Dollar’s rally continues today and breached parity against Euro for the first time in two decades. Nevertheless, the greenback seems to be losing some momentum since then, in particular against Yen. There is prospect of a deeper retreat for Dollar as 10-year yield is also weakening slightly. Yen is currently the stronger one for today, followed by Kiwi and Aussie. Sterling is the worst, followed by Canadian and Swiss Franc.

Technically, while Dollar might be paring gain, there is no sign of topping for now. Levels to watch including 1.0189 minor resistance in EUR/USD, 1.2055 minor resistance in GBP/USD, 0.6873 minor resistance in AUD/USD, 0.9721 minor support in USD/CHF, 134.74 minor support in USD/JPY. As long as these levels holds, further rally is still expected in Dollar in general.

In Europe, at the time of writing, FTSE is down -0.21%. DAX is down -0.61%. CAC is down -0.22%. Germany 10-year yield is down -0.1065 at 1.142. Earlier in Asia, Nikkei dropped -1.77%. Hong Kong HSI dropped -1.32%. China Shanghai SSE dropped -0.97%. Singapore Strait Times rose 0.46%. Japan1 0-yaer JGB yield dropped -0.0059 to 0.244.

Germany ZEW economic sentiment dropped to -53.8, even worse than pandemic low

Germany ZEW Economic Sentiment dropped from -28 to -53.8 in July, well below expectation of -38.0. Current Situation Index dropped from -27.6 to -45.8, below expectation of -33.5. Both readings were even worse than the values recorded at the beginning of the COVID-19 pandemic.

Eurozone ZEW Economic Sentiment dropped form -28.0 to -51.1, below expectation of -40.0. Current Situation Index dropped -18.0 to -44.4. Inflation expectations rose 6.8 pts to -25.6, remaining clearly in negative territory.

ZEW President Professor Achim Wambach: “The current major concerns about the energy supply in Germany, the ECB’s announced interest rate hike and further pandemic-related restrictions in China have led to a considerable deterioration in the economic outlook.

“The experts assess the current economic situation significantly more negatively than in the previous month and have further lowered their already unfavourable forecast for the next six months.

“Expectations for energy-intensive and export-oriented sectors of the economy have fallen particularly sharply, and private consumption is also assessed as significantly weaker.”

BoE Cunliffe on four lessons learned from crypto winter

In a speech, BoE Deputy Governor Jon Cunliffe talked about the lessons learned from recent “instability and losses in crypto markets”, also called the “crypto winter”.

He said, “a widespread collapse of crypto-asset valuations has cascaded through the crypto ecosystem and generated a number of high-profile firm failures,” which also resulted in Bitcoin losing 70% of its value.

The four lessons learned include:

- Technology does not change the underlying risks in economics and finance;

- Regulators should continue and accelerate their work to put in place effective regulation of the use of crypto technologies in finance;

- This regulation should be constructed on the iron principle of ‘same risk, same regulatory outcome’ ;

- Crypto – technologies offer the prospect of substantive innovation and improvement in finance. But to be successful and sustainable innovation has to happen within a framework in which risks are managed: people don’t fly for long in unsafe aeroplanes.

Australia Westpac consumer sentiment dropped to 83.8, comparable to previous major shocks

Australia Westpac Consumer Sentiment Index dropped from 86.4 to to 83.8 in July. The confidence has been falling every month this year, and it’s now -19.7% below December’s level.

Westpac said that both level and pace of deterioration are “comparable to previous major shocks”. It added that rate fears were intensifying, with 73% polled expecting rates to rise more than 1%.

As for RBA policy, Westpac expects another 50bps rate hike on August 2, taking interest rate to 1.85%. That would be near to Westpac’s assessed “neutral zone” of 1.5-2.0%. It expects RBA to adopt a “more cautious approach” once policy moved to “neutral”, and pause the tightening first after August’s hike.

Australia NAB business confidence dropped to 1, but conditions held up

Australia NAB business confidence dropped from 6 to 1 in June. Business conditions dropped from 15 to 13. Looking at some details, trading conditions dropped from 21 to 18. Profitability conditions dropped from 16 to 12. Employment conditions dropped from 12 to 10.

“Confidence sank below average in June as inflation and interest rate hikes clouded the outlook,” said NAB Group Chief Economist Alan Oster. “Confidence in the retail sector took a significant hit, falling more than 20pts to be well into negative territory, reflecting concerns about the outlook for household spending.”

“While confidence fell, business conditions held up in June,” said Oster. “Conditions remain strong across the states and in most industries. Construction continues to be the only real outlier with building costs weighing, despite a healthy pipeline of work in the sector.”

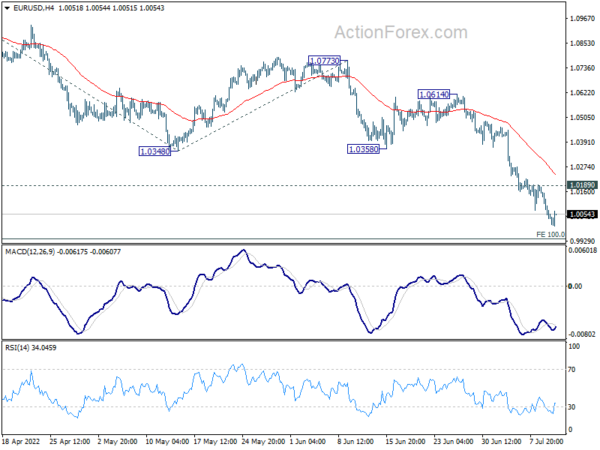

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 0.9989; (P) 1.0086 (R1) 1.0139; More…

EUR/USD’s down trend is in progress today and reaches as low as 0.9999 so far. Intraday bias stays on the downside. Current down trend should target 100% projection of 1.1184 to 1.0348 from 1.0773 at 0.9937, which is close to parity. Firm break there could prompt downside acceleration to 161.8% projection at 0.9420. On the upside, break of 1.0189 minor resistance will turn intraday bias neutral again. But outlook stays bearish as long as 1.0358 support turned resistance holds.

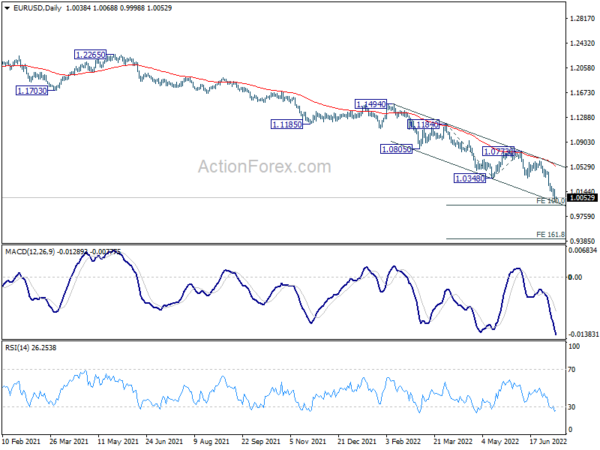

In the bigger picture, down trend from 1.6039 (2008 high) is still in progress. Next target is 100% projection of 1.3993 to 1.0339 from 1.2348 at 0.8694. In any case, outlook will stay bearish as long as 1.0773 resistance holds, in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | BRC Like-For-Like Retail Sales Y/Y Jun | -1.30% | -1.50% | ||

| 23:50 | JPY | PPI Y/Y Jun | 9.20% | 9.00% | 9.10% | 9.30% |

| 01:30 | AUD | NAB Business Confidence Jun | 1 | 6 | ||

| 01:30 | AUD | NAB Business Conditions Jun | 13 | 16 | ||

| 09:00 | EUR | Germany ZEW Economic Sentiment Jul | -53.8 | -38 | -28 | |

| 09:00 | EUR | Germany ZEW Current Situation Jul | -45.8 | -33.5 | -27.6 | |

| 09:00 | EUR | Eurozone ZEW Economic Sentiment Jul | -51.1 | -40 | -28 | |

| 10:00 | USD | NFIB Business Optimism Index Jun | 89.5 | 93 | 93.1 |