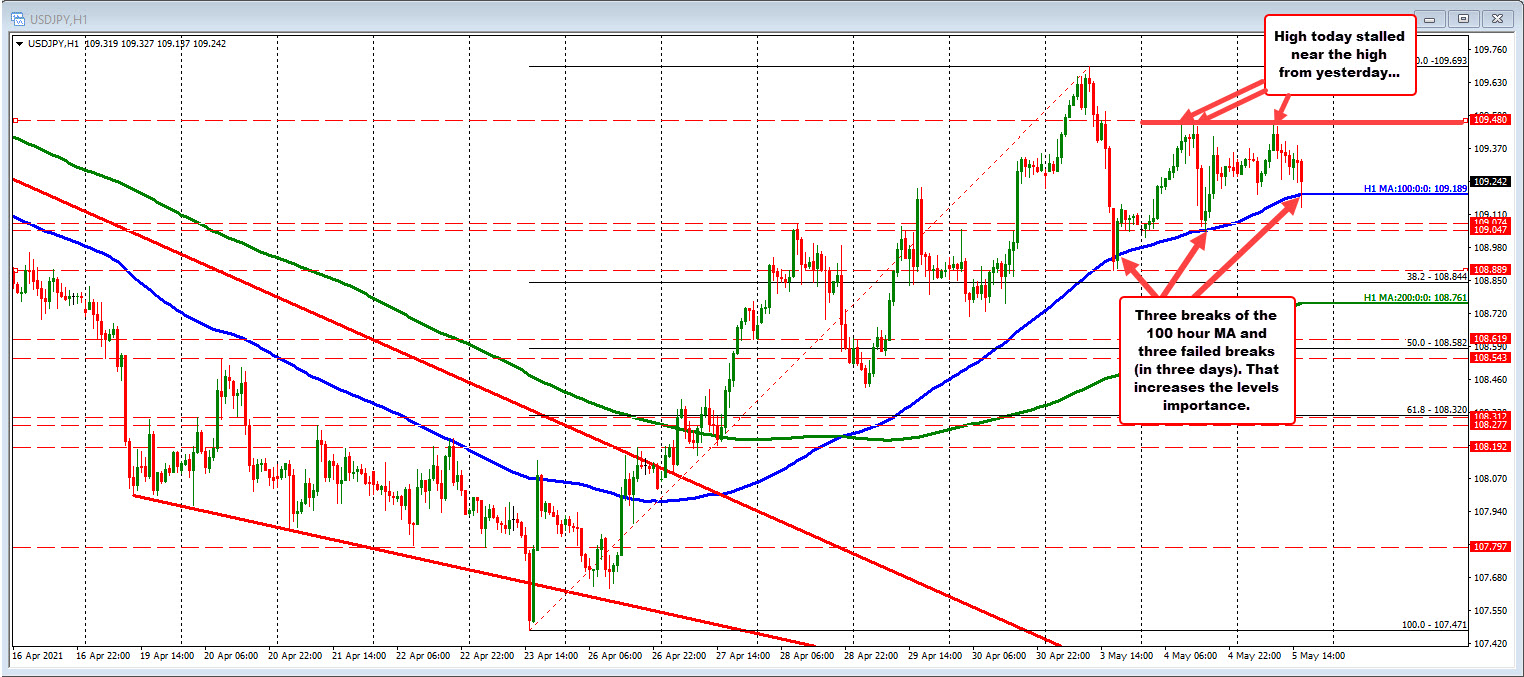

Dips below the rising 100 hour MA have been short lived this week

The USDJPY just dip below its 100 hour moving average as yields moved back down and stocks seemed to be getting off to a “sell the higher open” start. However, the dip below the MA line at 109.189 was short lived (so far at least). The pair is trading at 109.23 as I type.

This week, the pair has seen the price fall below the 100 hour moving average on Monday, Tuesday and now today. On Monday, there was a dip and close on one hourly bar with the next hourly bar running back higher. Failed break. Yesterday, the dip was less than a pip below (the price closed above). Failed break. Today, we may have just seen yet another brief peek, only to find buyers. Failed break.

When the pattern presents itself, it should solidify the level as a key bias defined level going forward. Yes, traders who just sold on the break, might not feel all that great now. That’s trading. However, going forward, we know we want to see increased downside momentum on the break below. Hopefully, you will know and feel it, but the more failed breaks like we have seen, the better chance the “next one” won’t be a failure.

Until then, of course, the nod is still in favor of the buyers.

Although the buyers hold more control, the ceiling at 109.48 (near highs from today and yesterday) is a key upside target to get to and through. It will take a move above that level to increase the buyers control.