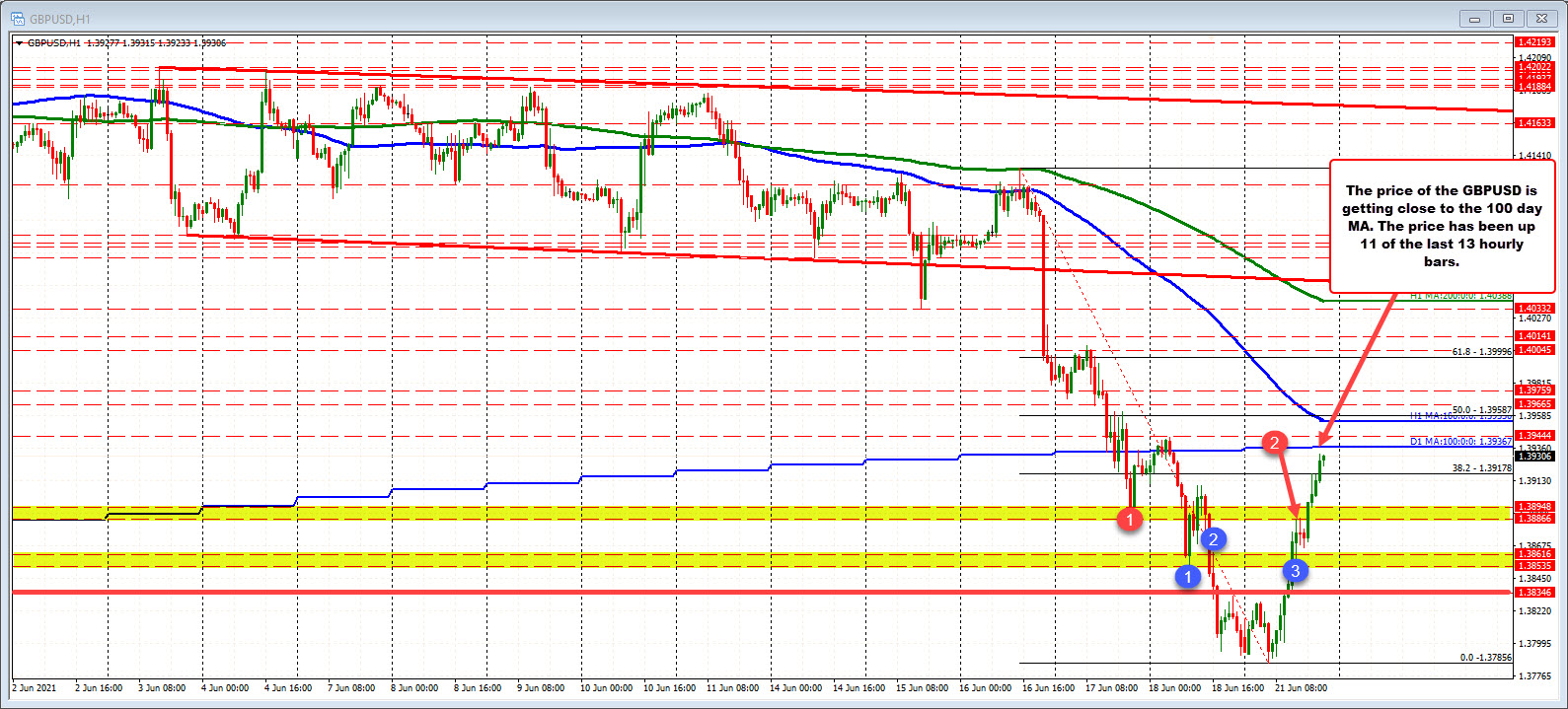

100 day MA at 1.39367

The GBPUSD is moving closer to its 100 day MA at 1.3937 (off the bid side prices). The high price just reached 1.39317.

The move back to the 100 day MA should solicit sellers looking to lean against the risk defining level. The price moved below the MA on Thursday, corrected modestly above it on Friday, before rotating back below the MA level and running lower.

Today a new cycle low was reached (lowest level since April 16), but started its rebound higher soon after breaking Friday’s low at 1.3794. The low could only reach to 1.37856 before rebounding higher.

Since bottoming, the pair’s price has been up in 11 of the last 13 hourly bars (working on the 12th above 1.39274). The current price is at 1.3931.

A move above the 100 day MA would have traders looking toward the falling 100 hour MA at 1.3555. The 50% mid point is at 1.39587.

The run lower last week took the pair outside a sideways market. Moving back above the aforementioned levels would put into question, the sellers strength.