The markets are trading in consolidative mode in Asia today. Dollar attempted to resume near term rally against Euro overnight, but quickly lost momentum. While Yen remains generally weak, selloff slowed, along with slight retreat in US 10-year yield, and retreat in stocks. Traders will turn their focuses firstly to UK GDP in European session, and then US CPI and FOMC minutes later in the day.

Technically, we’d put some attention to the interplay between Dollar, Euro and Sterling today. EUR/GBP turned sideway after hitting 0.8471 but recovery has been weak and more downside is in favor. Break of 0.8471 will resume the fall from 0.8656 towards 0.8448 low. That might help lift GBP/USD through 1.3672 temporary top to resume the rebound from 1.3410. Also, such development could help cap EUR/USD’s recovery below 1.1639 minor resistance. Let’s see how it goes.

In Asia, at the time of writing, Nikkei is down -0.24%. China Shanghai SSE is down -0.35%. Singapore Strait Times is up 1.42%. Japan 10-year JGB yield is down -0.0070 at -0.089. Overnight, DOW dropped -0.34%. S&P 500 dropped -0.24%. NASDAQ dropped -0.14%. 10-year yield dropped -0.034 to 1.580.

Fed Bullard advocates starting tapering in Nov, finishing it in Q1

St. Louis Federal Reserve President James Bullard told CNBC, “I’d support starting the taper in November.” He added, “I’ve been advocating trying to get finished with the taper process by the end of the first quarter next year because I want to be in a position to react to possible upside risks to inflation next year as we try to move out of this pandemic.”

But he also emphasized “there’s no reason for us to commit one way or another at this point,” regarding interest rate hike. “I just want to be in a position in case we have to move sooner that we’re able to do so next year in the spring or summer if we have to do so.”

He noted that a supply shock alone cannot cause inflation”. But, “a supply shock being accommodated by very easy monetary policy, it’s those two things that lead to the inflation.” Yet, he’s not concerned with the risk of a 1970s-style stagflation since “the probability of recession is exceptionally low at this point.”

Separately, Atlanta Fed President Raphael Bostic said the job markets had made “sufficient” gains to allow tapering the USD 120B per month asset purchases. He “would be comfortable starting tapering of asset purchase programme in November.” Nevertheless, he noted that “there is significant uncertainty about how long inflationary pressures will last.”

Australia Westpac consumer sentiment dropped to 104.6, still more optimists

Australia Westpac-Melbourne Institute consumer sentiment dropped -1.5% to 104.6 in October, down from September’s 106.2. There continued to be a clear majority of optimists nationally, even at state level – NSW (103.4); Victoria (105.4); Queensland (105.3) and Western Australia (105.4).

Westpac expects RBA to “almost certainly maintain its policy settings” at November 2 meeting. Instead, the next change is likely to be another round of tapering in February. Looking forward, Westpac expects a rate hike in Q2 of 2023, while RBA has repeated said the conditions of hike won’t be met until 2024.

New Zealand ANZ business confidence dropped slightly to -8.6 in Oct

New Zealand ANZ business confidence dropped slightly to -8.6 in October’s preliminary reading, down from September’s -7.2. Own activity outlook rose strongly from 18.2 to 26.2. Export intentions rose from 7.4 to 9.2. Investment intentions rose from 9.2 to 14.3. Employment intentions dropped from 14.1 to 12.1. Cost expectations rose form 84.2 to 84.9. Inflation expectations also ticked up from 3.02% to 3.04%.

ANZ said the survey is telling a story of “remarkable resilience”, with most forward-looking activity indicators holding up or improving. Inflation pressures remain “intense” and cost pressures are “extreme”.

Elsewhere

China’s exports, in USD term, rose 28.1% yoy in September, versus expectation of 21.0%. Imports rose 17.6% yoy versus expectation of 20.0% yoy. Trade surplus widened to USD 66.8B, above expectation of USD 47.2B.

Looking ahead, UK GDP, productions and trade balance will be released in European session. Germany will release CPI final. Eurozone will release industrial production. Later in the day, US will release CPI and FOMC minutes.

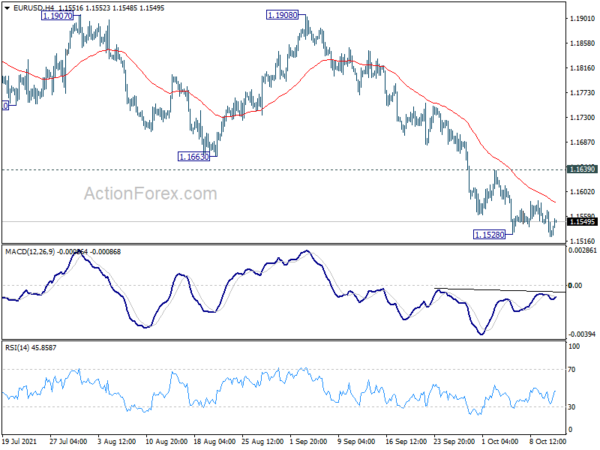

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.1514; (P) 1.1542; (R1) 1.1559; More…

Intraday bias in EUR/USD is mildly on the downside with breach of 1.1528 temporary low. Current decline from 1.2265 would target 1.1289 medium term fibonacci level next. On the upside, break of 1.1639 resistance, however, will indicate short term bottoming. intraday bias will be turned back to the upside for stronger rebound.

In the bigger picture, sustained break of 1.1602 will argue that rise from 1.0635 (2020 low) has completed at 1.2348. Deeper fall would be seen to 61.8% retracement of 1.0635 to 1.2348 at 1.1289. Note also that rejection by 55 week EMA (1.1830) also carries medium term bearish implication. Firm break of 1.1289 will pave the way to retest 1.0635 low. On the upside, though, break of 1.1908 resistance will revive medium term bullishness and turn focus back to 1.2348 high.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | AUD | Westpac Consumer Confidence Oct | -1.50% | 2.00% | ||

| 23:50 | JPY | Money Supply M2+CD Y/Y Sep | 4.20% | 4.20% | 4.70% | |

| 23:50 | JPY | Machinery Orders M/M Aug | -2.40% | 1.60% | 0.90% | |

| 3:00 | CNY | Trade Balance (USD) Sep | 66.8B | 47.2B | 58.3B | |

| 3:00 | CNY | Exports (USD) Y/Y Sep | 28.10% | 21.50% | 25.60% | |

| 3:00 | CNY | Imports (USD) Y/Y Sep | 17.60% | 19.20% | 33.10% | |

| 3:00 | CNY | Trade Balance (CNY) Sep | 433B | 323B | 376B | |

| 3:00 | CNY | Exports (CNY) Y/Y Sep | 19.90% | 17.10% | 15.70% | |

| 3:00 | CNY | Imports (CNY) Y/Y Sep | 10.10% | 22.30% | 23.10% | |

| 6:00 | EUR | Germany CPI M/M Sep F | 0.00% | 0.00% | ||

| 6:00 | EUR | Germany CPI Y/Y Sep F | 4.10% | 4.10% | ||

| 6:00 | GBP | GDP M/M Aug | 0.50% | 0.10% | ||

| 6:00 | GBP | Industrial Production M/M Aug | 0.40% | 1.20% | ||

| 6:00 | GBP | Industrial Production Y/Y Aug | 3.00% | 3.80% | ||

| 6:00 | GBP | Manufacturing Production M/M Aug | 0.00% | 0.00% | ||

| 6:00 | GBP | Manufacturing Production Y/Y Aug | 6.00% | 6.00% | ||

| 6:00 | GBP | Goods Trade Balance (GBP) Aug | -11.9B | -12.7B | ||

| 9:00 | EUR | Eurozone Industrial Production M/M Aug | -1.60% | 1.50% | ||

| 12:30 | USD | CPI M/M Sep | 0.30% | 0.30% | ||

| 12:30 | USD | CPI Y/Y Sep | 5.30% | 5.30% | ||

| 12:30 | USD | CPI Core M/M Sep | 0.20% | 0.10% | ||

| 12:30 | USD | CPI Core Y/Y Sep | 4.00% | 4.00% | ||

| 18:00 | USD | FOMC Minutes |