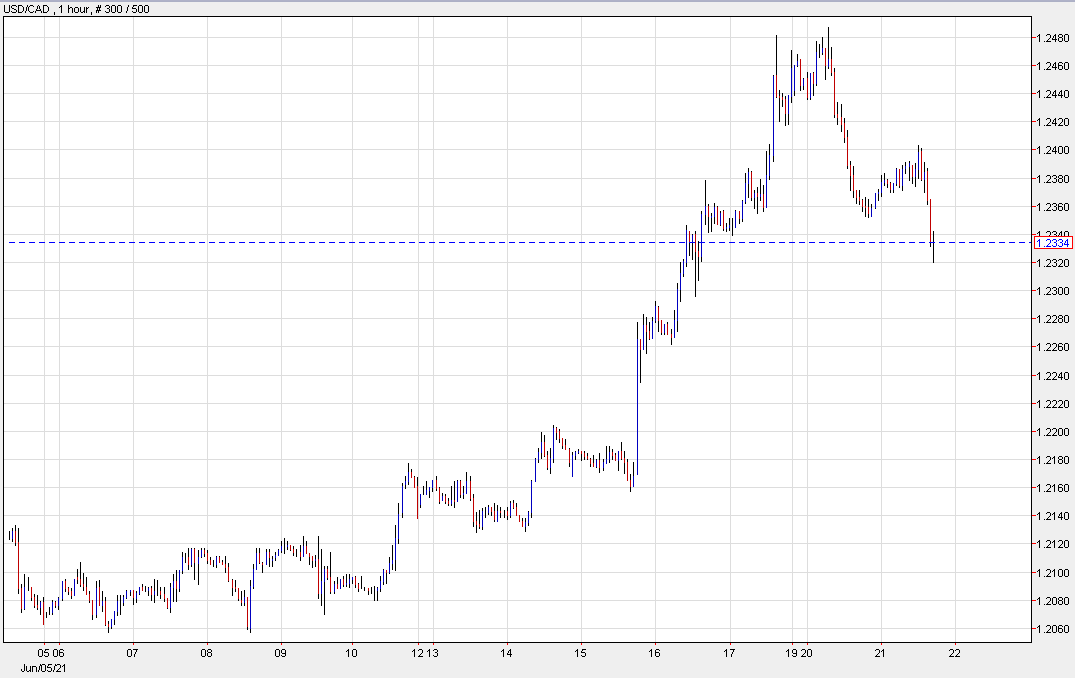

USD/CAD down 27 pips to 1.2336 today

USD/CAD touched 1.24 again today but that’s where it found sellers and the better tone in risk assets along with Western Canadian Select crude near $60/barrel leaves the loonie in a good spot.

The market is trying to figure out what to do next with commodities more broadly. There have been some large pullbacks across the board on profit taking, the ease of bottlenecks and some actions from China.

The copper move today though might be instructive. China jawboned copper and when that didn’t offer much, they pledged to sell some reserves. Naturally that spooked the market but they were vague on the amount they would be selling. Today they outlined a plan to sell 20,000 tons on July 5/6.

More is to come but that’s not the kind of number that will spook the market and you can see that in the 1% bounce in copper today. More broadly, it’s a mixed picture in commodities today but the overall mood is calmer. Even the wild lumber market is relatively unchanged over the past three days.

If commodities can stabilize anywhere close to these levels, there is plenty of room for CAD and the commodity bloc to run. But for it to truly be durable, it’s going to have to be accompanied by signs of strong economic growth outside the US.

Technically, the USD/CAD 1 hour chart (above) shows a messy head-and-shoulders top targeting 1.2240.