Crude oil is down for the 7th consecutive day

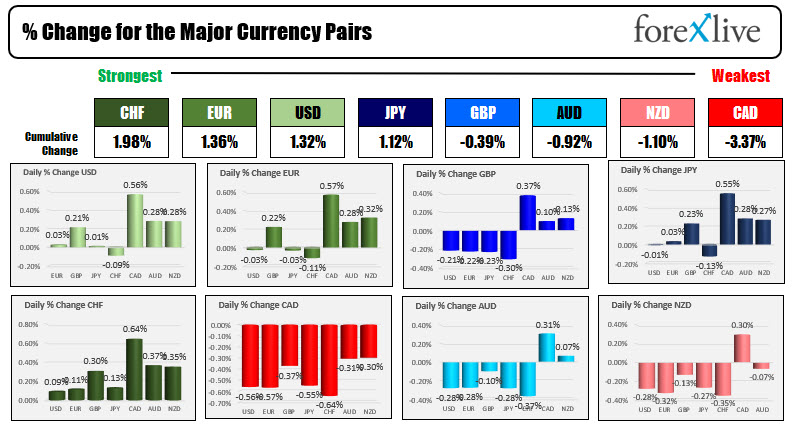

The CHF is the strongest and the CAD is the weakest as flows are once again out of the commodity currencies with help from China regulation, concerns about slowing from Covid delta variant (at least now), lower stocks, and all that dynamic continues to hurt commodities. Crude oil is down for the 7th consecutive day helping to push the CAD lower once again (the USDCAD is up for 5 consecutive days (every day this week) with the pair trending from low to high 437 pips.

Looking at other markets:

- Spot gold is up $5.44 or 0.3% at $1784.98.

- Spot silver is unchanged at $23.21

- WTI crude oil futures are down $1.19 or -1.85% at $62.45

- the price of bitcoin is trading up $183 at $46,947

In the premarket for US stocks, the major indices are down with the Dow and S&P on track for the its worst week since June. The NASDAQ index is on track for its worst week in May. A snapshot from the futures market currently projects:

- Dow -173 points. It fell -66.59 point yesterday

- S&P index -19.05 points. It closed higher by 5.53 point yesterday

- Nasdaq -28.08 points. It rose 15.87 point yesterday gather

in the European equity markets, the major indices are lower after yesterday’s sharp tumble:

- German DAX -0.4%

- France’s CAC -0.3%

- UK’s FTSE 100 -0.1%

- Spain’s Ibex -0.4%

- Italy’s FTSE MIB -0.6%

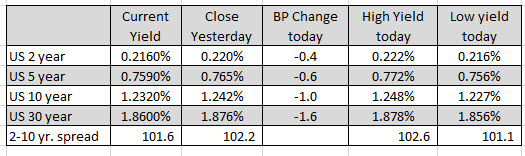

In the US debt market, the yields are lower with a flatter yield curve. The two – 10 year spread is moving back toward the 100 level. Currently trades at one of 1.6 basis point as traders react to the prospects for lower growth.

In the European debt market, the benchmark 10 year yields are going the other way, narrowing the spread between US and European interest rates:

In the European debt market, the benchmark 10 year yields are going the other way, narrowing the spread between US and European interest rates: