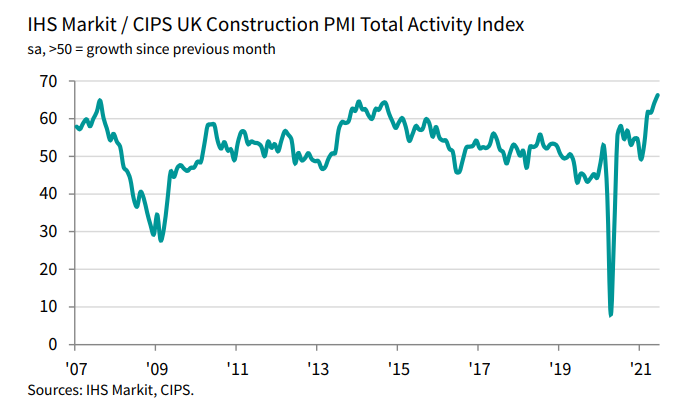

Latest data released by Markit/CIPS – 6 July 2021

Of note, construction output growth hits a 24-year high in June with the recovery led by house building and commercial work. Overall construction activity climbed by its quickest pace since June 1997 with new orders also rising sharply.

That said, input price inflation is observed to be the highest in the survey’s history and supply disruptions may pose a problem moving forward. Markit notes that:

“June data signalled another rapid increase in UK

construction output as housing, commercial and civil

engineering activity all expanded at a brisk pace. The

headline index signalled the fastest rise in business activity

across the construction sector for 24 years. Total new orders

expanded at one of the strongest rates since the summer

of 2007, mostly reflecting robust demand for residential

projects and a boost to commercial work from the reopening

UK economy.“Supply chains once again struggled to keep up with

demand for construction products and materials, with lead

times lengthening to the greatest extent since the survey

began in April 1997. Survey respondents widely reported

delays due to low stocks of building materials, shortages

of transport capacity and long wait times for items sourced

from abroad.“Purchasing prices and sub-contractor charges both

increased at a survey-record pace in June, fuelled by supply

shortages across the construction sector. Escalating cost

pressures and concerns about labour availability appear

to have constrained business optimism at some building

firms. The degree of positive sentiment towards the yearahead growth outlook remained high, but eased to its

lowest since the start of 2021.”