Dollar turns notably weaker against Swiss Franc and Yen today but markets are relatively steady elsewhere. Sterling pays little attention to employment data which showed some positive signs. Canadian Dollar also shrugged off yesterday’s BoC tapering. General focus will now turn to US job data, and the movements in stock markets for next moves in currencies.

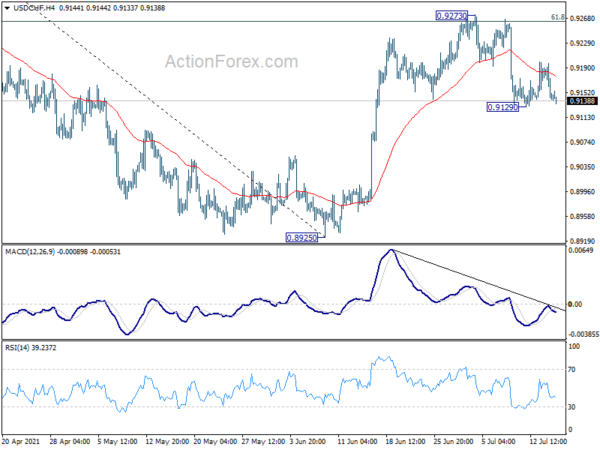

Technically, immediate focus is now on 0.9129 support in USD/CHF and 109.52 support in USD/JPY. Break there will resume falls from 0.9273 and 111.65 respectively. More importantly, such development would affirm the case of near term bearish reversal. We might see spillover to other pairs. In particular, break of 1.1880 resistance in EUR/USD would align the outlook with USD/CHF and USD/JPY.

In Asia, Nikkei closed down -1.15%. Hong Kong HSI is up 1.07%. China Shanghai SSE is up 1.03%. Singapore Strait Times is down -0.38%. Japan 10-year JGB yield is down -0.0039 at 0.017. Overnight, DOW rose 0.13%. S&P 500 rose 0.12%. NASDAQ dropped -0.22%. 10-year yield dropped -0.049 to 1.356.

UK employment back above pre-pandemic levels in some regions

UK employment rose another 356k in June to 28.9m, but remains -206k below pre-pandemic levels. Nevertheless, employment in some regions, including North East, North West, East Midlands and Norther Ireland, were already back above pre-pandemic levels.

Employment rate was at 74.8%, -1.8% below pre-pandemic levels. unemployment rate edged up to 4.8% in May, above expectation of 4.7%. That’s also still 0.9% higher than before the pandemic.

Average earnings including bonus rose 7.3% 3moy in May, above expectation of 7.2% 3moy. Average earnings excluding bonus rose 6.6% 3moy, matched expectations. Claimant count dropped -114.7k in June.

BoE Bailey won’t be rushed into rate hike despite higher inflation

BoE Governor admitted in an interview that yesterday’s inflation numbers were “higher than we thought it would be”. But he added, “what we will have to do, again, is go through all the evidence and assess to what extent we think the sorts of things that underlie that are likely to be transitory.”

“And to what extent is it going to cause second round effects – so it starts to get embedded in expectations and it gets into wage negotiations and it’s difficult to get out (of an inflationary cycle),” he added.

In reaction to people who said that BoE is being “casual” about the surge in inflation, he emphasized, “we’re not at all actually.” “The committee has been very clear – if we think the case is made, then of course, we will respond and use the policy tools. We must do that.”

Australia unemployment rate dropped to 4.9%, lowest since 2010

Australia employment grew 29.1k in June, or 0.2% mom, above expectation of 20.3k. Full time jobs grew 51.6k while part-time jobs dropped -22.5k. Over the year, employment grew 777.9k, or 6.3% yoy. Unemployment rate dropped -0.2% to 4.9%, better than expectation of 5.0%. Participation rate was unchanged at 66.2%.

Bjorn Jarvis, head of labour statistics at the ABS, said June saw the eighth consecutive monthly fall in the unemployment rate. “The unemployment rate fell to 4.9 per cent in June. This was 0.4 percentage points below March 2020 (5.3 per cent) and the lowest it has been since December 2010. The declining unemployment rate continues to coincide with employers reporting high levels of job vacancies and difficulties in finding suitable people for them,” Jarvis said.

China recovery slowed in June, but momentum still strong

China GDP grew 1.3% qoq in Q2, matched expectations. Industrial production growth slowed to 8.3% yoy in June, but beat expectation of 7.9% yoy. Retail sales growth slowed to 12.1% yoy, above expectation of 11.0% yoy. Fixed asset investment growth slowed to 12.6% ytd yoy, above expectation of 12.5% yoy. While growth momentum appears to be slowing, recovery is still very strong.

Hong Kong HSI rises in response to the solid data from China, and it’s trading up more than 1% at the time of writing. Notable support was seen from 26782.61 resistance turned support after last week’s spike low. Focus is back on 55 day EMA (now at 28484.00). Sustained break there will argue that correction from 31183.35 has completed and would bring retest of this high.

Looking ahead

US will release jobless claims, import price index, Empire state manufacturing, Philly Fed manufacturing and industrial production. Canada will release ADP employment change.

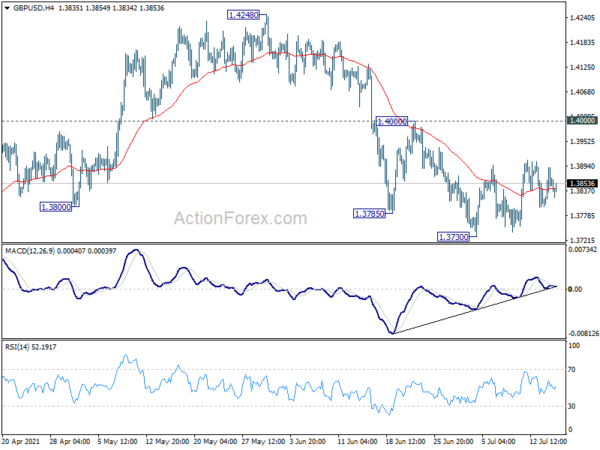

GBP/USD Daily Outlook

Daily Pivots: (S1) 1.3813; (P) 1.3852; (R1) 1.3903; More….

Range trading continues in GBP/USD and intraday bias remains neutral for the moment. On the downside, break of 1.3730 will resume the fall from 1.4248, as the third leg of the consolidation pattern from 1.4240, to 1.3668 support and possibly below. On the upside, break of 1.4000 will turn bias back to the upside for retesting 1.4240/8 resistance zone instead.

In the bigger picture, as long as 1.3482 resistance turned support holds, up trend from 1.1409 should still continue. Decisive break of 1.4376 resistance will carry larger bullish implications and target 38.2% retracement of 2.1161 (2007 high) to 1.1409 (2020 low) at 1.5134. However, firm break of 1.3482 support will argue that the rise from 1.1409 has completed and bring deeper fall to 1.2675 support and below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 1:00 | AUD | Consumer Inflation Expectations Jul | 3.70% | 4.40% | ||

| 1:30 | AUD | Employment Change Jun | 29.1K | 20.3K | 115.2K | |

| 1:30 | AUD | Unemployment Rate Jun | 4.90% | 5.00% | 5.10% | |

| 2:00 | CNY | Retail Sales Y/Y Jun | 12.10% | 11.00% | 12.40% | |

| 2:00 | CNY | Industrial Production Y/Y Jun | 8.30% | 7.90% | 8.80% | |

| 2:00 | CNY | Fixed Asset Investment (YTD) Y/Y Jun | 12.60% | 12.50% | 15.40% | |

| 2:00 | CNY | GDP Q/Q Q2 | 1.30% | 1.30% | 0.60% | |

| 2:00 | CNY | GDP Y/Y Q2 | 7.90% | 8.10% | 18.30% | |

| 4:30 | JPY | Tertiary Industry Index M/M May | -2.70% | -0.90% | -0.70% | |

| 6:00 | GBP | Claimant Count Change Jun | -114.7K | -92.6K | -151.4K | |

| 6:00 | GBP | ILO Unemployment Rate (3M) May | 4.80% | 4.70% | 4.70% | |

| 6:00 | GBP | Average Earnings Including Bonus 3M/Y May | 7.30% | 7.20% | 5.60% | 5.70% |

| 6:00 | GBP | Average Earnings Excluding Bonus 3M/Y May | 6.60% | 6.60% | 5.60% | 5.70% |

| 12:30 | CAD | ADP Employment Change Jun | 101.6K | |||

| 12:30 | USD | Initial Jobless Claims (Jul 9) | 360K | 373K | ||

| 12:30 | USD | Import Price Index M/M Jun | 1.00% | 1.10% | ||

| 12:30 | USD | Empire State Manufacturing Index Jul | 19.2 | 17.4 | ||

| 12:30 | USD | Philadelphia Fed Manufacturing Survey Jul | 28.3 | 30.7 | ||

| 13:15 | USD | Industrial Production M/M Jun | 0.70% | 0.80% | ||

| 14:30 | USD | Natural Gas Storage | 16B |