10-year on the way to 1%

It is almost inconceivable that someone would accept less than 1% for 7 years in US Treasuries with an economic boom on the horizon after the pandemic.

But the answer to that question may be: We’re not heading to a boom and the pandemic was just taking a break.

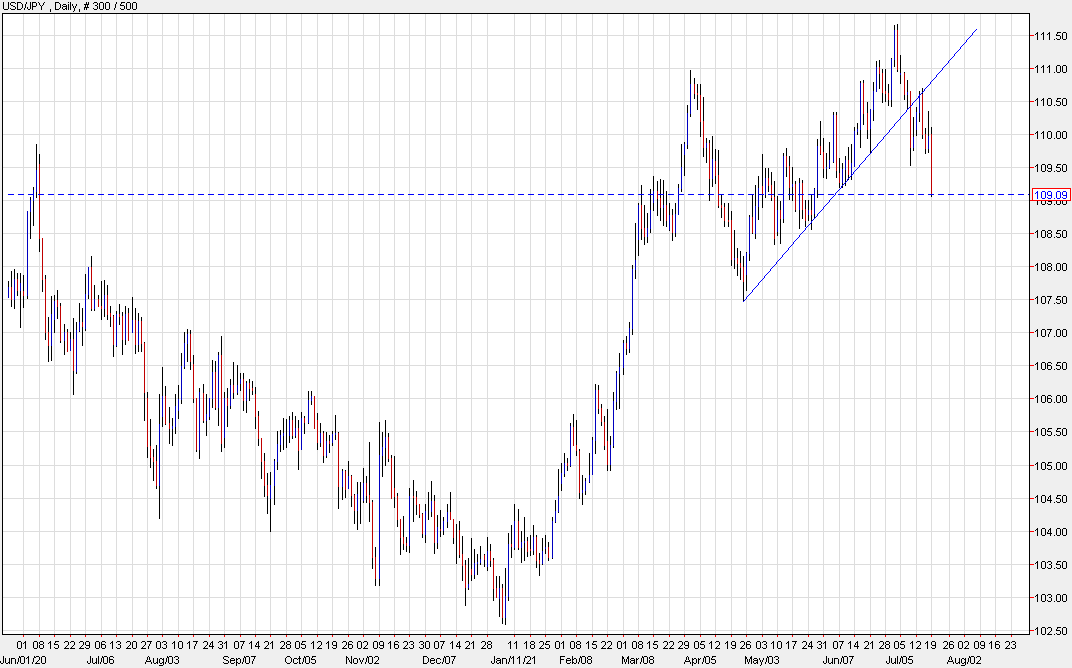

In FX, the dollar is increasingly being sold against the euro and the yen. USD/JPY is down 101 pips on the day to 109.07.

The 109.00 level and some support just above is being tested.

Unfortunately, I don’t see much for bulls to cling to on this chart. I’m carefully watching 1.20% in US 10s and I think that’s the linchpin for the broader market, though we’re seeing risk trades puke some more here and crude is down 5%.

This article was originally published by Forexlive.com. Read the original article here.