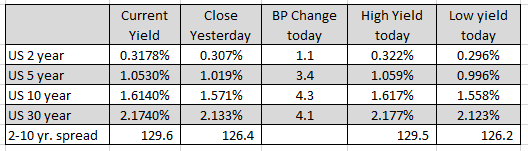

10 year up to 1.614%.

The nUS 10 year yields continue to move higher with the 10 year now up to 1.614%. That’s up 4.3 basis points on the day.

The move higher is starting to hurt the NASDAQ index which is currently down -53 points or -0.37% at 14600.26.

The USDJPY is also being impacted as it moves to a new 2021 high price of 112.172. The high price from February 2020 comes in at 1.1222. Above that and April 2019 high price cuts across at 112.389.

In other markets as London/European traders look to exit for the weekend:

- Spot gold has given up its gains that took the price up to $1781.30. It is currently trading at $1757.50 still up about one dollar on the day but well off it’s highs.

- Spot silver is up $0.17 or 0.81% at $22.75

- WTI crude oil futures moved above 80 for the first time since 2014. It currently trades at $79.90 up $1.58.

- The price of bitcoin is up $375 and $54,162. That is off it’s intraday high of $56,168, but remains above its intraday low at $53,623

In the forex:

- EURUSD. The EURUSD is back up testing its 100 hour moving average at 1.15754. There have been three hourly bars since the jobs report where the price traded above that moving average level, but quickly stalled. As we head into the afternoon session, getting above and staying above that moving average is still needed to give the buyers more confidence. The 200 hour moving averages at at 1.15971. That would be an upside target on a break above.

- GBPUSD: The GBPUSD stay below its 50% retracement of the move down from the September swing high at 1.3661. The high price reached 1.3655. The current price trade at 1.36288. That is between support at the 100 hour moving average at 1.3604 and the 50% retracement 1.36617.

- USDCAD: The USDCAD has moved lower after stronger Canada job gains and weaker US job gains. The price has moved below both its 200 day moving average at 1.2511 and its 100 day moving average 1.24797. The low price reached 1.24526. The current price is currently just below the 100 day moving average at 1.24776. As long as the price can remain below that moving average, the sellers remain more control.

This article was originally published by Forexlive.com. Read the original article here.