- Prior -3.7%; revised to -4.0%

- Retail sales +9.1% vs +8.7% y/y expected

- Prior -0.9%; revised to -1.7%

- Retail sales (ex fuel) +1.7% vs +1.2% m/m expected

- Prior -3.6%; revised to -3.9%

- Retail sales (ex fuel) +7.2% vs +7.9% y/y expected

- Prior -3.0%; revised to -3.8%

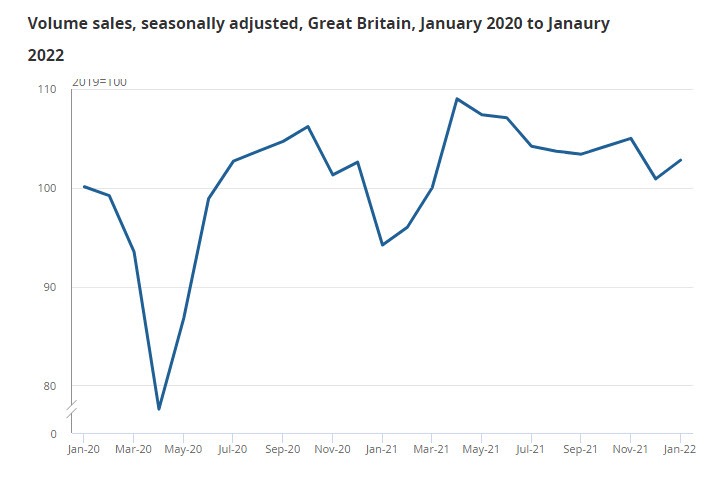

After the omicron impact in December, retail sales activity picked up to start the new year with non-food stores sales volumes increasing by 3.4% on the month. That is offset by a first drop in food store sales volumes to below pre-pandemic levels for the first time (seen 0.8% below levels in February 2020). Overall, retail sales volumes were seen 3.6% higher than pre-pandemic i.e. February 2020 levels.

The data just reaffirms a bounce in economic activity, which is to be expected after the hit in December amid the spread of the omicron variant at the time. Economic conditions in general should continue to support the BOE narrative to tighten monetary policy in the months ahead.

Inflation

This article was originally published by Forexlive.com. Read the original article here.