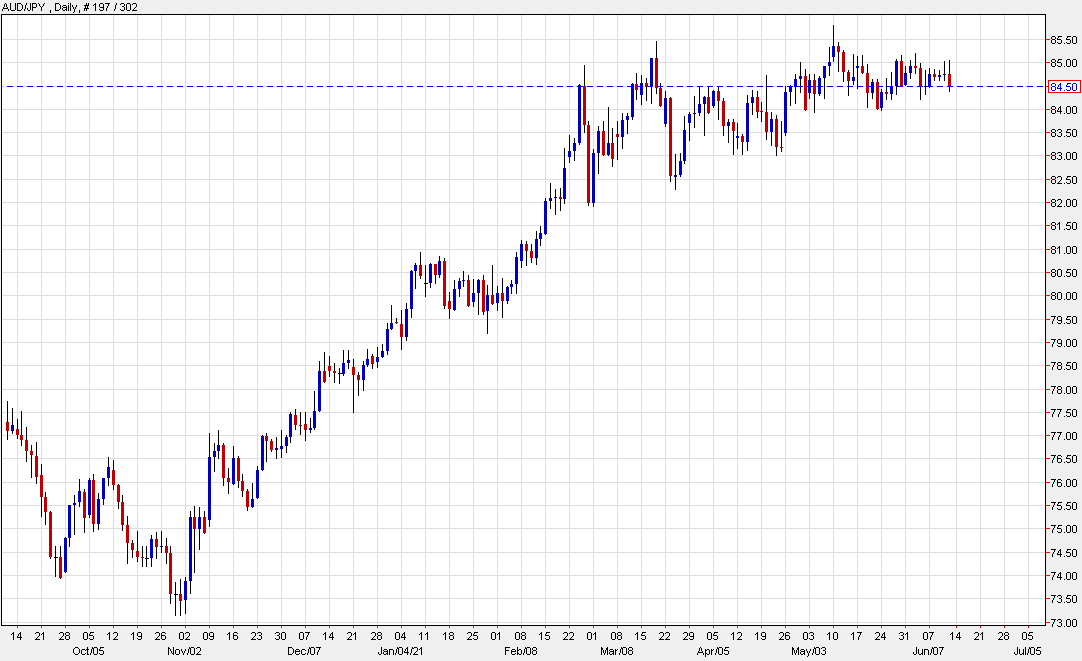

Looking at the chart… is AUD/JPY taking a long pause, or topping out? Either way, the next move will be a big one.

This article was originally published by Forexlive.com. Read the original article here.