Me and Eamonn both highlighted the bearish outside day in oil yesterday and it’s coming to pass.

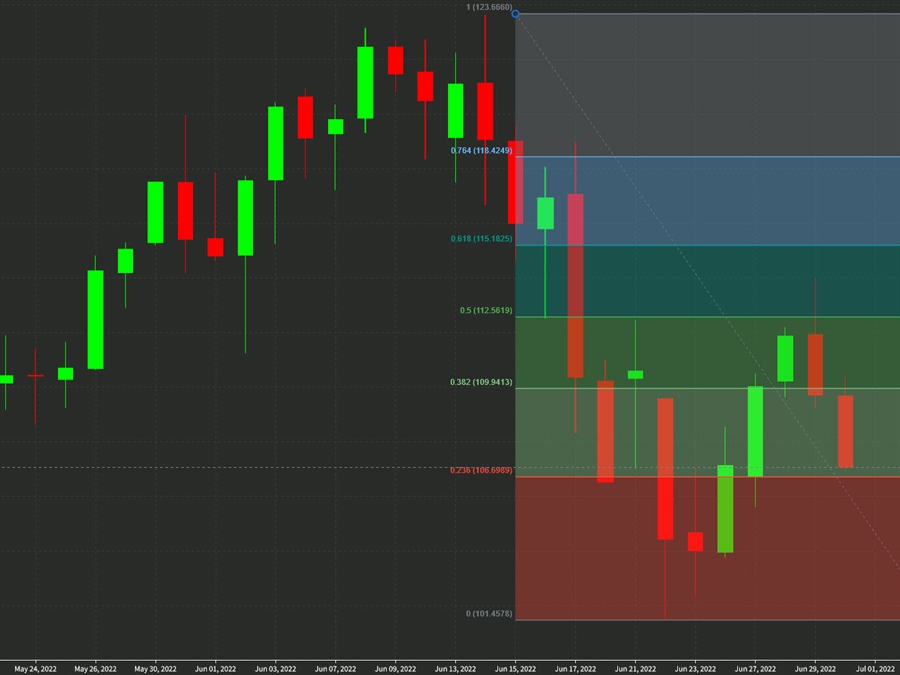

There was a bearish outside day yesterday and it came after a test of the 50-61.8% fibonacci retracement level of the June swoon.

OPEC+ today was a non-factor as it endorsed the August production hike that was already announced and didn’t offer anything on September and beyond.

Comments from Biden may have hurt oil as he urged Gulf states to produce more but also said that he won’t be talking directly with Saudi Arabia about increasing production. I’m not sure that’s believable but it is what it is.

The main driver right now is worries about growth. Today’s Japanese manufacturing data was terrible and US overall consumption data was soft (with fears of more consumer weakness).