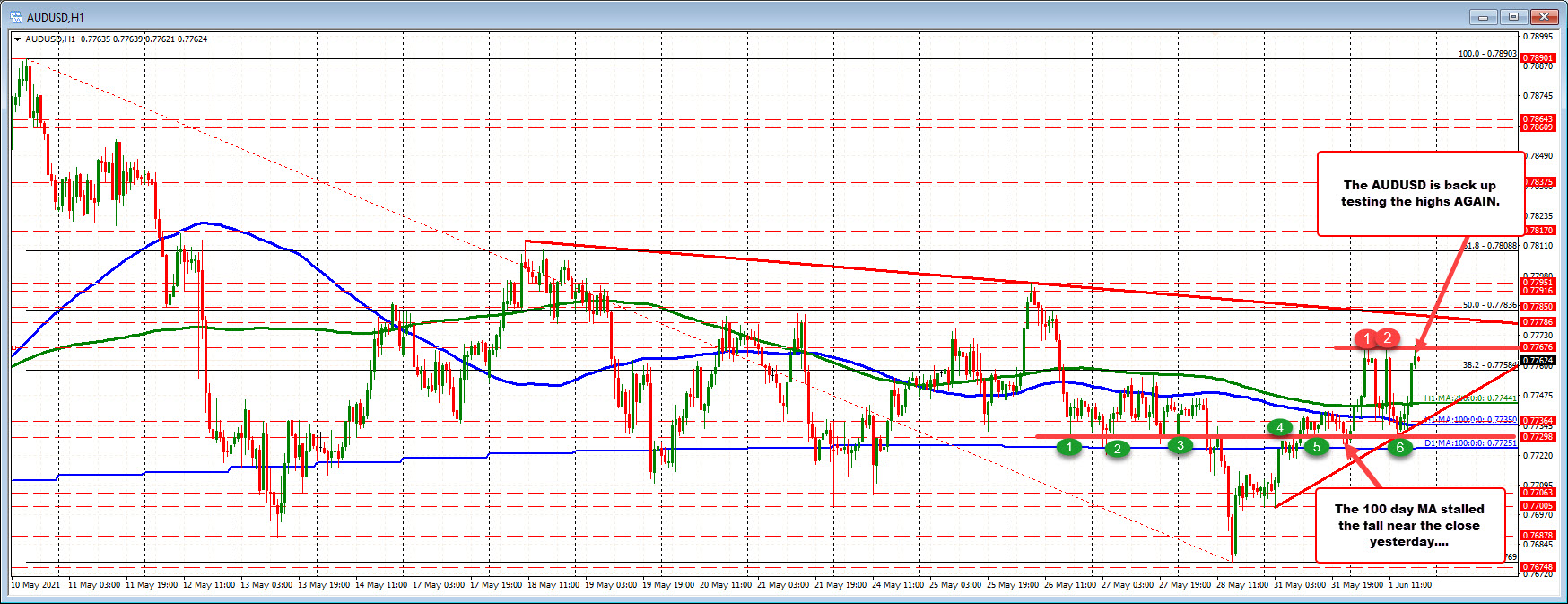

Up and down activity but above 100/200 hour MA

The RBA Rates unchanged and kept a more dovish stance as Governor Lowe said “inflation and wage pressures are subdued” and that a pickup in prices is expected to only be “gradual and modest”.

Despite the less hawkish comments the dips in the AUDUSD have been bought. The pair did dipped below its 100 hour moving average currently at 0.7735, but was not able to extend below the 100 day moving average at 0.77251 (the low reach 0.7730) . Yesterday, the price moved back above that 100 day moving average and tested it near the close of day. However buyers held the support and the price has stayed above that level keeping the bulls/buyers more in control technically.

Having said that, and despite the buyers below, there is a ceiling being developed at 0.77676. That area has stalled the rises today on three separate occasions (including on the last hourly bar).

So technically, the tilt is in the favor of the buyers above the 100/200 hour MAs (at 0.7744 and 0.7735 respectively) and the 100 day MA. However, sellers are putting a lid on the pair at a fairly random 0.7767 area. If that level cannot be broken, the up and down battle can continue with the moving averages providing support below, and the ceiling as resistance.