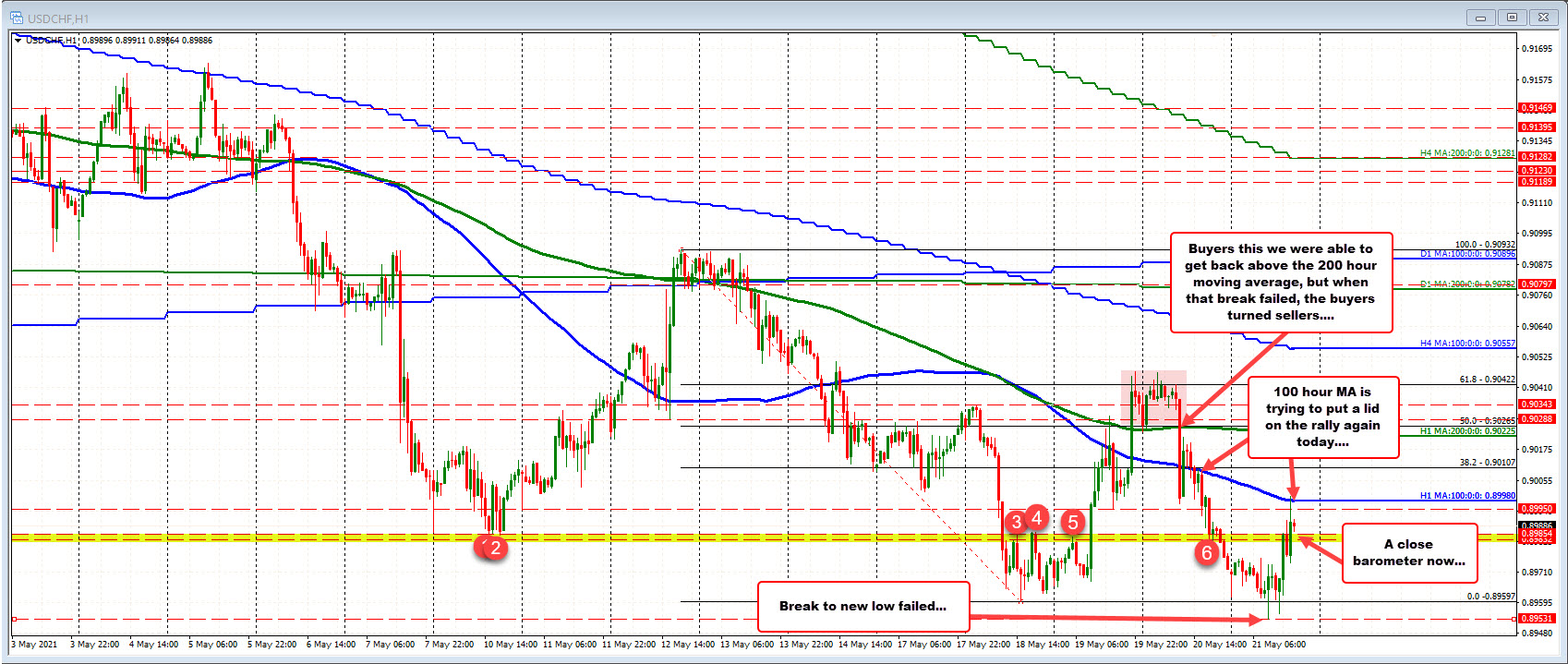

The 100 hour MA comes in at 0.8998

The USDCHF traded to the lowest level since February 24 today after taking out the low from Tuesday’s trade at 0.89597. However, the moves below that low (there were 2), both failed today (the lowest low reached 0.89531).

After the 2nd failed run below the Tuesday low, the sellers turned buyers and was able to push back above the swing area between 0.8983 and 0.89854, and make a run toward the 100 hour moving average (blue line) currently at 0.8998.

The high for the day reached a shade above the moving average but below the natural resistance target at 0.9000. The price has rotated back toward the aforementioned swing area between 0.8983 to 0.89854. Now, a move below that level would put the price back into the lower extreme area for the week and tilt the intraday bias back in the favor of the sellers..

With the 100 hour moving average holding resistance at today, it increases the levels importance going forward. It will take a move above that moving average to solicit more buying.

Ultimately, getting back above the 200 hour moving average at 0.90225 (green line) will be needed to give buyers more control. On Wednesday and Thursday, the price traded above that moving average line, but the price fell back below during yesterday’s trading. The buyers turned sellers quickly and the break was in traders rear view mirror.