Light slate of data coming

Today’s US retail sales report was the last top-tier data point ahead of the FOMC decision next Wednesday. That will leave markets drifting around until there’s some clarity.

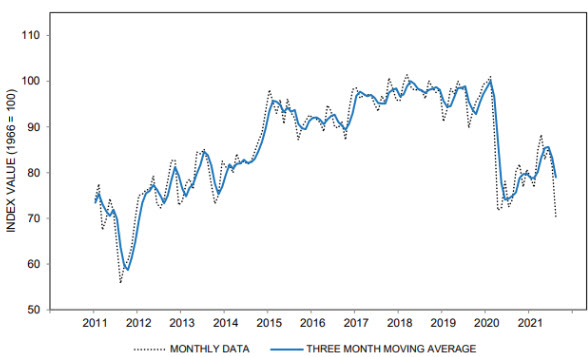

Tomorrow, we get the UMich consumer sentiment report. This data point along with consumer confidence weighed on markets in August but today’s retail sales report showed that have consumers feel and how they spend are disconnected. As I’ve written before, the sentiment reports appear to be more political now than economic.

So that will dent the potential impact of tomorrow’s report, which is expected to bounce to 72.2 from 70.3.

Early next week is thin with some housing data and a 20-year bond auction as the lone notable events ahead of the FOMC.

This article was originally published by Forexlive.com. Read the original article here.