To everyone’s surprise, the RBNZ left the OCR unchanged at 0.25% in August. The decision was made in light of the renewed New Zealand’s lockdown after a report of one coronavirus case. Policymakers, however, maintained a hawkish stance, suggesting that the next policy decision would be tightening. Meanwhile, the Funding-For-Lending program (FLP) also stayed unchanged at NZ$28B.

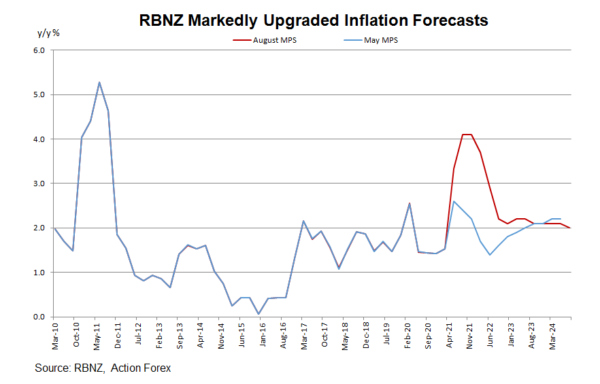

On the economic outlook, the members acknowledged that “rising capacity pressures will feed through into inflation, and that employment is at its maximum sustainable level”. The assessment is likely driven by the strong inflation and employment data released since the last meeting. The RBNZ forecast that the unemployment rate would remain around 4% over the coming few years, and headline inflation would stay well above the 1-3% target band until 2H22. While elevated inflation would partly be driven by transitory factors, policymakers were paying more attention to its sustainability.

Concerning the economic impacts of the lockdown, the RBNZ indicated that “the economy is resilient to periods at higher alert levels if there is significant government support provided, and alert levels can be lowered relatively quickly”, and that “fiscal policy (government spending and transfer payments) has proved to be a very effective tool to respond to any immediate reduction in demand in the event of outbreaks. A monetary policy response may be required if a health-related lockdown has a more enduring impact on inflation and employment”. We don’t expect the central bank to respond to temporary economic disruption brought about by the lockdown

While leaving the monetary policy on hold might sound dovish, policymakers indicated that the decision to leave the monetary policy unchanged was mainly driven by “the Government’s imposition of Level 4 COVID restrictions on activity across New Zealand”and ”the heightened uncertainty with the country in a lockdown”.

The central bank maintained a hawkish outlook. As noted in the policy statement, “the Committee will assess the inflation and employment outlook on an ongoing basis, with a view to continue to reduce the level of monetary stimulus over time so as to best meet their policy remit”. The members agreed that the “least regrets policy stance” is to “further reduce the level of monetary stimulus so as to anchor inflation expectations and continue to contribute to maximum sustainable employment”. At the press conference, Governor Orr affirmed that the “clear direction is to reduce policy stimulus”, and the central bank “would need to see significant changes in demand to change course”.

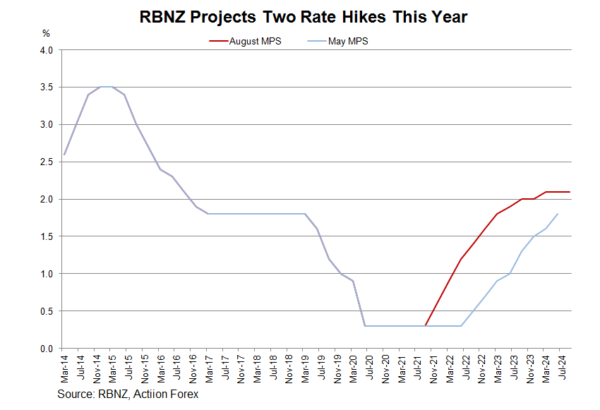

RBNZ’s projections revealed that there would be around two rate hikes in 4Q21, followed by one rate hike per quarter over the course of 2022 and 2023 before reaching the neutral rate of 2% in 3Q23.