Range at the start of the day was only 27 pips

The USDCAD started the North American session with only a 27 Pippa trading range. That range is being extended to the upside and is up to 37 pips. That is still off the average of around 76 pips. There is room to roam.

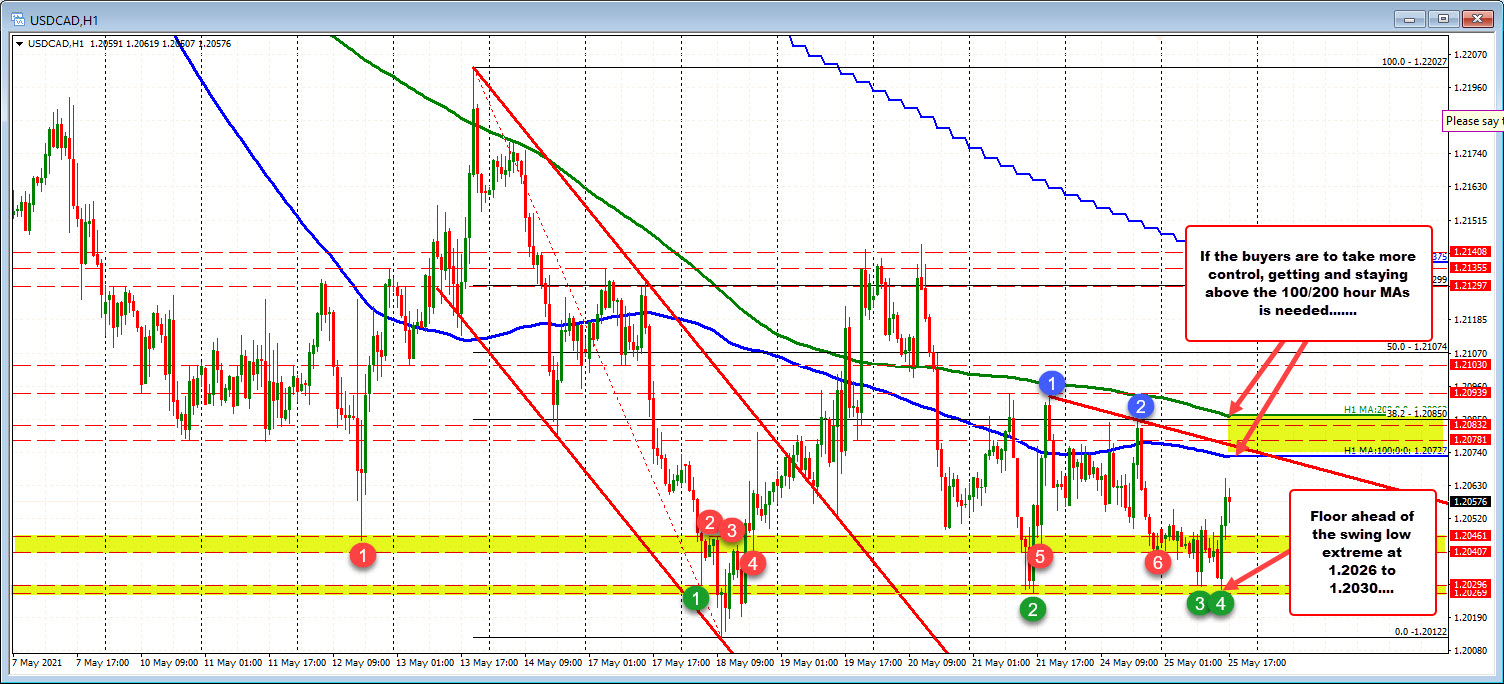

Looking at the hourly chart, the choppy up and down trading range did find the support (and solidified a floor ahead of the May extreme at 1.20122) in a swing area between 1.20269 and 1.20296. There were two separate looks in that area today, and each found support buyers (see green numbered circles 3 and 4 in the chart above).

The rise over the last 2-3 hours has extended to a high of 1.20663. The next key target comes against the 100 hour moving average of 1.20727. The last two days has seen a number of breaches of that moving average, but price action stalled well ahead of the 200 hour moving average (green line) currently at 1.2086.

Ultimately, if the buyers are to take more control, getting above the 100 AND 200 hour moving averages would be the minimum requirement.

PS, the 38.2% retracement of the trading range since May 13 is near the 200 hour moving average 1.20850 and is also a minimum target if buyers are to win more control from the sellers..

Although the price is higher, and there is room to roam, buyers still need to prove that they can take back more control. Close risk for the dip buyers can probably be targeted in the 1.20407 to 1.20461 swing area. If the price can stay above that area, that would give the dip buyers some comfort. Move below, and the progress from the bulls/buyers is just not all that convincing.