All major indices higher

All the major indices are closing the session with gains. The day was led by the NASDAQ index

- NASDAQ has its best day since May 20

- NASDAQ higher for the third straight week

- S&P has its best day since May 24

- Dow and S&P higher for the second straight week

A look at the closes shows:

- S&P index rose 37.04 points or 0.88% at 4229.89. The high price reached 4233.45. That was just short of its all-time high of 4238.04

- NASDAQ index rose 199.90 points or 1.47% at 13814.49. The high price reached 13826.82. The low extended to 13692.01

- Dow industrial average rose 179.35 points or 0.52% at 34756.39. The high price reached 34772.12. The low price extended to 34618.69

- Russell 2000 index closes up 7.16 points or +0.31% at 2286. It’s high price reached 2293.67. The low price extended to 2277.39

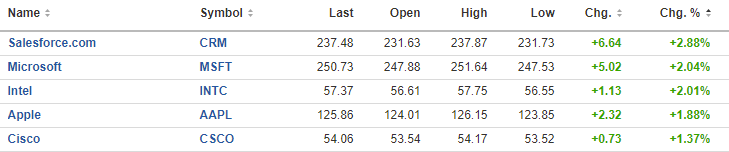

The biggest gain or of the Dow 30 was salesforce with a gain of 2.28%.

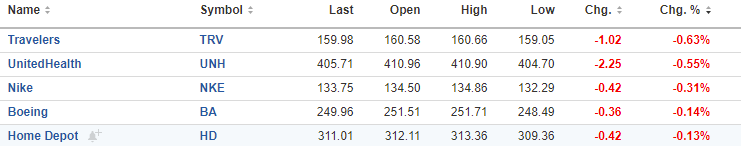

The biggest loser in the Dow 30 was Travelers at -0.63%.

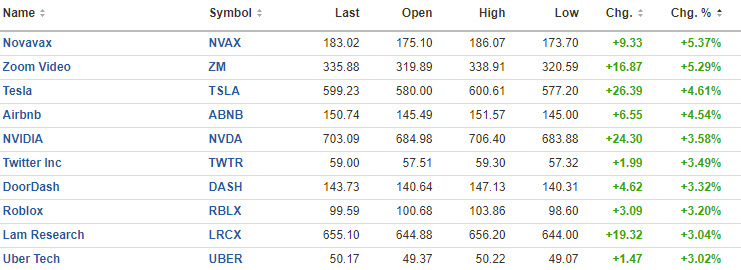

Outside of the Dow 30, below is a list of some of the other bigger winners for the day. Roblox which recently IPO would near the $70 level, traded above $100 this week. Nvidia is cracking above the $700 level of the first time:

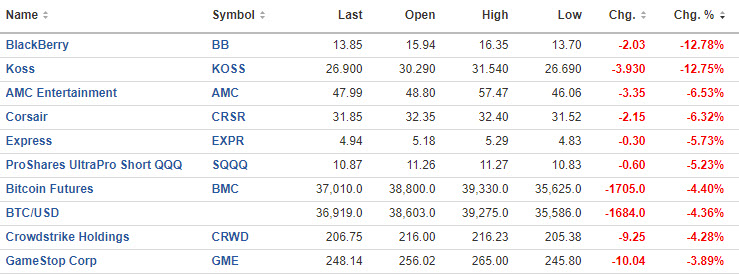

Losers today included the recent Meme gainers. Blackberry fell -12.78%. AMC fell -6.53% and Gamestop fell -3.89% .

For the trading week, the major indices all rose modestly:

- S&P rose 0.69%

- NASDAQ rose 0.57%

- Dow rose 0.85%

This article was originally published by Forexlive.com. Read the original article here.