Risk aversion is a main theme today, on situation in Afghanistan, poor China data, and spread of Delta virus. Yen and Swiss Franc rise broadly, and to a lesser extent followed by Dollar. Commodity currencies are all in red, in particular with Aussie pressured by increasing pandemic restrictions. On the other hand, Euro and Sterling and mixed for the moment, awaiting the next move.

Technically, EUR/CHF’s break of 1.0788 minor support suggests that rebound from 1.0715 has completed much earlier than expected. EUR/JPY is eyeing 128.85 support and break will resume the fall from 134.11. EUR/GBP’s recovery also lost momentum after hitting 0.8516. the question now is whether recovery in EUR/USD would be cut short but selling in Euro in crosses.

In Europe, at the time of writing, FTSE is down -1.22%. DAX is down -0.48%. CAC is down -0.85%. Germany 10-year yield is up 0.005 at -0.459. Earlier in Asia, Nikkei dropped -1.62%. Hong Kong HSI dropped -0.80%. China Shanghai SSE rose 0.03%. Singapore Strait Times dropped -0.63%. Japan 10-year JGB yield dropped -0.0077 to 0.017.

US Empire state manufacturing dropped sharply to 18.3

In the August Empire State Manufacturing Survey, the headline general business conditions index dropped sharply from 43.0 to 18.3, even worse than expectation of 28.9. New York Fed said manufacturing activity continued to increase the the New York state, but growth was much slower. Index of future business conditions, on the other hand, rose from 39.5, pointing to ongoing optimism about future conditions.

Canada manufacturing sales rose 2.1% mom in June, led by auto assembly

Canada manufacturing sales rose 2.1% mom to CAD 59.2B in June, slightly above expectation of 2.0% mom. Sales rose in 13 of 21 industries, with most of the increase attributable to improved production at auto assembly plants and higher sales of petroleum and coal products. On the other hand, wood product sales posted the largest decline.

China industrial production, retail sales, investment missed expectations

Industrial production rose 6.4% yoy in July, below expectation of 7.8% yoy. Retail sales rose 8.5% yoy, below expectation of 11.5% yoy. Fixed asset investment grew 10.3% ytd yoy, below expectation of 11.3% ytd yoy.

“Given the combined impact of sporadic local outbreaks of Covid-19 and natural disasters on the economy of some regions, the economic recovery is still unstable and uneven,” said NBS. “We should not only look at the growth to analyze the economic situation, but also need to look at the overall picture of employment, prices and residential incomes.”

Japan GDP grew 0.3% qoq, 1.3% annualized in Q2

Japan GDP grew 0.3% qoq in Q2, above expectation of 0.2% qoq. The economy was back in growth after -1.0% qoq contraction in Q1. In annualized term, GDP grew 1.3%, above expectation of 0.7%.

Looking at some details, external demand contracted -0.3% qoq, versus expectation of -0.1% qoq. Capital expenditure rose 1.7% qoq, matched expectations. Private consumption grew 0.8% qoq, much better than expectation of -1.0% qoq. Price index dropped -0.7% yoy, worse than expectation of -0.4% yoy.

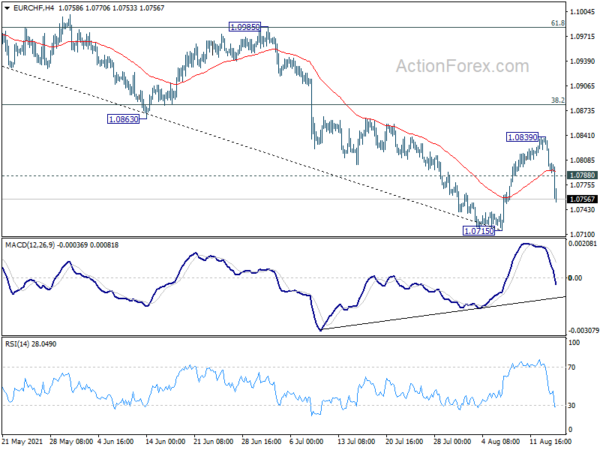

EUR/CHF Mid-Day Outlook

Daily Pivots: (S1) 1.0782; (P) 1.0811; (R1) 1.0827; More….

EUR/CHF’s sharp fall and break of 1.0788 minor support suggests that rebound from 1.0715 has completed earlier than expected at 1.0839. Failure below 55 day EMA retains near term bearishness too. Intraday bias is back on the downside for retesting 1.0715 first. Break will resume whole decline from 1.1149, towards 1.0505 low. On the upside, above 1.0839 will resume the rebound to 38.2% retracement of 1.1149 to 1.0715 at 1.0881.

In the bigger picture, rebound from 1.0505 (2020 low) should have completed at 1.1149 already. The three-wave corrective structure argues that the downtrend from 1.2004 (2018 high) is not over yet. Medium term outlook will now stay bearish as long as 55 week EMA (now at 1.0865) holds. Break of 1.0505 low would be seen at a later stage.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | Rightmove House Price Index M/M Aug | -0.30% | 0.70% | ||

| 23:50 | JPY | GDP Q/Q Q2 P | 0.30% | 0.20% | -1.00% | |

| 23:50 | JPY | GDP Deflator Y/Y Q2 P | -0.70% | -0.40% | -0.10% | |

| 02:00 | CNY | Retail Sales Y/Y Jul | 8.50% | 11.50% | 12.10% | |

| 02:00 | CNY | Industrial Production Y/Y Jul | 6.40% | 7.80% | 8.30% | |

| 02:00 | CNY | Fixed Asset Investment YTD Y/Y Jul | 10.30% | 11.30% | 12.60% | |

| 04:30 | JPY | Industrial Production M/M Jun F | 6.50% | 6.20% | 6.20% | |

| 12:30 | USD | Empire State Manufacturing Index Aug | 18.3 | 28.9 | 43 | |

| 12:30 | CAD | Manufacturing Sales M/M Jun | 2.10% | 2.00% | -0.60% | |

| 12:30 | CAD | Wholesale Sales M/M Jun | -0.80% | -1.80% | 0.50% |