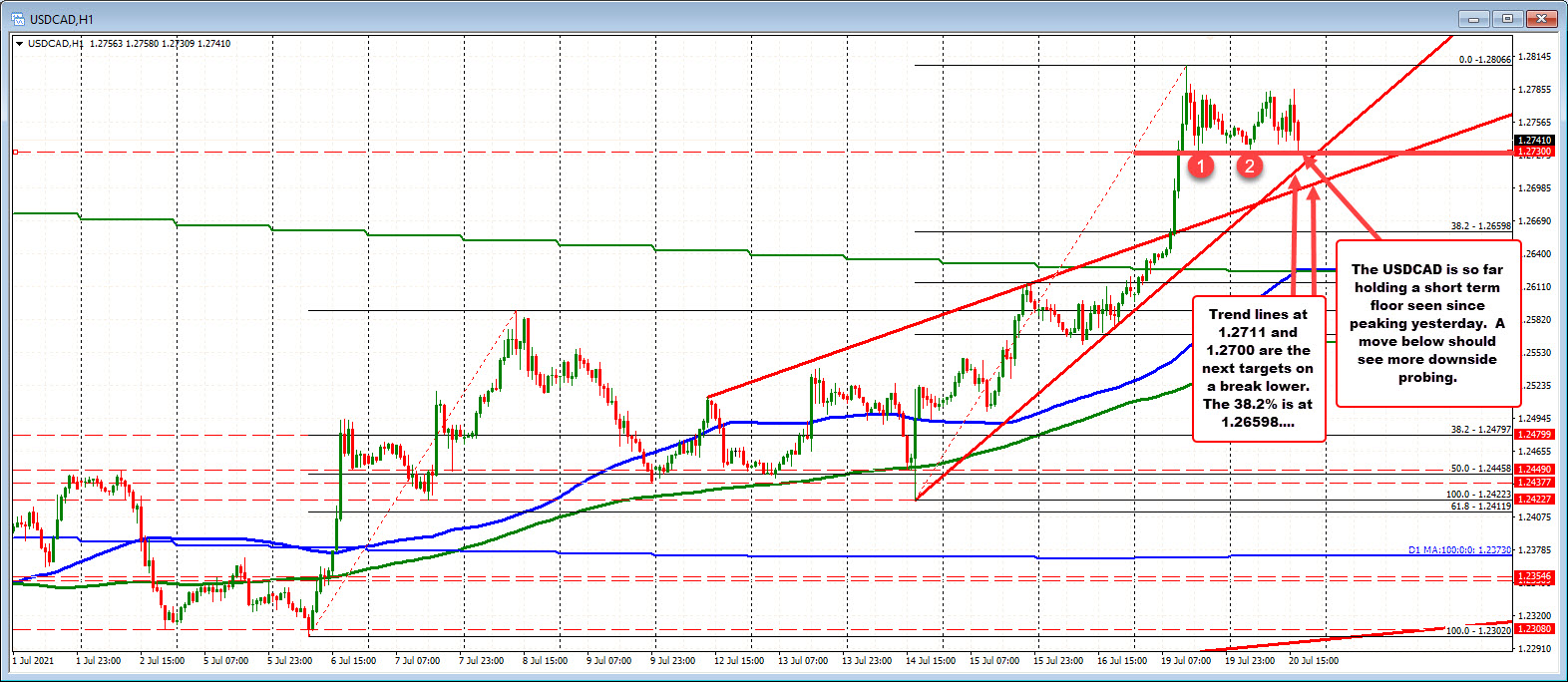

Move below 1.2730 should see more selling

The USDCAD moved sharply higher yesterday on the back of tumbling oil prices.

Today, the price of WTI crude oil has turn back to positive territory after trading to a new cycle low near $65.20. That move lower, took the price below its 100 day moving average at $66.24 (see blue line in the chart above).

The current rebounded price is trading at $66.72, back above the key MA level. Stay above and the tilt would shift more toward the buyers after the sharp fall from the July high near $77

The bounce in crude has helped to push the USDCAD back toward what has been a floor since the peak yesterday. That level comes in at 1.2730.

Move below the 1.2730 level and we should see more downside probing.

On a break, an upward sloping trend line cuts across at 1.2711. A broken trend line (connecting recent highs ) cuts across around 1.2700. Below that, and the 38.2% at 1.26598 would be targeted.

Hold the support, and the consolidation continues with the high from yesterday at 1.28066, the next key target. The high price today at 1.2786 is an interim target to get to and through.