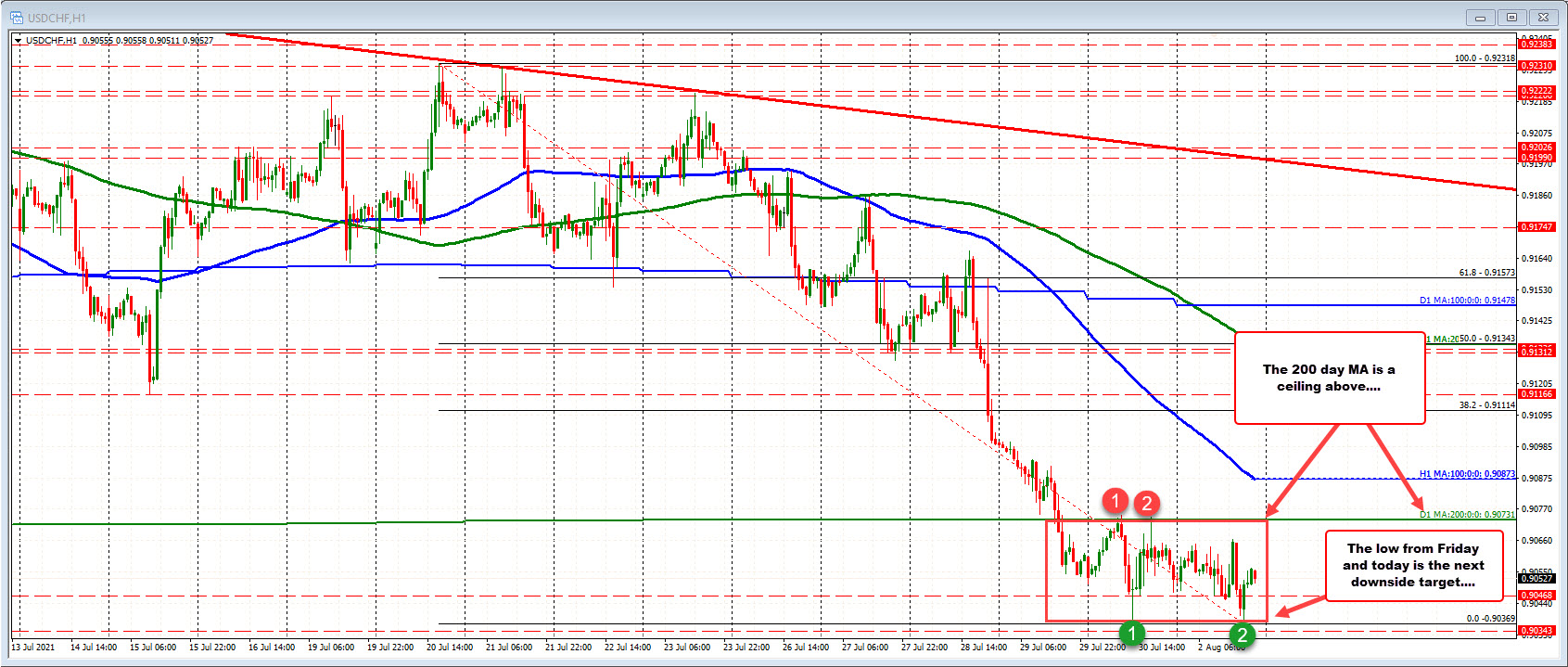

The low last week was at 0.90384.

The USDCHF traded to a low today of 0.90369. That took out the Friday low of 0.90384 but only by a pip and 1/2. That is not what traders expect on a new low.

The price has rebounded modestly over the last three hours and currently trades at 0.9052 (14-15 pips above the low). The markets are quiet and the bounce is modest. So it is not something to get too excited about. Nevertheless, the new low, found no momentum.

If the buyers are to start to take back more control, there would be two requirements.

1. Stay above the lows at 0.90369 to 0.90384.

2. Get back above the higher 200 day MA (green line and top of the red box in the chart above) at 0.90731.

With the price currently at 0.9052, the price is 15 or so pips from the low and 21 pips from the 200 day moving average. So it is a coin flip from a risk/reward standpoint. Nevertheless, the price action suggests a neutrality between the buyers and sellers at the current level of trading with work left to do by sellers, if they want to make the next push lower, and work to do by the buyers if they want to take back more control after the recent run lower.