Financial markets have steadied following a brief period of heightened volatility triggered by fears of escalating conflict in the Middle East. Initial concerns about a full-scale confrontation were alleviated. Both Israel and Iran played down the significance of recent explosions near an Iranian military base, suggesting a broader conflict might be avoided for now. As a result, while major European indices and US futures are trading lower, losses remain contained. WTI crude oil has retracted to around 82 after a temporary spike above 86, and gold has settled back below 2400 handle.

In currency markets, Swiss Franc is currently the strongest performer this week, followed by Canadian Dollar and Euro. Conversely, Yen is the weakest, with Kiwi and the Aussie also underperforming. Dollar and Sterling are positioning in the middle. With no significant economic data expected in the US session today, the markets are anticipated to close the week without major fluctuations, maintaining a calm posture after today’s geopolitical scare.

In Europe, at the time of writing, FTSE is down -0.49%. DAX is down -0.63%. CAC is down -0.12%. UK 10-year yield is down -0.0218 at 4.258. Germany 10-year yield is down -0.011 at 2.489. Earlier in Asia, Nikkeifell -2.66%. Hong Kong HSI fell -0.99%. China Shanghai SSE fell -0.29%. Singapore Strait Times fell -0.35%. Japan 10-year JGB yield fell -0.034 to 0.837.

UK retail sales flat in Mar, misses expectations

In the UK, retail sales volumes was unchanged in March, falling short of the modest 0.3% mom growth anticipated by analysts. The performance within the retail sector was varied: automotive fuel and non-food store sales saw increases of 3.2% and 0.5%, respectively, which were offset by declines in food stores and non-store retailers, dropping by 0.7% and 1.5%.

On a quarterly basis, retail sales volumes rising 1.9% in the three months to March, a recovery attributed to the bounce back from particularly low sales volumes experienced during the Christmas shopping season.

BoJ’s Ueda: Impact of weak Yen on inflation could lead to policy shift

During a press conference today, BoJ Governor Kazuo Ueda highlighted the potential economic repercussions of the persistently weak yen, particularly its effect on trend inflation through increased costs of imported goods.

“There’s a possibility the weak yen could push up trend inflation through rises in imported goods prices,” Ueda noted, indicating that such a scenario “might lead to a change in monetary policy.”

At the same occasion, Finance Minister Shunichi Suzuki pointed out that exchange rates are not solely influenced by interest rate differentials. Various other factors, such as each country’s current account balance, market participants’ sentiment, and speculative trade, drive currency moves,” Suzuki explained.

Japan’s CPI core slows to 2.6% in Mar, CPI core-core down to 2.9%

In March, Japan observed a subtle cooling in core inflation, though levels persistently exceed BoJ’s target.

Core CPI, which excludes food prices, slowed from 2.8% yoy to 2.6% yoy, slightly under the expectation of 2.7% yoy, marking a continued stretch above BoJ’s 2% target for two full years.

Further detail is seen in the core-core CPI, excluding both food and energy, which decreased from 3.2% yoy to 2.9% yoy. This marks the seventh consecutive month of deceleration and brings this measure below 3% level for the first time since November 2022.

Meanwhile, headline CPI dipped slightly from 2.8% year-on-year to 2.7%, aligning with analysts’ forecasts.

EUR/USD Mid-Day Outlook

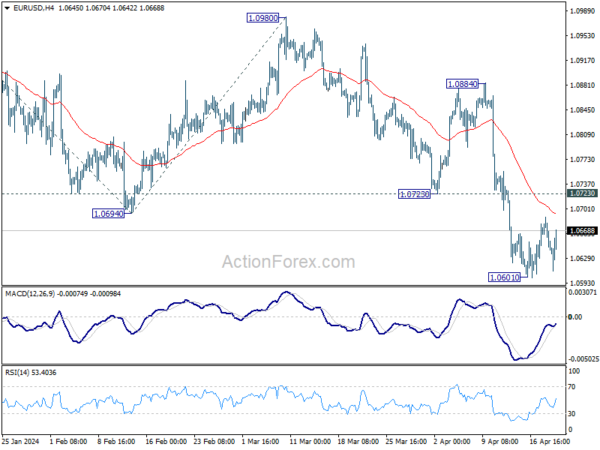

Daily Pivots: (S1) 1.0626; (P) 1.0658; (R1) 1.0675; More…

Intraday bias in EUR/USD remains neutral and outlook is unchanged. While stronger recovery cannot be ruled out, upside should be limited by 1.0723 support turned resistance. On the downside, break of 1.0601 will resume the decline from 1.1138 to 100% projection of 1.1138 to 1.0694 from 1.0980 at 1.0536 next.

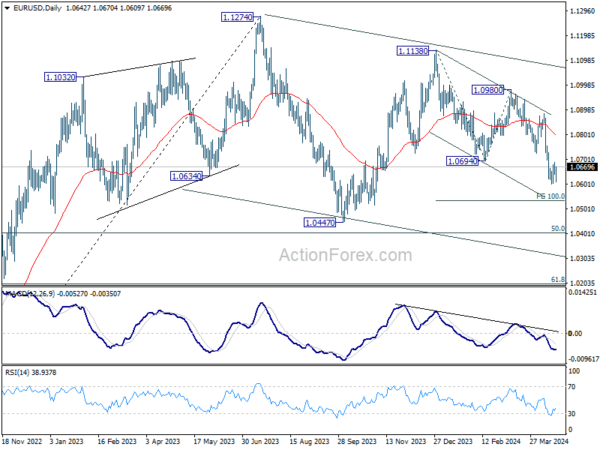

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern to rise from 0.9534 (2022 low). Current fall from 1.1138 is seen as the third leg. While deeper decline is would be seen to 1.0447 and possibly below. Strong support should emerge from 61.8% retracement of 0.9534 to 1.1274 at 1.0199 to complete the correction.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | National CPI Y/Y Mar | 2.70% | 2.70% | 2.80% | |

| 23:30 | JPY | National CPI core Y/Y Mar | 2.60% | 2.70% | 2.80% | |

| 23:30 | JPY | National CPI core-core Y/Y Mar | 2.90% | 3.20% | ||

| 06:00 | GBP | Retail Sales M/M Mar | 0.00% | 0.30% | 0.00% | |

| 06:00 | EUR | Germany PPI M/M Mar | 0.20% | 0.00% | -0.40% | |

| 06:00 | EUR | Germany PPI Y/Y Mar | -2.90% | -4.10% |