Yen rises broadly as the markets start the week with risk aversion in Asia. On the other hand, Canadian Dollar is trading as the weakest, leading other commodity currencies lower. European majors are mixed together with Dollar for the moment. The economic calendar is rather light today and focuses will stay on development in the risk markets. Though, attention will be turning to ECB meeting later in the week, in particular its new forward guidance.

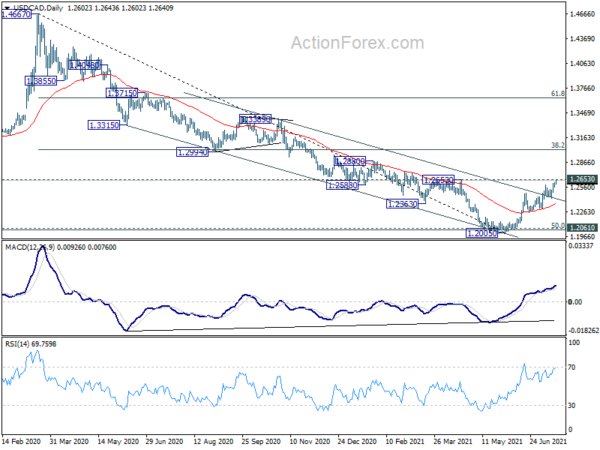

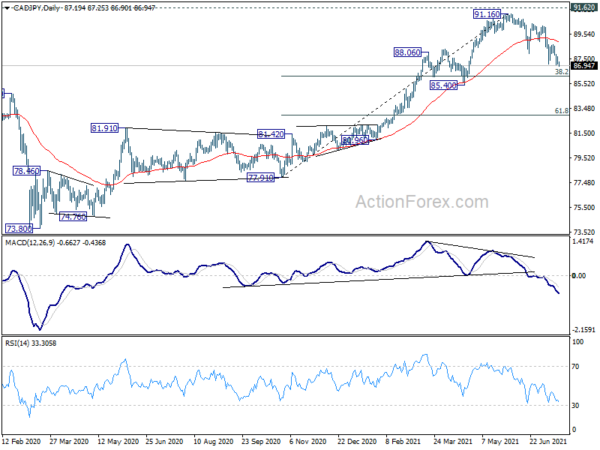

Technically, AUD/JPY and CAD/JPY has already broke out to the downside. Eyes will be on 129.60 support in EUR/JPY and 150.64 support in GBP/JPY. Break of these levels will align the developments with other Yen crosses and solidify Yen’s near term strength. At the same time, USD/CAD is edging close to 1.2653 structural resistance. Break there will also solidify the case of medium term bullish reversal, which could then see USD/CAD heading back to 1.3 handle.

In Asia, at the time of writing, Nikkei is down -1.40%. Hong Kong HSI is down -1.57%. China Shanghai SSE is down -0.12%. Singapore Strait Times is down -0.95%. Japan 10-year JGB yield is down -0.004 at 0.017.

Hong Kong HSI gaps down after US warned of business risks

Asian markets are trading broadly lower as led by Hong Kong HSI, which is down nearly -1.6% at the time of writing. In a late move last week, the US administration published a nine-page Hong Kong Business Advisory, jointly by the departments of State, Treasury, Commerce and Homeland Security. The document warned US firms of encountering a number of risks posed by China’s national security law in the city.

Today’s gap down in HSI suggests that corrective rebound from 26861.87 could have completed at 28218.52 already. The failure to even touch 55 day EMA is a near term bearish sign. The index could at least have another test on 26782.61 key medium term resistance turned support. Such development to cap gains in other Asian markets, and give Yen additional support.

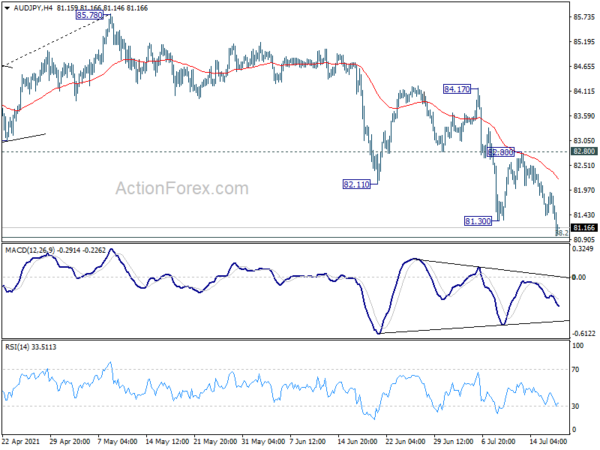

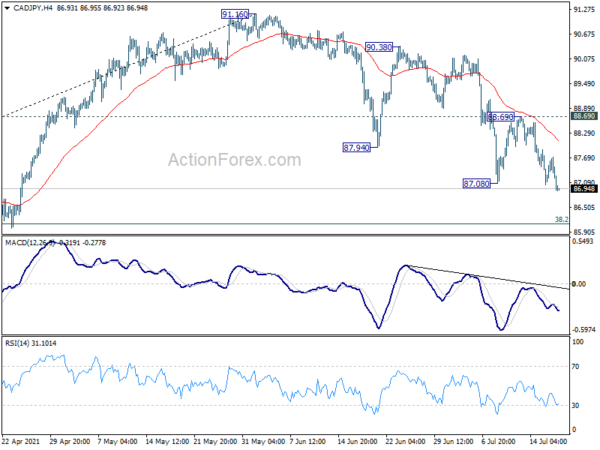

AUD/JPY and CAD/JPY downside breakouts on risk aversion

AUD/JPY and CAD/JPY break out to the downside on risk aversion in Asian markets. AUD/JPY’s fall from 85.78 resumed and hits as low as as 80.98 so far. Rejection by 4 hour 55 EMA is a near term bearish sign and outlook will stay bearish as long as 82.80 resistance.

Immediate focus is now on 38.2% retracement of 73.12 to 85.78 at 80.94, which is close to medium term channel support. Sustained break there will argue that the fall from 85.78 is indeed corrective whole up trend from 59.85. Deeper fall could then be seen back to 73.12/78.44 support next next.

CAD/JPY also breaks through 87.08 support to resume the whole decline from 91.16. Outlook will stay bearish as long as 88.69 resistance holds. Current fall would target 38.2% retracement of 77.91 to 91.16 at 86.09. Reaction from there would unveil whether it’s correcting the rise from 77.91, or the whole up trend from 73.80.

ECB to adjust forward guidances, PMIs watched

ECB meeting will be the major focus this week. In particular, it’s known that the central bank will change it forward guidance to reflect the new 2% symmetric inflation target. Other than that, there is little chance for any change in monetary policy. It’s too early to indicate what ECB would do in Q4 regarding the pace of asset purchases, not to mention adjustment in interest rates.

Also on central bank front, RBA and BoJ will release meeting minutes. On the data front, major focuses will be towards the end of the week, with PMIs from Australia, UK, Eurozone and US.

Here are some highlights for the week:

- Monday: UK Rightmove house price index; US NAHB housing index.

- Tuesday: Japan CPI core; RBA minutes; Swiss trade balance; Germany PPI; Eurozone current account; US housing starts and building permits.

- Wednesday: BoJ minutes, Japan trade balance; Australia retail sales; UK public sector net borrowing; Canada new housing price index.

- Thursday: Australia goods trade balance,NAB quarterly business confidence; ECB rate decision; US jobless claims, existing home sales.

- Friday: Australia PMIs; UK Gfk consumer confidence, retail sales, PMIs; Eurozone PMIs; Canada retail sales; US PMIs.

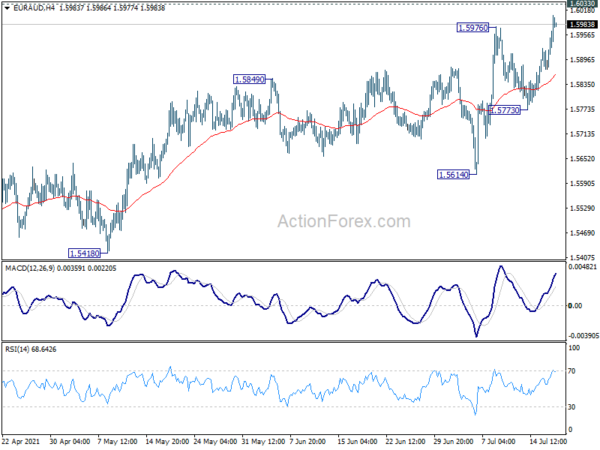

EUR/AUD Daily Outlook

Daily Pivots: (S1) 1.5901; (P) 1.5935; (R1) 1.5997; More…

EUR/AUD’s break of 1.5976 resistance suggests resumption of whole rise from 1.5250. Intraday bias is back on the upside for 1.6003 key resistance level. Decisive break there will argue that rise from 1.5250 is at least correcting the whole fall from 1.9799. Further rally would be seen to 1.6827 resistance next. For now, further rise is expected as long as 1.5773 support holds, in case of retreat.

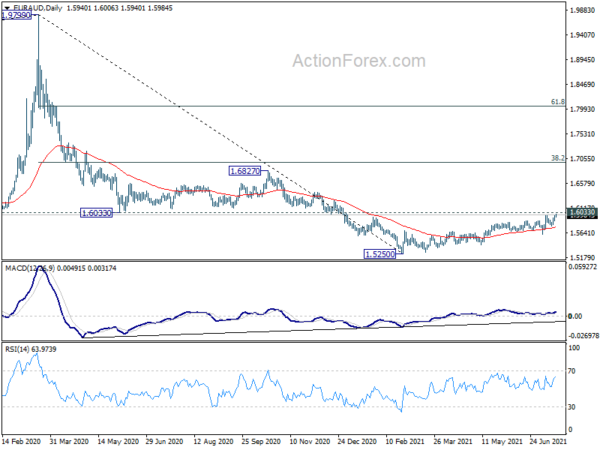

In the bigger picture, outlook stays bearish with 1.6033 support turned resistance intact for now. Fall from 1.9799, as a correction to to long term up trend from 1.1602 (2012 low) is still in favor to resume through 1.5250 later. However, firm break of 1.6033 will argue that such decline has completed. Stronger rebound would then be seen 38.2% retracement of 1.9799 to 1.5250 at 1.6988.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | Rightmove House Price Index M/M Jul | 0.70% | 0.80% | ||

| 14:00 | USD | NAHB Housing Market Index Jul | 82 | 81 |