Trades between 100/200 hour MAs

The NZDUSD has followed the trend higher in the US dollar today (NZDUSD lower) after the stronger than expected US jobs report.

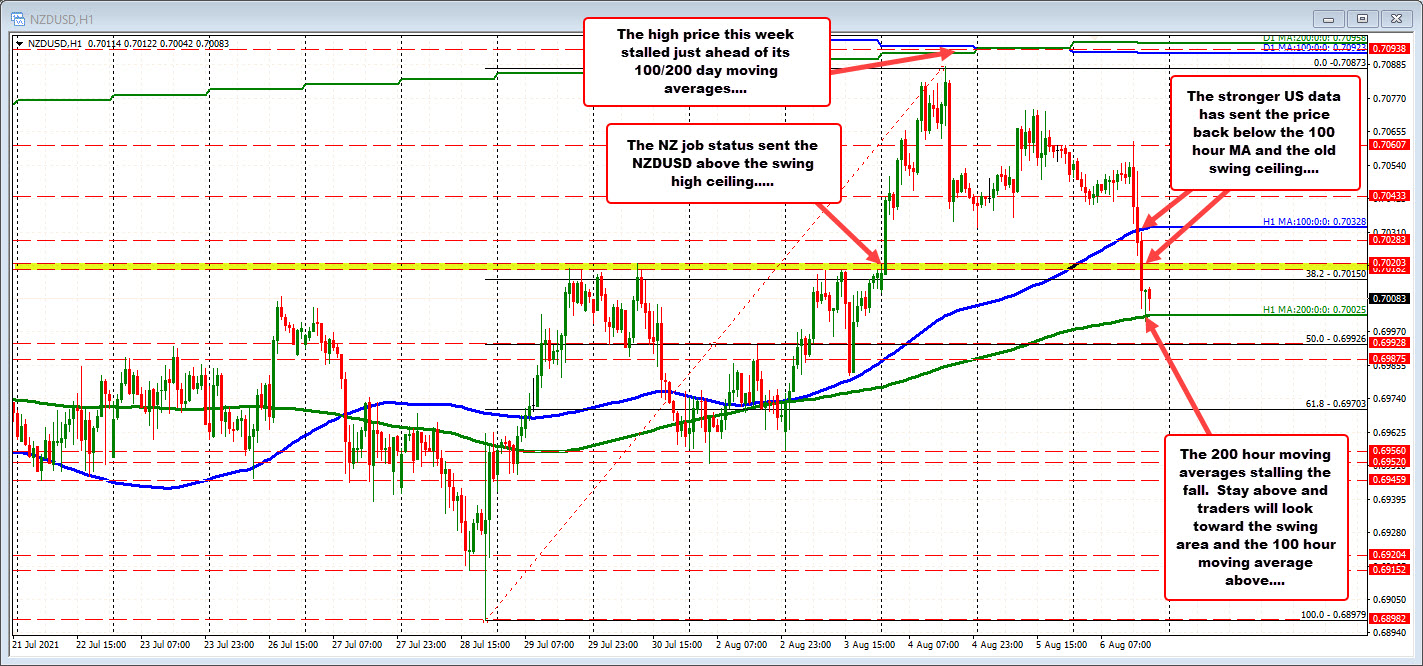

The pair moved lower, and in the process cracked below its 100 hour moving average (currently at 0.70328), and continued through an old swing ceiling at 0.7018 to 0.70203 on it’s way to a test of its 200 hour moving average (green line currently at 0.70025). The price traded just below the level briefly, but has modestly bounced.

The bounce off the low has been able to stay below the 38.2% retracement of the move up from the July 28 low, and also below the aforementioned swing area between 0.7018 and 0.70203. Those levels will need to be rebroken, to make the dip buyers against the 200 hour more comfortable with their trade low risk focused trade against the 200H MA.

Recall from earlier this week, the NZDUSD spiked higher on Wednesday after the much stronger than expected NZDUSD employment report. ON that day, the aforementioned swing area (between 0.7018 and 0.70203) was broken and the price raced higher. The price peaked on Wednesday at 0.70873. That high was just short of the near converged 100 and 200 day moving averages at around 0.7093.

New Zealand had strong jobs. US had strong jobs. Both releases have potential implications for central bank policy. The analyst in New Zealand moved up a tightening to as early as August 18. IN the US, the trend is to a taper sooner rather than later.

The move back through the 100 and toward the 200 hour moving averages given the data, makes sense. However, it is now time for traders to make the next shove.

Will traders break the price below the 200 hour MA (in which case look for more selling)? Or will the low risk dip buyers gather enough momentum to get the price back above the swing area and take another look at the 100 hour moving average?

So far the low risk dip buyers are still in play.