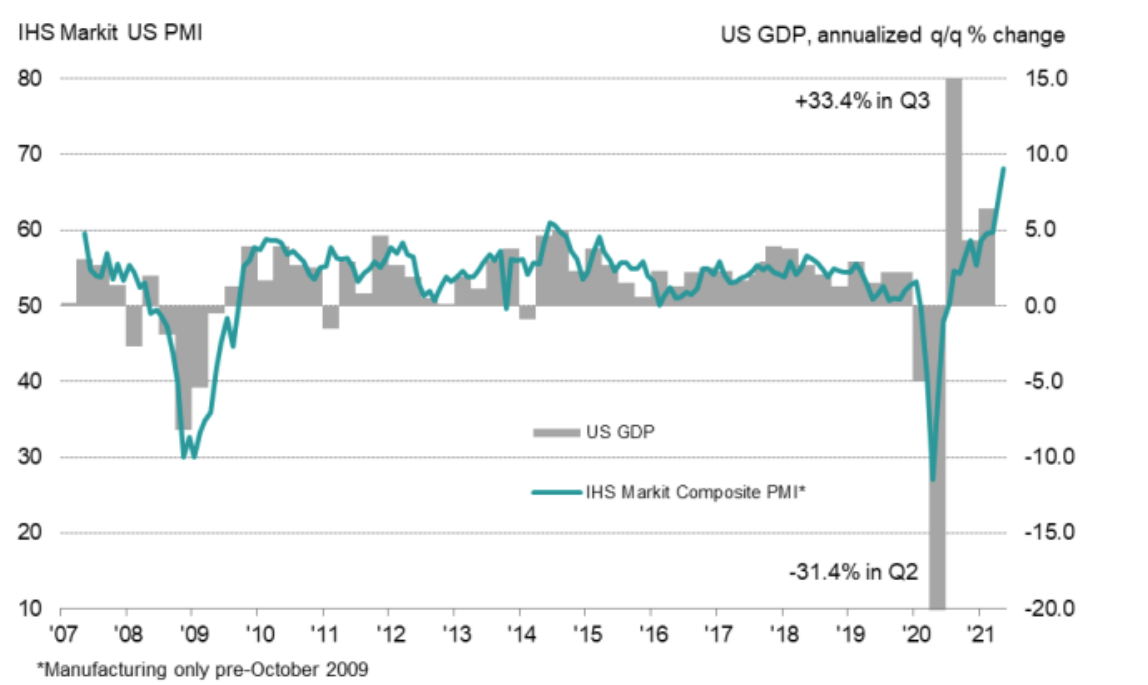

Markit US manufacturing and services surveys for May 2021

- Record highs in services, manufacturing and composite (series began in 2009)

- Prior was 64.7

- Manufacturing 61.5 vs 60.2

- Prior manufacturing was 60.5

- Composite 68.1 vs 63.5 prior (pictured above)

- Services new orders hit a record

- Services input prices hit a record

- Manufacturing new orders hit a record

- Manufacturing order backlogs hit a record

- Manufacturing business confidence hit a seven-month low on capacity and raw materials shortages

That’s a huge beat on an important forward-looking indicator and wipes away some of the uneasy that’s been in markets since the US jobs report.

Commenting on the PMI data, Chris Williamson,

Chief Business Economist at IHS Markit, said:

“The US economy saw a spectacular acceleration of

growth in May, the rate of expansion of business activity

soaring well above anything previously recorded in recent

history as the economy continued to reopen from COVID19 restrictions. The service sector saw an especially

impressive surge in growth, beating all prior records by a

wide margin, accompanied by another solid expansion of

manufacturing output.“Growth would have been even stronger had it not been for

businesses often being constrained by supply shortages

and difficulties filling vacancies.“With businesses optimistic about the outlook, backlogs of

orders rising sharply and demand continuing to pick up

both at home and in export markets, the scene is set for

strong economic growth to persist through the summer.“The May survey also brings further concerns in relation to

inflation, however, as the growth surge continued to result

in ever-higher prices. Average selling prices for goods and

services are both rising at unprecedented rates, which will

feed through to higher consumer inflation in coming

months.”