Event risk

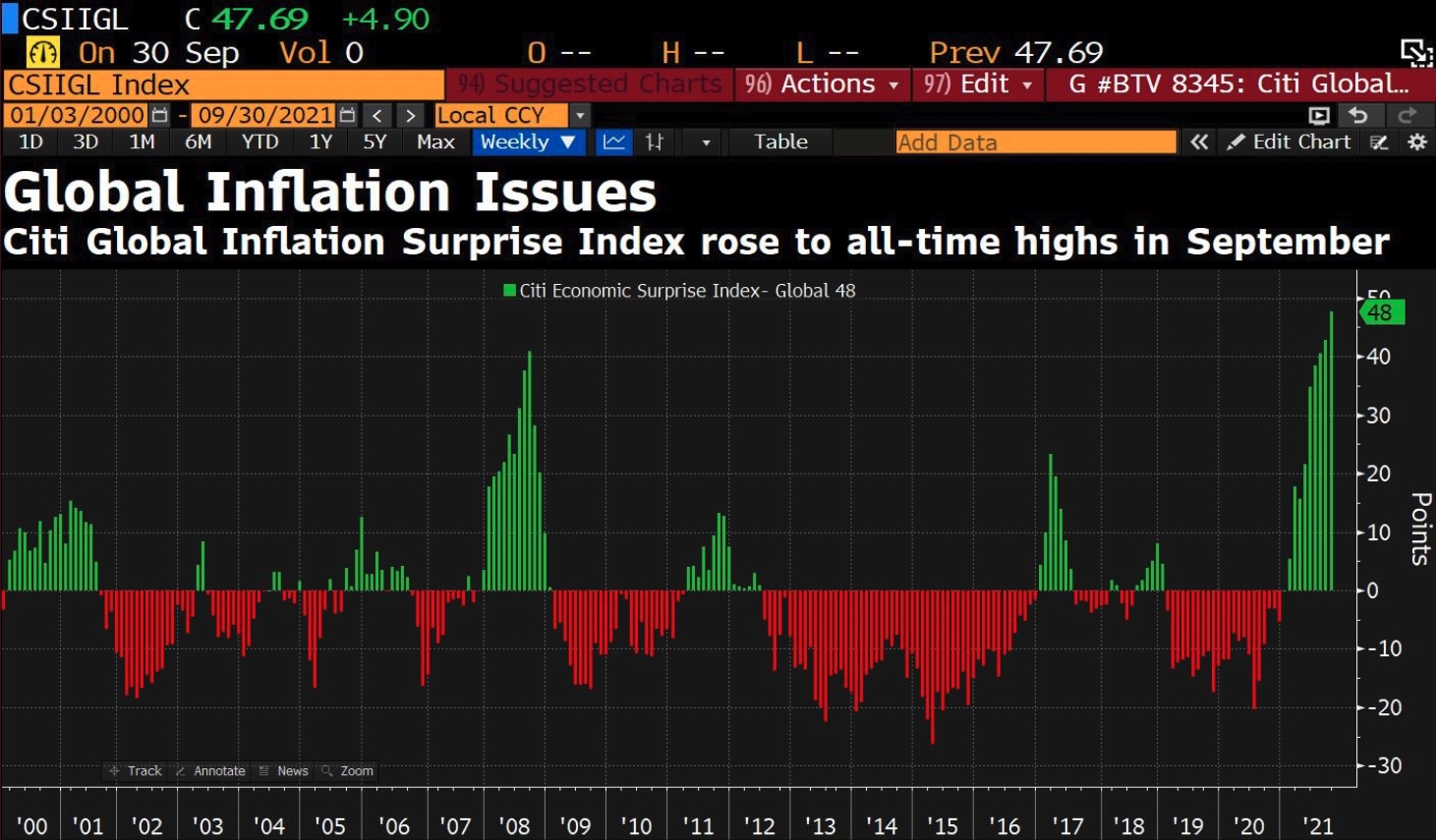

One of the best opportunities this week comes in the form of the UK CPI data on Wednesday morning. Inflation has been surging higher across the world and that has resulted in yields rising very sharply higher.

The fear is that rising inflation will result in central banks around the world increasing interest rates more quickly than they ought to. In effect stifling growth too soon,

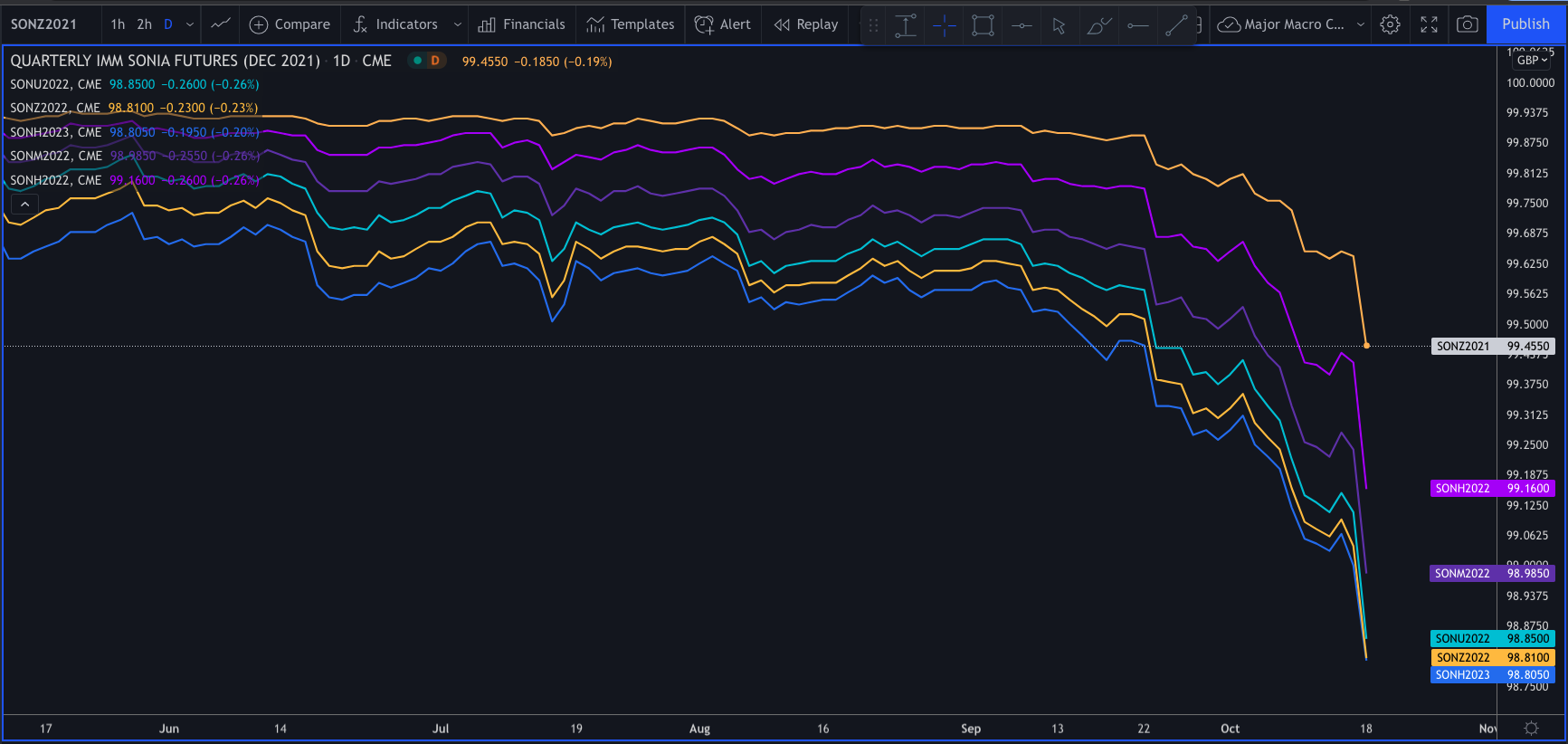

The SONIA futures have been dropping sharply lower showing that rates markets expect a series of interest rate hike from the BoE to combat this rising inflation. This has prompted many analysts to say that the SONIA futures have moved too far, too fast. After all, will the BoE really hike interest rates four times next year? Especially on supply chain driven inflation.

This creates a great opportunity. The opportunity is with the release of the UK CPI data. If the data comes in below minimum expectations then the relief in the GBP could be marked. It could mean some substantial selling in the GBP with the potential for that to carry on for a few sessions.

On top of the CPI data there will be retail sales data released too for the UK. Any surprise to the downside here too could pressure the GBP if the headline inflation data is also a miss.

So here is a framework to use over the next coming days

The headline UK Core CPI is expected to be 3.0% vs a previous reading of 3.1%. Inflation should be rising higher in the UK and that is the base case . However, if we get a reading below 2.8% then expect the EURGBP to rally higher.The UK’s core y/y retail sales headline is expected to come in at -1.7%, so expect anything lower than -3.1% to further lift the GBP higher. Remember this trade is based on a rapid re-pricing of a stretched bullish GBP move. So, any stronger than expected data should have less impact than surprise misses to the downside. For a few tips on trading fresh sentiment see a piece I have written previously here.

The chart

This major trendline on the EURGBP chart will also be helpful as a reference point