- FDIC propose a special fee to pay for banking failures

- Special fees will be based on amount of uninsured deposits at each bank

- Proposal would set annual special assessment rate of 12.5 basis points on a bank’s uninsured deposits as of December 2022

- Proposes a special assessment fee on larger banks to recoup losses to insurance fund incurred by recent bank failures

- Estimates 113 banks would be subject to special assessment

- 1st 5 billion of uninsured deposits at each firm would be exempt from the

- Says it would collect a fee over 8/4 beginning in June 2024, which could be extended or shortened as needed

- Estimates banks with over 50 billion in assets would pay over 95% of the fees, no banks under 5 billion would pay

- New fee estimated to roughly equal losses incurred, it currently estimated at $15.8 billion

Someone has to pay and it will be the larger banks with the larger deposit base above the FDIC limits. They would benefit from the move of deposits from smaller to larger banks. The question is “Is the inertia toward less but bigger banks in motion and now hard to stop?”

The KRE regional bank indexes down -2.27%. PacWest Bancorp shares are lower by 19.49% at $4.92. The good news is the price is off the low of the day at $4, and the low from last week of $2.48.

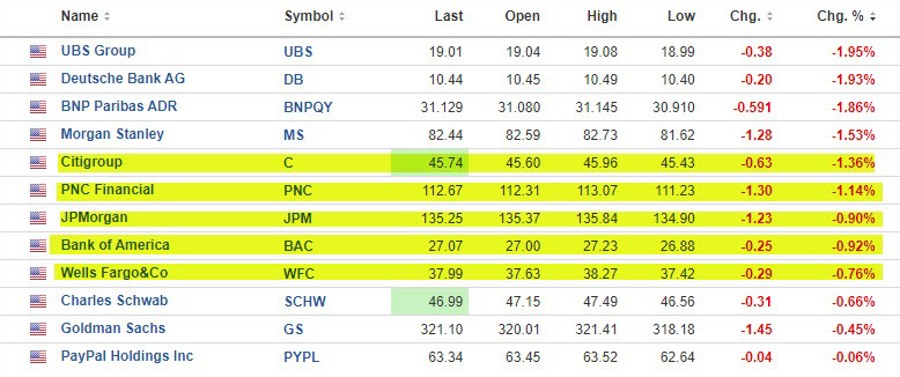

Shares of US banks are trading lower:

Bank shares are moving lower

Looking at the major indices :

- Dow Industrial Average is down -372.2 or -1.11%

- S&P index is down minus 25.64.or -0.62%

- NASDAQ indexes down -25.28 points or -0.21%

Shares of Disney are a major drag on the Dow industrial average. They are down -8.72% at $92.30

This article was originally published by Forexlive.com. Read the original article here.