EURUSD continues to trend lower

The EURUSD has a 148 pip trading range now. That is well above the 22 day average of 80 pips (about a month of trading).

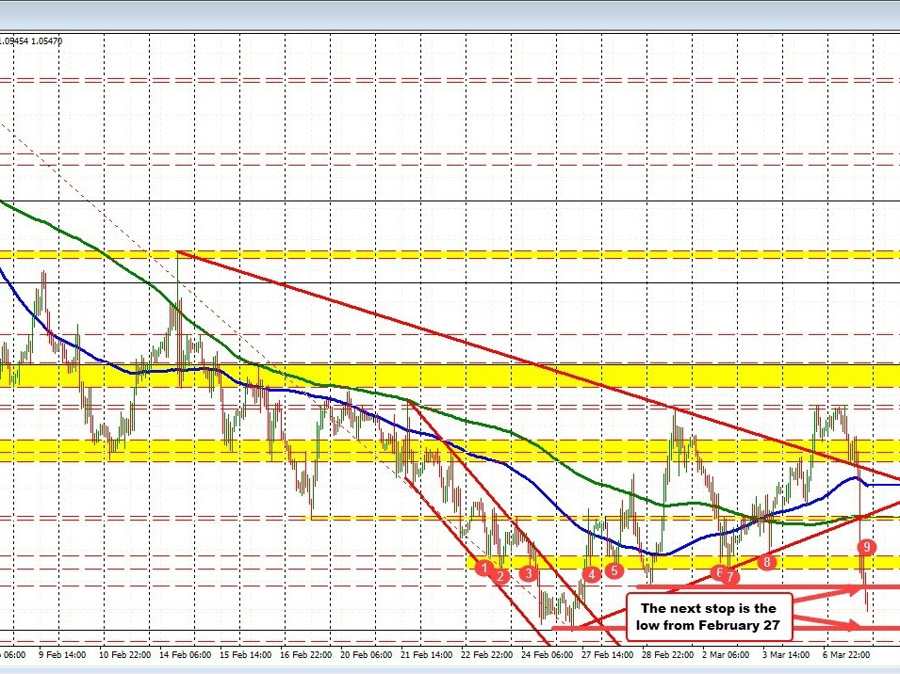

Technically, the price cracked below both the 200 hour MA and trend line support at 1.0613 soon after the Fed Chair prepared remarks. There was a corrective move higher that retested that MA/underside of the broken trend line. Sellers leaned and pushed the pair lower.

The swing area between 1.0576 to 1.0585 was broken as well with more momentum to the downside over the last 2-3 hours. The Low from March 1 was broken more recently. The low from last Monday is the next obvious target at 1.0532.

Looking at the five minute chart below, the trend like move is more obvious. Note the corrective move up to the 200 hour moving average that stalled the correction. The legs to the downside have been able to stay below the 38.2-50% retracement. It would take a move above 1.0561 – 1.05662 hurt the trend move in the short term. Absent that in the sellers and the trend is still full steam ahead.

Move above 1.0566 would take some of the steam out of the downside momentum, and we could see further corrective probing back to the upside as market traders take a breather.

EURUSD on 5-minute trends lower

Yields moving higher continue to be a catalyst. The two-year note is above 5% at 5.008%. That’s up 11.4 basis points. The two year yield has reached the highest level since 2007.

Stocks are also moving lower. The Dow Industrial Average is down -566 points or -1.7%. The S&P index is down 64 points or -1.57%. The NASDAQ index is down -147 points or -1.26%.