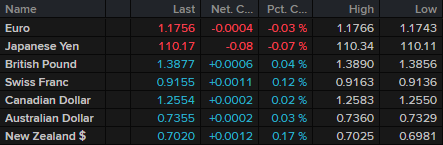

Not much going on in the FX space to kick start the new week

Ranges are still leaning more towards the narrower/tighter end and with risk appetite also more tentative, there isn’t much to work with for the time being.

The bond market remains a key focus with 10-year Treasury yields around 1.30%:

It’s a typical summer’s day start to Europe for now so hopefully the action will pick up in the hours ahead. But as mentioned earlier, if anything else, it may be tough to see any material weakness in the dollar this week:

“Focus on a strong US jobs report keeps the Fed on track to formally announce tapering by year-end, while focus on the delta variant/risk aversion also benefits the greenback mostly against commodity currencies.”

Looking ahead later today, we’ll be hearing from Bostic and Barkin in terms of Fedspeak.