Markets:

- Gold down $16 to $1695

- US 10-year yields up 6 bps to 3.88%

- WTI crude up $4.06 to $92.51

- S&P 500 down 115 points to 3629

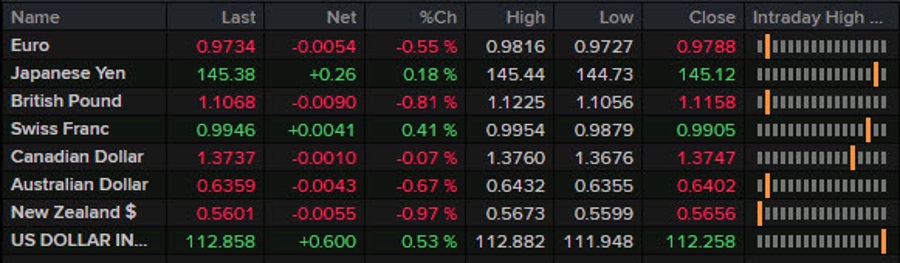

- USD leads, NZD lags

The Fed-pivot talk went down in flames today and it didn’t even take a big surprise in the jobs report. The headline was basically bang-on expectations but unemployment fell two ticks to 2.5% with half of that from a dip in labor force participation.

Beyond that the details didn’t matter and I have to think that the weight of all the hawkish Fed talk this week added to the tumble. The dollar rose on the data and then rose again late in the day as equities crumbled. The Nasdaq fell 4% to nearly give up the week’s gains.

Cable fell nearly a full cent to 1.1063 from as high as 1.1225 before the jobs report. It’s trading at the lows just ahead of the close.

AUD and NZD are similar while EUR/USD is just above the knee-jerk lows after the jobs data. The real worry going into Monday’s open may be USD/JPY as it presses to 145.40 and test’s the Japanese Ministry of Finance’s patience.

USD/CAD was able to hold the earlier highs on a sizzling day for oil. Crude has swung from demand worries to supply fears and rallied every day this week. Mission accomplished for OPEC+ and the moves will make the BOC’s job a bit easier.

All told, this was a rough day for risk assets and a strong start to Q4 has turned into a dud.