A whisper of taper talk is too much for this market

Imagine what it would look like if the Fed tapered? Or gasp, if they actually hiked rates?

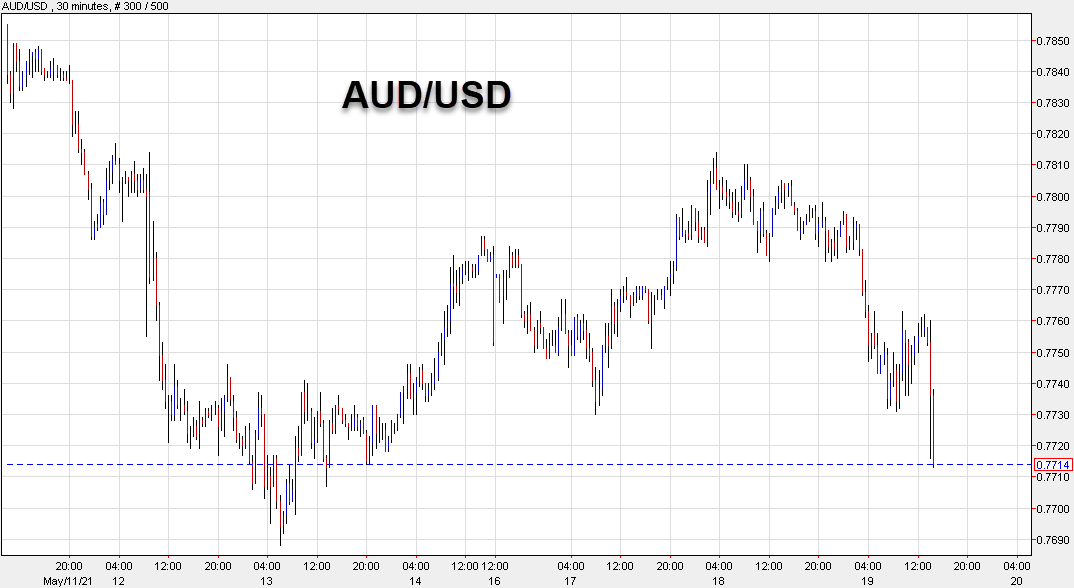

‘Some participants’ musing about maybe talking about tapering if there is ‘rapid progress’ in the economy has sent the dollar higher by around 40 pips across the board. We’re pushing even further as I type after some back-and-forth.

If this is how the market is reacting to a whisper of taper talk, I don’t know how the Fed is ever going to get it done; particularly due to their long track record of chickening out whenever markets recoil.

In any case, the price action is what it is at the moment. I don’t discount that all this landed in a market that was already off balance today, so it might be exaggerated (or at least I hope it is).

Nothing has changed and the days of easy money will still stretch long into the future. If anything, I’m a bit worried about China and their economic softness along with their worries about commodity prices.

I think this will be a dip to buy, but — as today’s crypto market showed — the timing is the hard part.