Euro’s rebound stalls after ECB policy announcement, mainly because risk markets turned softer again. Another round of negotiations between Russia and Ukraine failed and Russia will clearly continue its attack. Dollar is trading slightly higher after CPI came in expected, extending its run on making multi-decade high. Though, as for the day, Aussie is leading commodity currencies higher, Swiss Franc and Yen are weak.

Technically, we’ll keep focusing on USD/JPY as it should be ready to break through 116.34 to resume the larger up trend to 118.65 resistance. Also, focus will be on whether EUR/USD would be firmly rejected by 1.1120 resistance, to retain its near term bearishness.

In Europe, at the time of writing, FTSE is down -1.37%. DAX is down -2.92%. CAC is down -2.68%. Germany 10-year yield is up 0.057 at 0.275. Earlier in Asia, Nikkei rose 3.94%. Hong Kong HSI rose 1.27%. China Shanghai SSE rose 1.22%. Singapore Strait Times rose 1.42%. Japan 10-year JGB yield closed flat at 0.192.

ECB sets faster APP purchase wind-down schedule

ECB left interest rate unchanged as widely expected. Main refinancing, marginal lending facility and deposit rate are held at 0.00%, 0.25%, and -0.50% respectively. ECB added that “Any adjustments to the key ECB interest rates will take place some time after the end of the Governing Council’s net purchases under the APP and will be gradual.”

The pandemic emergency purchase program (PEPP) will stop net purchases as planned at the end of March. The purchase schedule for the regular asset purchase program (APP) is revised, with monthly net purchase at EUR 40B in April, EUR 30B in May and EUR 20B in June.

ECB added that the calibration for APP net purchases in Q3 will be “data-dependent and reflect its evolving assessment of the outlook”. If medium term inflation outlook “will not weaken after the end of the net purchases, ECB will conclude net APP purchases in Q3. Also, ECB leaves it open to revise the schedule, size and duration of the purchases.

ECB upgrade inflation forecasts significantly, downgrades GDP forecasts

ECB President Christine Lagarde said in the post meeting press conference, inflation has “continued to surprise on the upside because of unexpectedly high energy costs.”, and prices rises became “more broadly based”. GDP growth was revised down for the near term, owing to the war in Ukraine.

Inflation projections were revised up “significantly” to 5.1% in 2022 (up from 2.6%), 2.1% in 2023 (up form 1.8%), and 1.9% in 2024 (up from 1.8%).

Excluding food and energy, inflation is projected to average 2.6% in 2022 (up from 1.9%), 1.8% in 2023 (up from 1.7%), and 1.9% in 2024 (up from 1.8%).

The economy is projected to grow 3.7% in 2022 (down from 4.2%), 2.8% in 2023 (down from 2.9%), and 1.6% in 2024 (unchanged).

Lagarde also said, “the Russia-Ukraine war will have a material impact on economic activity and inflation through higher energy and commodity prices, the disruption of international commerce and weaker confidence. The extent of these effects will depend on how the conflict evolves, on the impact of current sanctions and on possible further measures.”

US CPI rose to 7.9% yoy in Feb, highest since 1982

US CPI rose 0.8% mom in February, matched expectations. Over the 12-month period, CPI accelerated from 7.5% yoy to 7.9% yoy, matched expectations. The 12-month increase is the largest since January 1982.

CPI core rose 0.5% mom. For the 12-month period, CPI core accelerated from 6.0% yoy to 6.4% yoy, matched expectations. The 12-month increase was the highest since August 1982.

Energy index rose 25.6% yoy. Food index rose 7.9% yoy, highest since July 1981.

US initial jobless claims rose to 227k, above expectations

US initial jobless claims rose 11k to 227k in the week ending March 5, above expectation of 205k. Four-week moving average of initial claims rose 500 to 231k.

Continuing claims rose 25k to 1494k in the week ending February 26. Four-week moving average of continuing claims dropped -31k to 157k, lowest since March 28, 1970.

Japan PPI rose record 9.3% yoy in Feb, led by energy and commodities

Japan corporate goods price index rose 9.3% yoy in February, above expectation of 8.7% yoy. At 110.7, the index hit the highest level marked since 1985. That’s also the highest rise on record, as led by skyrocketing energy prices. Coal and petroleum prices jumped 34.2% yoy. Electricity, city gas and water prices also surged 27.5% yoy.

Commodity prices also surged with iron and steel up 24.5% yoy. Nonferrous metal rose 24.9% yoy. Lumber and wood products rose 58.0% yoy.

Import prices rose 34.0% yoy while export prices rose 12.7% yoy.

EUR/USD Mid-Day Outlook

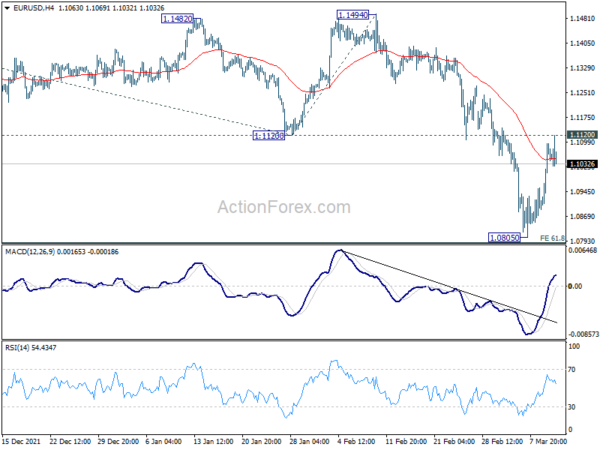

Daily Pivots: (S1) 1.0944; (P) 1.1019; (R1) 1.1149; More…

Intraday bias in EUR/USD remains neutral at this point. As long as 1.1120 support turned resistance holds, larger down trend from 1.1494 is still expected to continue. On the downside, firm break of 61.8% projection of 1.2265 to 1.1120 from 1.1494 at 1.0786 will pave they way to 100% projection at 1.0349 next. However, strong break of 1.1120 will confirm short term bottoming, at least, and bring stronger rebound back towards 1.1494 structural resistance instead.

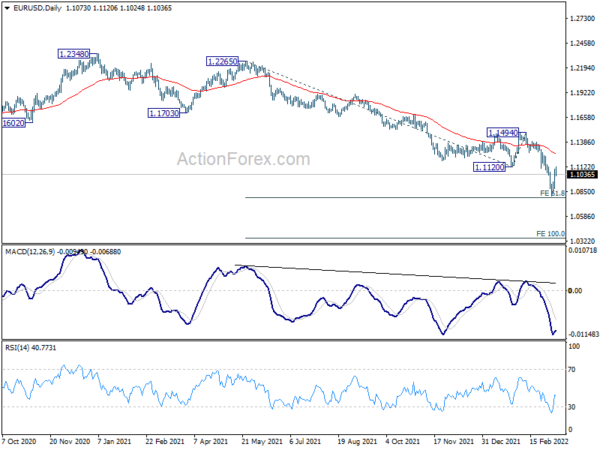

In the bigger picture, the decline from 1.2348 (2021 high) is expected to continue as long as 1.1494 resistance holds. Firm break of 1.0635 (2020 low) will raise the chance of long term down trend resumption and target a retest on 1.0339 (2017 low) next. Nevertheless, break of 1.1494 will maintain medium term neutral outlook, and extend range trading first.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | PPI Y/Y Feb | 9.30% | 8.70% | 8.60% | 8.90% |

| 00:00 | AUD | Consumer Inflation Expectations Mar | 4.90% | 4.60% | ||

| 00:01 | GBP | RICS Housing Price Balance Feb | 79% | 73% | 74% | |

| 12:45 | EUR | ECB Interest Rate Decision | 0.00% | 0.00% | 0.00% | |

| 13:30 | EUR | ECB Press Conference | ||||

| 13:30 | USD | Initial Jobless Claims (Mar 4) | 227K | 205K | 215K | 216K |

| 13:30 | USD | CPI M/M Feb | 0.80% | 0.80% | 0.60% | |

| 13:30 | USD | CPI Y/Y Feb | 7.90% | 7.90% | 7.50% | |

| 13:30 | USD | CPI Core M/M Feb | 0.50% | 0.50% | 0.60% | |

| 13:30 | USD | CPI Core Y/Y Feb | 6.40% | 6.40% | 6.00% | |

| 15:30 | USD | Natural Gas Storage | -116B | -139B |