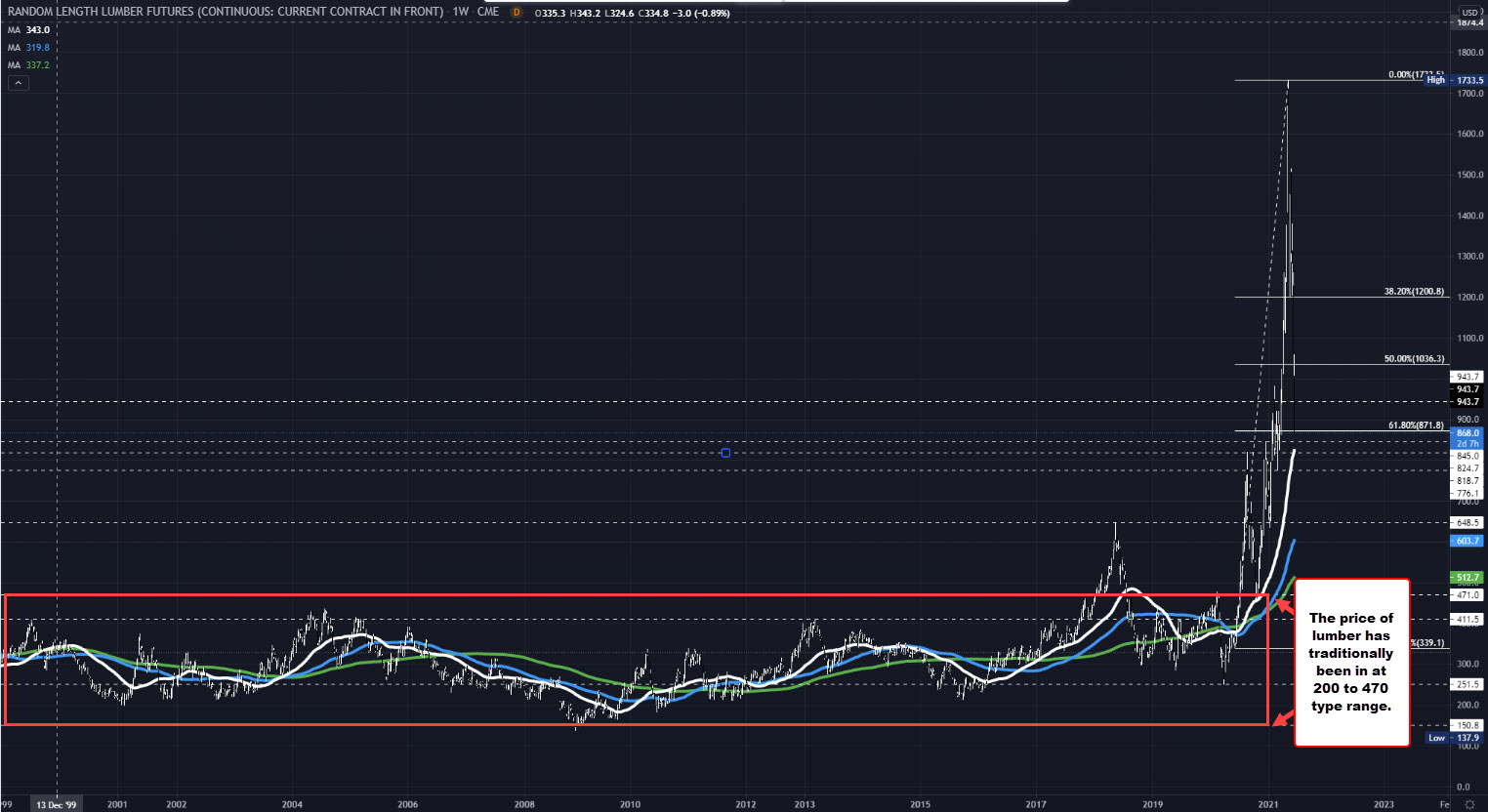

The high price on May 10 reached $1733.50. The price is now testing the 200 day MA at $861.50

The price of lumber futures has continued its downward spiral as it moves below $900 for the first time since March 22 and tests its 200 day MA at $861.50. The price high reached over $1733 on May 10. Since then, the price has moved down nearly 50% off that high.

Although well off the high which will gives relief to the home builders who have struggled with the high cost of materials, the price still remains well above what has traditionally been a market between around $200 and $470. In 2018 there was a spike up to $648.

The pandemic of 2020 started an exodus out of the cities and into the suburbs. The price spiked to $820 toward the end of August, tumbled back down toward $450 in the middle of October 2020, before starting the surge to the $1733 level in May 2021.

With the price now testing the $861 level. That is also close to the $845 spike at the end of August 2020. Get below both those levels, and traders will start to look back toward $648 as the next key target. Stay above, and the traders could start to ping pong the price between the 100 day MA above at $1094 and the 200 day MA below at $861.

Meanwhile, copper has also started to dip after it’s run higher. Looking at the weekly futures chart below, the price of the futures are at $4.27 a pound. That is down nearly 12% from the May high. However, it is still up some 22% from the end of year levels and well off the lows from March 2020 at $1.97.

The rising 100 day moving average currently comes in at $4.20. A move below that level would be the first dip below that moving average since June 2020.

Fundamentally there is concern that China may tamp down on rising commodity prices by releasing stockpiles.