Forex news for NY trading on July 26, 2021

The dollar dipped in trading today and the stocks moved higher ahead of a number of key large cap earnings this week and the FOMC rate decision. Apple, Amazon, Alphabet, Facebook, Microsoft, Starbucks, Boeing, MasterCard, PayPal and many others are all scheduled to release earnings between Tuesday and Thursday this week.

The major US indices all closed higher with the down S&P both rising 0.24%. The NASDAQ squeaked out a 0.3% rise. Each made a new intraday all time highs and all closed at record levels.

In Europe, the German DAX fell -0.32%. The case FTSE 100 was near unchanged, Spain’s Ibex and Italy’s FTSE MIB each rose by about 0.7%. China stocks were under pressure falling by over 2% on the backs of increase regulation and concerns about Covid lockdowns.

On Wednesday, the FOMC rate decision will likely lead to more discussion on tapering but without committing to a specific timetable (see post here).

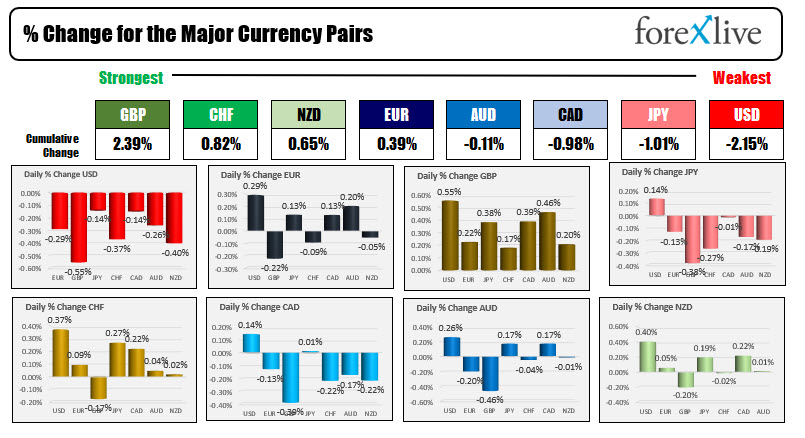

Looking at the rankings of the major currencies today, the GBP is the strongest of the majors, while the USD is the weakest.

Technically speaking, some key levels to hi in the new trading day:

- EURUSD: The EURUSD based in the New York session against the common currencies 100 hour moving average (currently at 1.17812). The subsequent rise saw the price spike above the 200 hour moving average at 1.1734 on its way to an intraday high of 1.18168. The pair is trading above and below the 1.1800 level at the close. With the 200 hour moving average of 1.17934, trading below that level in the new trading day would tilt the bias more to the downside, and have traders looking toward the 100 hour moving average again at 1.17812. Stay above the 200 hour moving average would target a topside downward sloping trendline near 1.1821 (and moving lower). A break above that level would look toward the Thursday high and high from last week at 1.18297. The 38.2% retracement of the July trading range comes in at 1.18366 and it too would be a minimum target if the buyers are to take more control.

- GBPUSD: After spending Thursday, Friday and half of today trading above and below the 200 hour moving average at 1.37461, the buyers started to flex their muscle, pushing the price higher and to the highest level since July 16. The price high for the day reached 1.38327 before modestly correcting into the close to 1.38172. Technically, getting above the high price from last week at 1.3786, and a swing area between 1.3796 and 1.3800 tilted the bias further in the direction of the bulls. Stay above those levels in the new trading day, and a move toward the 1.38616 swing high from July 16, and above that the July high prices between 1.38979 and 1.39094, would be targeted.

- USDJPY: The sellers was able to briefly move below the rising 100 hour moving average on two separate occasions today. One was in the London morning session, but after dipping below by two pips, the price rebounded higher. In the New York session, the price briefly fell below the moving average line by four pips, but once again rebounded and close above the moving average before the hour of trading was complete. Going into the new trading day, the 100 hour moving averages trading at 110.225. The price is trading around 110.38. It will take a move below the 100 hour moving average to tilt the bias more to the downside (ps. It has to stay below that moving average). On the topside, the high from Friday the high from today near 110.53 is the next target followed by the swing high from July 13 near 110.693.